Trending Assets

Top investors this month

Trending Assets

Top investors this month

The Everything Portfolio

Putting together the optimal, easy-to-manage portfolio by looking at over a century’s worth of return data. It turns out that real estate is the cornerstone.

•••

"The Everything Portfolio" by DALL•E

Investors want practical ways to boost their returns and reduce risk. Yet, they often overlook passive, diversified asset allocation strategies. By analysing return data for American stocks, bonds and real estate equity from 1890-2022, we can see what would have worked in the long run. It turns out that real estate is the top dog. On a risk-adjusted basis, it outperformed stocks and bonds. But by diversifying across all three asset classes instead of holding just one, investors would have significantly boosted their risk-adjusted returns. Looking forward, a simple mix of the three would be easy to manage and will likely do well.

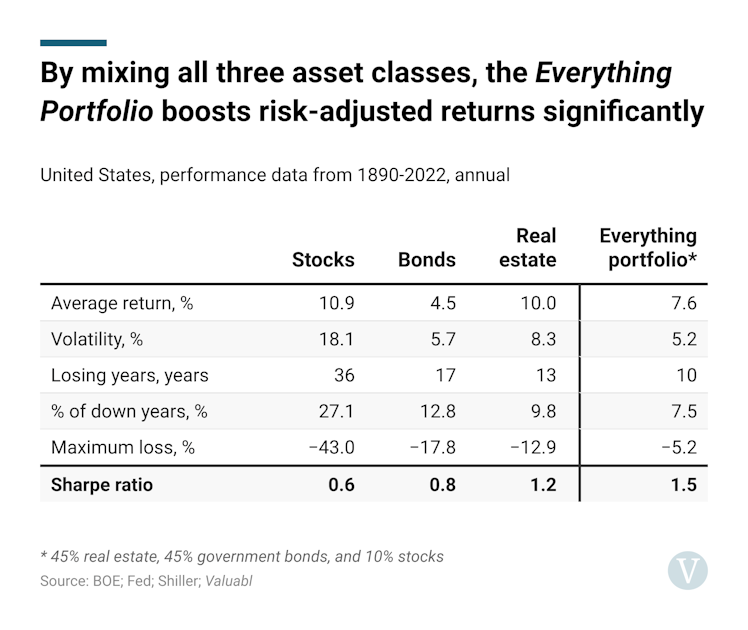

Over the past 130 years, real estate equity (based on Robert Shiller’s index) has crushed both stocks (Shiller composite index) and bonds (10 year Treasuries) on a risk-adjusted basis. Real estate's Sharpe, the ratio of annual returns to volatility, was 1.2. That's twice as high as the Sharpe for stocks and 1.5 times that of bonds. When it comes to risk-adjusted returns, real estate is the top dog.

Over that time, real estate investors got 10% per year on average, including equity capital gains and net rents, with 8% volatility. That was better than the 5% per year return with 6% volatility that bondholders, who received capital gains and coupons, got. And much better than stocks, which returned 11%, including capital gains and dividends, with 18% volatility.

Even though real estate returns were a percentage point lower than for stocks, the volatility was ten percentage points less. That's a massive difference in the risk taken. Real estate has produced stock-like returns with bond-like volatility over that time—a stunning and counterintuitive result.

Broad diversification reduces risk without hurting returns much. Over those 130 years, these three assets' returns have had little correlation. Stocks and bonds shimmied in the same direction, with a +0.2 correlation. As did stocks and real estate (+0.2 also). But bonds and real estate have had a slightly inverse relationship with a -0.1 correlation.

