Trending Assets

Top investors this month

Trending Assets

Top investors this month

Netflix: Reaping The Rewards

The past few years have been a wild ride for Netflix.

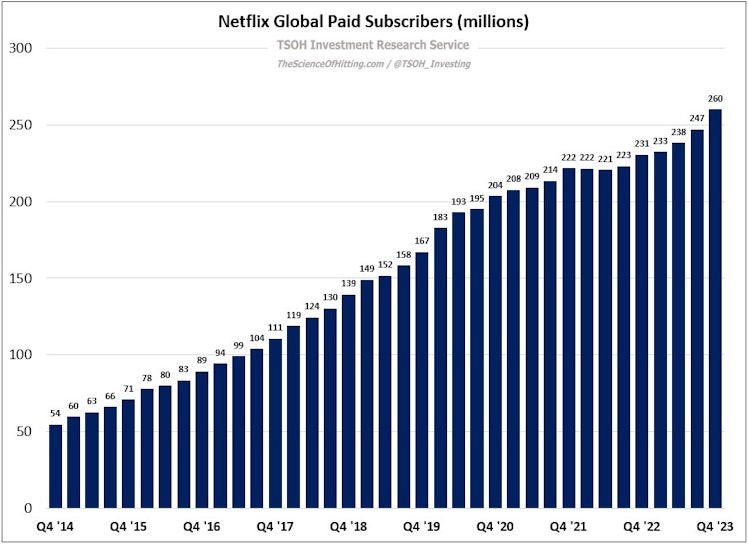

The most notable tough stretch of late came in early 2022, when subscriber growth and profit margins both came under pressure (and at a time when competitors were investing aggressively to scale their DTC services). As I noted in April 2022, I believed that what was perceived as a Netflix-specific issue was more likely a canary in the coal mine for broader media industry pressures - and it would soon lead to difficult decisions for legacy competitors who were relatively new entrants in DTC VOD / streaming. As we approach the two year anniversary of the April 2022 write-up, it’s interesting to consider the choices and outcomes we’ve seen subsequently. First, the next round of media industry M&A has proved elusive; whether that represents an inability or an unwillingness (a clear logic) for the next big deal is an open question. Second, while Netflix continues to make incremental investments to support the next leg of global growth for its business (from volumes and pricing), competitors have begun to reduce their (net) DTC content spend, along with other key operating expense lines like marketing. Third, streamers continue to evolve their DTC content offerings, with the most notable example being their most popular sports rights – putting further pressure on the U.S. linear TV business (which, as a reminder, typically covers their large DTC losses).

Amidst continued change in the media industry, and with the possibility of unexpected and substantial developments on the horizon (M&A), one thing I personally remain confident in is the sustainable competitive advantages that Netflix has established in DTC VOD / streaming. This is a company that has long recognized where the puck was going and accepted the significant costs required to achieve long-term success. They are reaping the rewards for decisions they made 10 months ago, as well as 10 years ago. With that said, the sustainability of their advantages isn’t God-given; it demands a continued commitment to their strategic vision, along with a willingness to reconsider new opportunities as their business and the industry continues to evolve. As I’ll discuss today, I believe Netflix’s results over the past 24 months, along with this week’s WWE deal, are indicative of a company and a management team that recognizes the huge opportunities that remain on the horizon.

Read the remainder of the post at the TSOH Investment Research service

thescienceofhitting.com

Netflix: Reaping The Rewards

The past few years have been a wild ride for Netflix.

Already have an account?