Trending Assets

Top investors this month

Trending Assets

Top investors this month

Compounding Collaboration, Month #2

In August I started a portfolio for my future kid who does not exist yet.

The first buy for the portfolio was Ark Invest's $ARKK ETF, which focuses on disruptive innovation. (So far its down .24% since I bought it).

My goal for this portfolio its to make buys I can hold for 15-20 years. Given that time horizon, I am looking to place money in companies of the future.

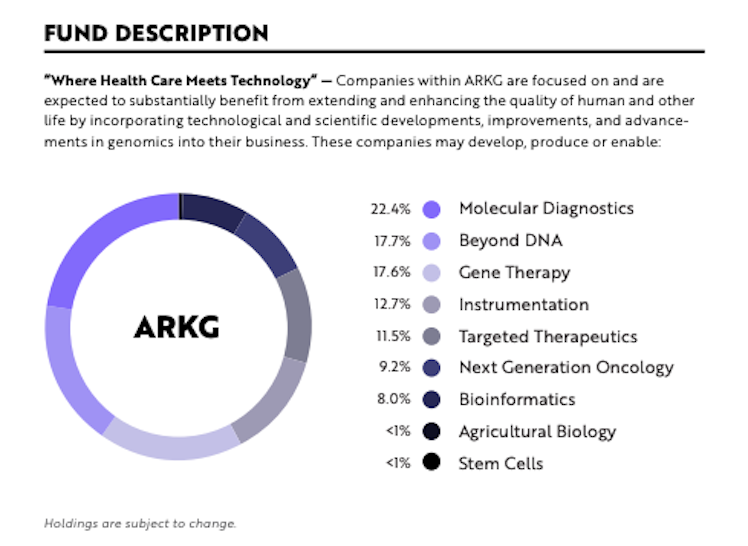

Tomorrow I'll be making the second buy and I will be choosing another Ark ETF, $ARKG which holds companies that are focused on extending and enhancing the quality of human life by incorporating scientific developments in genomics into their business.

We all get to fight for the future we want to participate in. I for one want to see cancer being reliably detected in stage 1 rather than stage 4 at some point in my kid's lifetime.

Ark picks companies that are innovating in gene therapy bio-informatics, bio-inspired computing, molecular medicine, and pharmaceutical innovations.

Ark estimates that next-generation DNA sequencing revenues could grow 43% at an annual rate, from $3.5 Billion in 2018 to $21 billion in 2024. That is some crazy growth, and while I'm not quite as bullish on the space, I think there is a significant opportunity here.

At the very least $ARKG has little overlap with traditional indices, giving it a nice diversification element

Already have an account?