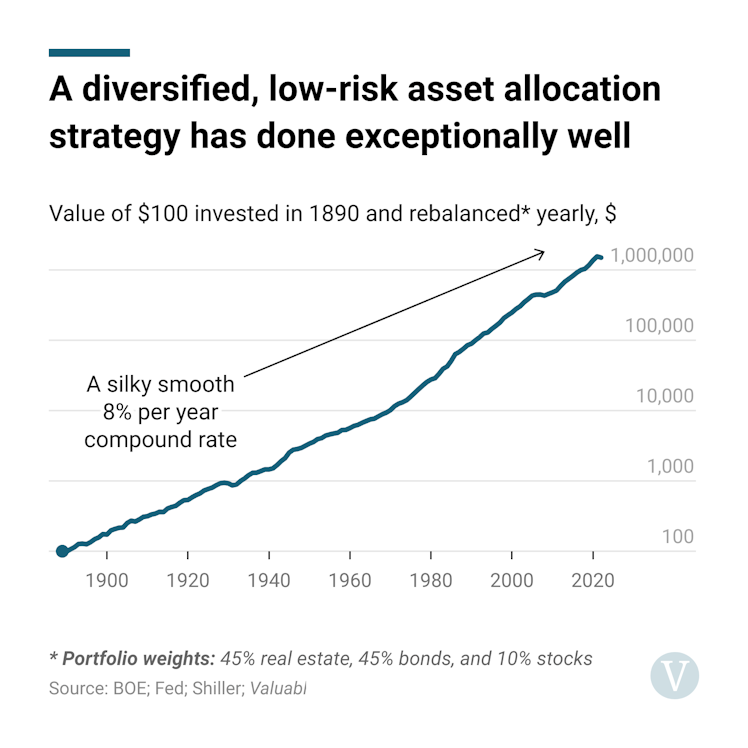

At a broad level, these three asset classes are almost independent return streams. By combining all three, investors will outperform any one of them on a risk-adjusted basis. A simple strategy of having 45% in real estate, 45% in bonds, and 10% in stocks boosts risk-adjusted returns considerably. In fact, the results for this Everything Portfolio are remarkable.

Without combining assets, the best you could have done was to put it all into real estate. The Sharpe would have been 1.2, and you would have lost at most 13% of your money once every ten years. But, by combining assets, the Sharpe jumps to 1.5, and you'd have lost at most 5% of your money once every 14 years. In contrast, the most challenging strategy would have been to go all-in on stocks. You'd have gained a small bump in returns but would have more than tripled your risk. And you'd have lost money a third of the time with a maximum drawdown of 43%—a brutal storm the weather.

As there are now so many exchange-traded funds, this strategy would be simple to implement today. That’s in stark contrast to 1890. It would also take just a few minutes of periodic management. Further, reducing drawdowns and volatility makes it much easier to stick to. This result also shows that diversification is vital. The returns studied were not individual securities but rather broad asset classes. That indicates that passive, diversified investment works well. Moreover, these returns are far better than those of almost all active fund managers. How many investors could do 8% yearly for 130 years and lose 5% at most? Almost none.

Including real estate is the key to this portfolio's success. There's no denying that real estate has done well. Its incredible performance flies in the face of traditional financial theory, which says there's an almost linear relationship between risk and return. But real estate is unique. Real estate does so well because it sops up the spillover returns from the rest of the economy. When industries innovate and produce more, society gets richer. As a result, wages and incomes rise, and landlords can raise rents. Regardless of what happens, landlords get paid first, as people need places to live, work, and be. That gives real estate stock-like upside, with bond-like downside—an attractive proposition.

Without real estate, as in the popular 60-40 portfolio of 60% stocks and 40% bonds, you're stuck with the same returns but have to bear much more risk. By comparison, the Everything Portfolio made 8% per year with 5% volatility, while the 60-40 portfolio did 8% with 12% volatility. That's the same return but with more than twice the risk.

For families worldwide, that real estate investment was usually their house. Then, by investing the rest of their money in stocks and bonds, they achieved a variation of this Everything Portfolio. Real estate may be in a bubble, but investors can get rich while sleeping easy by adding a healthy spoonful to their portfolios.

Already have an account?