Trending Assets

Top investors this month

Trending Assets

Top investors this month

$O Headwinds

I came across the below Tweet about $O hitting a 52 week low and how $DG, a struggling retailer, is one of their larger tenants.

While $DG is one of their issues, it’s not their largest issue in my opinion.

I personally think that the reason for the $O slump is more tied to the market and debt then it is on their make up of tenants.

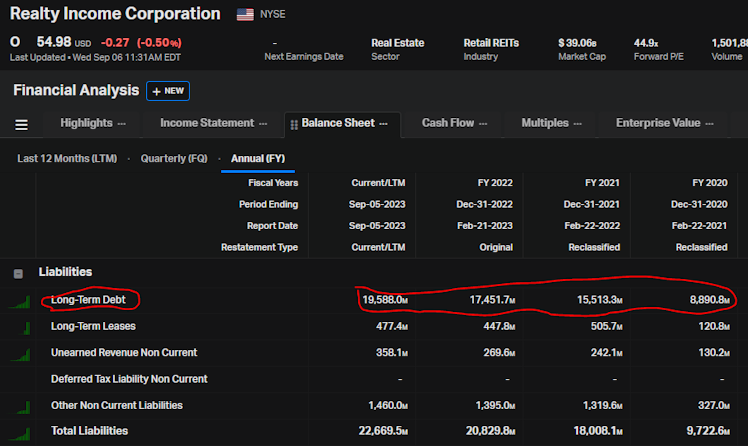

$O has more than doubled their long term debt since 2020. Commercial real estate loans underwritten 1-2 years ago do not underwrite to todays rates, I’ve seen this in my banking career. Any debt that has recently matured or will mature within the next 12-24 months is going to have to be refinanced at more expensive current rates.

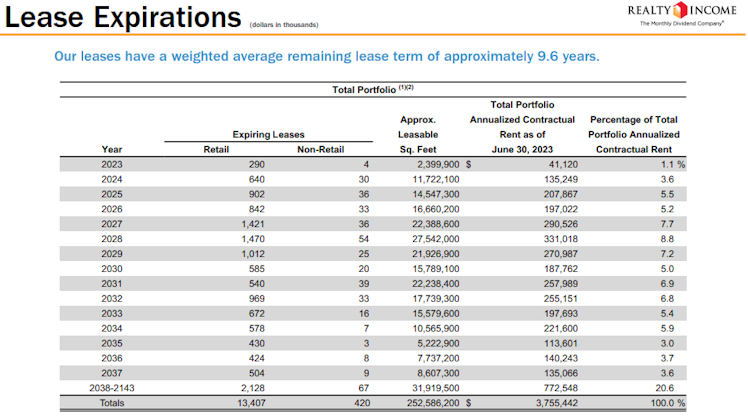

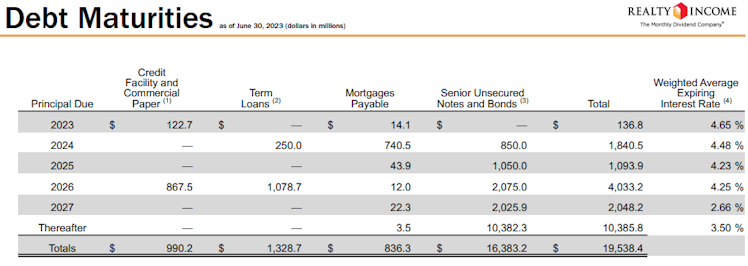

$O has 14M square feet of space with maturing leases through 2024. They also have $372M worth of debt (paper and term loans) maturing through 2024. Can they renew those leases at rates high enough to maintain their margin if they have to refinance that debt at market interest rates?

That looks increasingly difficult to me, and this is the exact reason that is making commercial real estate a tough market right now. Leveraged properties that were underwritten 2-3 years ago hardly underwrite at todays rate, which is hurting the value of these assets.

This may only be a problem for them in the short term (1-3 years), but it’s difficult to be positive when realistically looking out further than that.

X (formerly Twitter)

InvestmentKage (インベストメント影) (@Investmentkage) on X

$O is trading at 52 week lows.

one reason why I think big money is likely avoiding $O is because $DG makes a lot of their tenants.

The average salary a Dollar General shopper is around 40K a year. with student loans having to be paid back I see this company struggling more.

Already have an account?