Trending Assets

Top investors this month

Trending Assets

Top investors this month

Savers Value Village $SVV: Cracking the Thrift Code

“We love where we are in terms of brand awareness in Canada standing at 90%+, so you certainly have a bullseye on our ability to continue to monetize and drive growth in Canada. We’ve had some remarkably successful store openings in the last six months—we feel really good about our Canadian presence. That said, in the U.S., we’re even more excited, because of the strength of the growth pattern in thrift and what we represent. These are hyper-local stores, hyper-local markets. We get our supply and our demand from within an 8-10 mile radius of each store. Generating that awareness through influencers, through great signage, through great presence, through great real estate; we’re cracking the code on that.” - Mark Walsh, SVV CEO, Q2 2023 Q&A

On occasion, you come across a business model so purely brilliant that you can’t shake it from your mind. Savers Value Village has such a model. The company is the largest for-profit thrift store operator in North America, with the majority of its inventory being simply given to it as donations, which are then sorted, stocked, and sold. This profitable endeavor traces back to 1954, with the company steadily growing ever since. But it was only recently, in June, that it became public via an Initial Public Offering. Shortly before the deal, I published Second-Hand Retail: A First-Class Market.

Since its IPO, Savers Value Village has continued to execute a strategy that I believe can create substantial long-term value. In August, the company held its first quarterly call as a publicly traded company—showcasing results above management’s expectations. Excerpts from that call, as well as a discussion I had with a retail specialist, further paint the opportunity ahead.

In Q2 2023, SVV net sales increased by 4% to $379.1 million, and by 6.2% ($387.4 million) at constant currency. For the same period, comparable store sales increased by 5.5%. While these growth rates may not be eye-popping, it should be noted that the CSS growth marks a 15+ year continuation (ex. Covid 2020), in which the company grew CSS even during the GFC. More importantly, there are several key components driving what management has referred to as the company’s new growth phase, driven by new store openings paired with a number of efficiency gains.

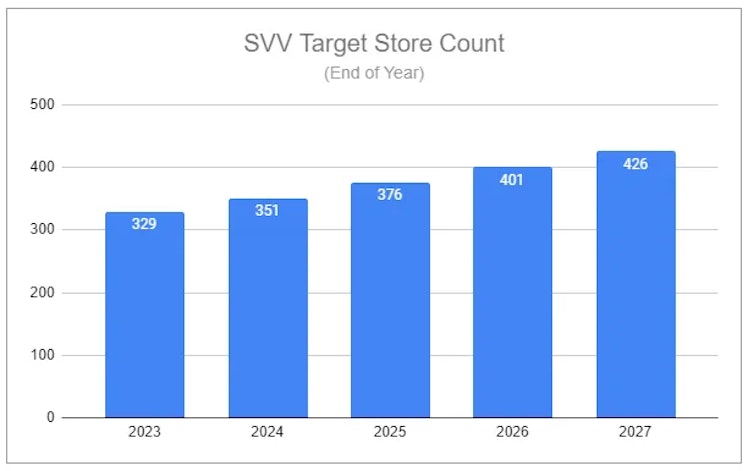

New store openings are fairly straightforward. At the time of SVV’s S-1/A filing, it operated a total of 317 stores, with an aim to open 12 total in 2023, and 20+ in each following year. In Q2, the company opened 1 new store, with 11 more aimed to be opened throughout the remainder of 2023, 22 in 2024, and 25 per year thereafter.

At an end-state potential of 2,200+, SVV’s new store opening can lead to store count growth at a mid-single-digit rate well into the future. And with a target payback period of ~3 years, new store economics are compelling. This is especially true when you layer on potential efficiency gains.

A primary driver of SVV store efficiency is the amount of inventory that is from on-site donations. These donations are both, generally, higher-quality, and also carry far fewer additional costs, such as paying partner organizations additional sums and transport costs.

On-site donations (OSD) have continued to become a larger piece of the overall value equation, which has been continually reflected in SVV’s progressively higher sales yield—a function (using comparable store sales at constant currency) of retail sales per pound of processed volume. In Q2, sales yield increased 8% y/y to $1.49.

As powerful a driver as a shift from delivered supply to OSD may be, the future benefits may...

Continue reading at the link below:

open.substack.com

Savers Value Village: Cracking the Thrift Code

Post-IPO update on an intriguingly-durable enterprise.

Already have an account?