Trending Assets

Top investors this month

Trending Assets

Top investors this month

United-Guardian: Patience Is the Game

“You don’t have to swing hard to hit a home run. If you got the timing, it’ll go.” - Yogi Berra

Several months ago, responding to a comment made by an avid reader, I wrote:

"Digging through decades of old filings, hunting for obscure data sources, collating data, marking models, and occasionally gaining opportunities to speak with management all helps refine the approach. I think of UG as a great mental exercise, and the company showcases both great and terrible attributes. I've also had no issue acknowledging the lack of clarity and a deficit in my own conviction - thus expressed in the small stake. And while I theorize that UG may be setting up for something compelling, it's only one of many names I track (though many I have not published on publicly). I like to be patient and wait for clarity and fat pitches, even if that means they never come from a particular name. Above all else, I prioritize capital preservation and survival."

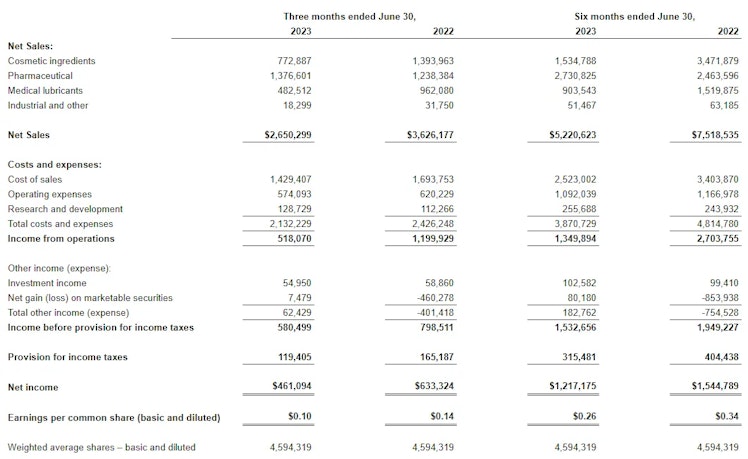

Patience has been the name of the game with United-Guardian, although the lack of granular disclosures certainly tests our ability to make sense of what’s what. The company reported its Q2 numbers on August 11th. Cosmetic ingredients, once the company’s largest operating segment, continued to falter, with net sales down -44.55% y/y. Medical lubricants also continued to crater, down -49.85% y/y. These alarming numbers follow the abrupt resignation of Beatriz Blanco, the company’s newly appointed CEO, in early June.

Oof.

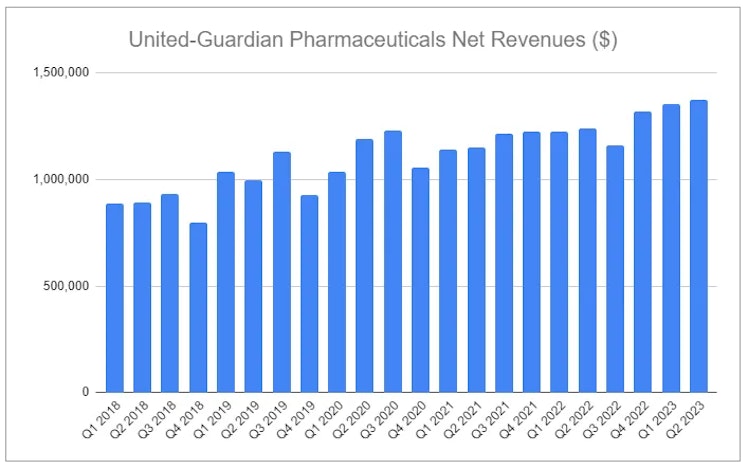

Following Beatriz Blanco’s resignation, Donna Vigilante was appointed by the board as the company’s next president. The boards also voted to declare a mid-year dividend of $0.10/share, which was paid on Aug 2nd to stockholders of record on July 26th. This payout was considerably lower than in previous years, with the board aiming to retain a greater percentage of earnings to reinvest into new growth initiatives. What initiatives? That remains shrouded in mystery—but likely relates to either working with SIGN Fracture Care to scale out Clorpactin, or efforts to introduce Renacidin into Europe. These products make up the company’s Pharmaceuticals segment, which, following the phasing out of Industrials and implosion of Lubrajel-related sales, are the shining star of the business. And Q2 marked another notch of impressive associated growth, with net sales up +11.16% y/y. While the exact extent is undisclosed, a driver was another price increase during the quarter for Renacidin.

