Trending Assets

Top investors this month

Trending Assets

Top investors this month

$OTLY | oat milk trading like software

I typically don't bet against companies with most of my research time being spent on identifying emerging categories and taking long positions. But Oatly's very premium valuation is very enticing. As a quick snapshot, the oat milk brand is at:

- $10-12B enterprise value

- $421m in 2020 revenue

- 106% YoY growth (nice!)

- 30.7% gross margin

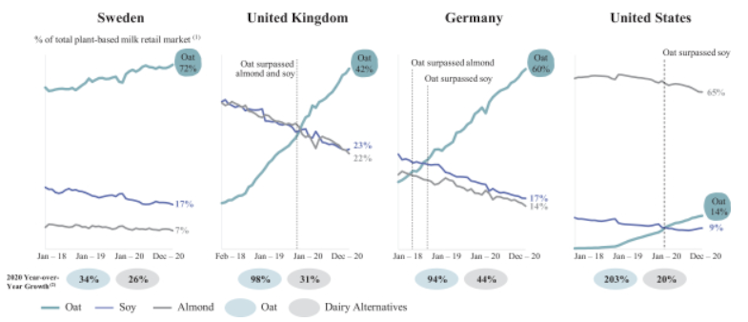

Of course the market for plant-based dairy has been growing and there's an argument to be made that it will erode regular milk sales to some degree. It also appears to be true that oat-milk is emerging as the champion of plant-based alternatives in many major markets. Of course, Oatly's home market of Sweden are die-hard oat milk fans, but the UK and Germany numbers are particularly impressive.

Despite the tide that appears to be shifting in favor of oat milk, I still think Oatly is more attractive as a short at the current valuation. Ultimately, I struggle to believe that they won't be heavily commoditized and stripped of its pricing power. Today, Oatly's brand communicates a level of trust in a relatively new category, but as oat milk is more broadly accepted, I anticipate that consumers' will be less brand-conscious in this market. Absent brand, I don't believe that the company has significant sources of defensibility.

I still need to do the actual heavy lifting on translating some of these beliefs into numbers, but at the end of the day low margin, commoditized goods should not trade like software.

Also, pea-based milk > oat milk.

Already have an account?