Trending Assets

Top investors this month

Trending Assets

Top investors this month

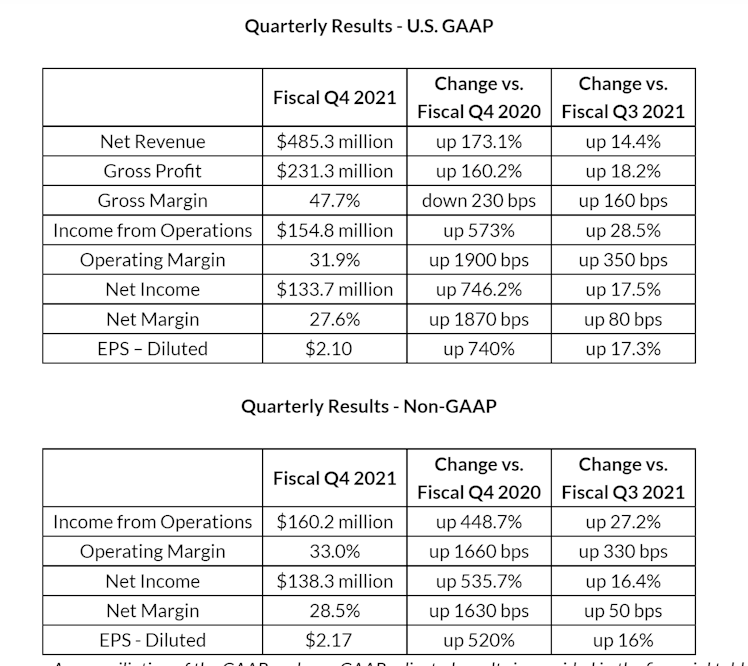

$KLIC FY Q4 2021 Earnings Beat and Raise... Again

$KLIC with another beat and raise Q.

FYQ1 rev/EPS guide beat by 12% and 22%. Most likely light on these numbs too.

Triple digit rev/EPS growth only goes so far when a downturn is perpetually priced in.

First Quarter Fiscal 2022 Outlook

The Company currently expects net revenue in the first fiscal quarter of 2022, ending January 1, 2022, to be approximately $460 million, +/- $20 million, and expects non-GAAP EPS to be approximately $1.88, +/- 10%.

This revenue outlook is very similar to the fourth fiscal quarter expectations provided on August 4, 2021.

Looking forward, Fusen Chen commented, "We continue to efficiently support strong, ongoing and broad demand across our served end-markets. Throughout fiscal 2022, we anticipate ongoing industry expansion and also rapid growth of our emerging portfolio of solutions which directly addresses semiconductor, electric vehicle, and advanced LED assembly challenges."

Already have an account?