Trending Assets

Top investors this month

Trending Assets

Top investors this month

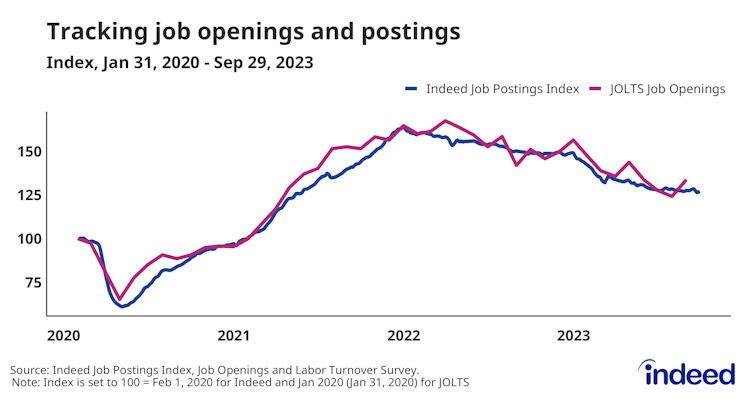

Indeed, the largest job posting site, shows us that a soft landing is on the horizon

On Fintwit, it's common to find people who think that the Fed's job is to create recessions and asset bubbles. While the effects of the Federal Reserve have created those things, the Fed has been able to conduct soft landing in the past, once. Unlike 1994, the Fed has bigger problems today. But that doesn't mean that a soft landing is impossible.

According to Indeed, the cooldown of the labor market that people hear about on the news is a longstanding cooldown, not a sudden reversal like what we see before recessions. The Big Tech and bank layoffs that we've been hearing about throughout last year and early this year are at a lower magnitude than the collapse of Bear Sterns, Lehman Brothers, GM, AIG, and other big businesses during the Great Financial Crisis. In Indeed's words, "Layoffs are still so low that the layoff rate in August would have been a record low prior to 2020."

Remember the Great Resignation from the pandemic days? Well, the rate of people quitting their jobs has fallen back to their pre-pandemic average of 2.3%. This means that wage growth will continue to slow. Companies are no longer in a bidding war for workers. Add in the low rate of layoffs and workers are enjoying job security.

In summary, the labor markets are in a sweet spots. The soft landing that many don't believe is on the horizon will be arriving. And when it arrives, it wouldn't surprise me if we witness a buying frenzy in the stock market.

Indeed Hiring Lab

August 2023 JOLTS Report: Look Past the Surprising Spike in Openings - Indeed Hiring Lab

Don’t be fooled into thinking the longstanding cooldown in the labor market has suddenly reversed itself after an unexpectedly strong August.

Already have an account?