Trending Assets

Top investors this month

Trending Assets

Top investors this month

Newlat Food $NWL.MI - Investment thesis - A huge opportunity in a defensive Italian small cap

What is Newlat Food?

Newlat is a small Italian company in terms of market capitalization but not in relevance in the European agri-food sector. Founded in 2004 within the Italian Parmalat group and controlled by the Mastrolia family since 2008 (who took advantage of its insolvency situation to take over the €36 MM debt and acquire the company). Newlat, at its origins specialised in Milk products and pasta. However, over the years, it has grown through M&A and is now present in seven segment of products and more than 60 countries, with annual revenue exceeding €800 MM (our estimation for FY23). Since its IPO in October 2019, it has been listed on the Milan Stock Exchange with the ticker NWL.MI

Brief history

The Mastrolia family has been involved in the agri-food sector for several generations. In 1929, they began procuring milk from local producers in Salerno (Italy) and supplying it to Salerno milk plants, and in the 1960s, they expanded their operations when they started milk cleaning and refrigeration treatments. Currently, they own 60% of the group's shares.

If Newlat, under the leadership of Angelo Mastrolia, is characterized by something, it is that M&A is in its DNA. Over the years, Newlat has developed a strong track record in M&A, often acquiring unprofitable industrial assets and restructuring them. They have been involved in more than 10 acquisitions since their inception, diversifying their business in terms of both countries and segments. From their origins closely tied to the dairy and pasta segments in Italy to the seven segments they have today.

They entered the German market in 2013 with the acquisition of assets from Ebro Foods and the British market in 2021 with the purchase of Symmington. Italy remains their primary market, accounting for almost half of their sales, but Germany and the UK represent 20% each.

The acquisitions they have made since going public have been funded with IPO money (€75 MM) and the issuance of shares (Centrale di Latte, 2020). Additionally, they also took the opportunity to issue a €200 MM fixed-rate bond (2.625%) in February 2021 for acquisitions (which has not been spent). In recent months, their margins have been significantly affected by disruptions in the supply chain and inflation, a situation that appears to be turning around. They currently have a market capitalisation of €280 MM and an enterprise value of €350 MM.

Today, we analyse its numbers, growth strategy, main risks, and company valuation in detail to understand the size of the potential opportunity that Newlat currently presents. To do this, we also focus on aspects such as management, financial structure, procurement,….

Main markets and segments

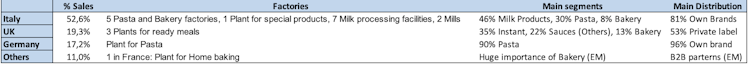

As we mentioned, thanks to the mentioned acquisitions, Newlat's main markets are Italy, Germany, and the United Kingdom. However, each country is characterized by a different product mix (due to the type of acquisitions made and competition characteristics), which logically have different margins as well as the use of different sales channels.

Italy, whose weight has decreased in recent years despite representing 52% of sales, focuses mainly on milk and pasta (lower margins), largely due to the acquisition of Centrale del Latte (details later).

In Germany, pasta represents almost all of the country's sales (90%). Newlat is the second pasta brand in Germany (it has a very strong private label and almost everything it sells in Germany is under its own brand - We believe Newlat has higher margins in German vs Italy in this segment).

In the United Kingdom, the opposite occurs; more than half of the sales are made with private label products, affecting margins. Working on convert one of its ready meals plant into one for pasta.

Apart from these three main countries, they serve more than 60 countries (including the US, Spain, etc.), with France standing out thanks to its latest acquisition in 2022 (EM Foods).

By segments, they are present in Milk Products, Pasta, Instant Products, Dairy Products, Bakery Products, Special Products, and Others.

Among them, Milk Products stand out (more than 60% coming from the acquisition of Centrale del Latte) . In terms of margins, Bakery Products is the segment that by far contributes the highest margin to the group, followed by Dairy (not in the LTM) and Special Products. On the other end of the spectrum, Milk Products, Others, and Instant Products (although the latter usually has margins around 7.5%, in the LTM, it has been affected by the impact of inflation in the UK and plant utilisation, details in later sections).

Acquisitions and Growth

FULL ARTICLE ON our Substack: https://open.substack.com/pub/moram/p/newlat-investment-thesis-2q23-results?r=94dqf&utm_campaign=post&utm_medium=web

open.substack.com

Newlat Food - Updated Investment thesis

Sunday 17th September 2023

Already have an account?