Trending Assets

Top investors this month

Trending Assets

Top investors this month

Chewy ($CHWY) Add

I've been looking for an opportunity to add to my Chewy position and noticed today it's under $30/sh so I added 21% more shares at $28.68/sh.

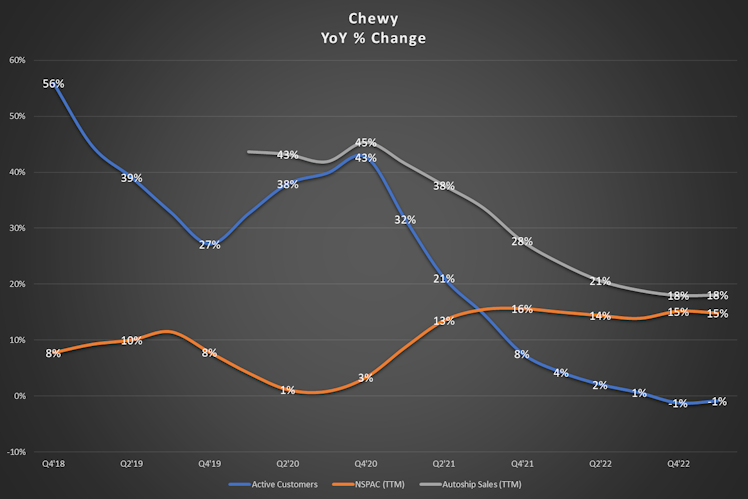

Active customer growth has basically plateaued since Q2'21 as COVID has a big pull-forward effect. However, net sales per active customer (NSPAC) continues to strongly growth and autoship sales, even though it isn't a moat-builder, continues to be a feature that customers clearly prefer as autoship sales were nearly 75% of total sales in Q1'23.

Operating cash flow, net income, and free cash flow have all finally swung to the positibve on a TTM basis (low bar, I know) but I believe management will continue to keep these in focus while investing in initiatives as well.

Chewy's currently trading as near all-time lows on P/S and P/GP. We may be in for some rough sledding in consumer discretionary in the near-term (although I continue to believe we won't see a recession until at least 2025) but that doesn't scare me off. I think Chewy is a great long-term hold and the best bet one can make if you're looking for a pure pet play.

Already have an account?