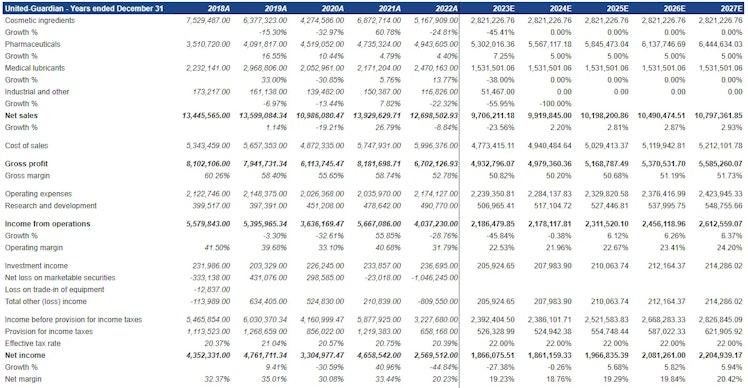

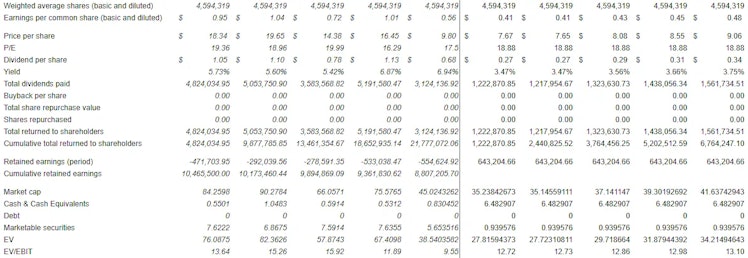

Based on Q2 results, I have updated my income model:

Further adjustments reflect greater permanent impairment to Lubrajel sales, both in Cosmetic Ingredients and Medical Lubricant segments. Along with this is a slight adjustment to the cost of sales, an increase to R&D, as well as doubling the amount of earnings retained for reinvestment, from $0.07/share to $0.14/share. Additionally, despite marginally increasing FY sales for Pharmaceuticals, no adjustment was made for forward growth, despite the past 4 years tracking firmly higher than what is illustrated. Focusing on the net result of cash flows paid back to stockholders, the estimated dividend per share for the year has decreased from $0.51 as last modeled to $0.27—nearly halved.

This looks downright ugly, but consider:

- Zero benefits are attributed to reinvestment from the doubling of retained earnings.

- Moving forward, Pharmaceuticals are modeled to perform weaker than recent trends.

- If Lubrajel lines are truly permanently impaired, the associated cost of sales and operating expenses will likely be cut dramatically, although it may take years for the company to fully concede defeat in CI and ML. If a recovery in either segment does occur, net sales could normalized significantly higher, without a massive step-up in additional costs.

- Along with using an increased effective tax rate of 22%, the model does not incorporate tax benefits such as the company selling the majority of its marketable securities to shift proceeds into short-term treasuries, recognizing a loss in the process.

At Friday’s closing price of $7.67, the company now sports a market cap of $35.2 million. Cash, equivalents, and marketable securities now make up 21% of that market cap. Backing them out provides an enterprise value of $27.8 million.

There very well could be more pain ahead for this company, but the value of Pharmaceuticals - namely Renacidin, a mini monopoly - continues to become more alluring. I wrote last quarter:

"Taking an extreme approach and assuming that 60% of the cost of sales and 50% of operating expenses are related to Pharmaceuticals, the present value of estimated associated future cash flows exceeds $20 million. Subtracting cash and marketable securities, further weakness in the equity would result in an enterprise value ascribing effectively zero value to the other operating segments."

Are Cosmetic Ingredients and Medical Lubricants truly worth nothing? Is any recovery outside the realm of possibility? Shares appear to be answering ‘yes’ to both. If shares continue to grind lower or drop out to due one of the few large holders dumping this tiny, illiquid name, we may be heading toward an extremely asymmetric opportunity.

If you enjoyed reading, hit “♡ like” and give this piece a share.

invariant.substack.com

United-Guardian: Patience Is the Game

Q2 2023 update.

Already have an account?