Trending Assets

Top investors this month

Trending Assets

Top investors this month

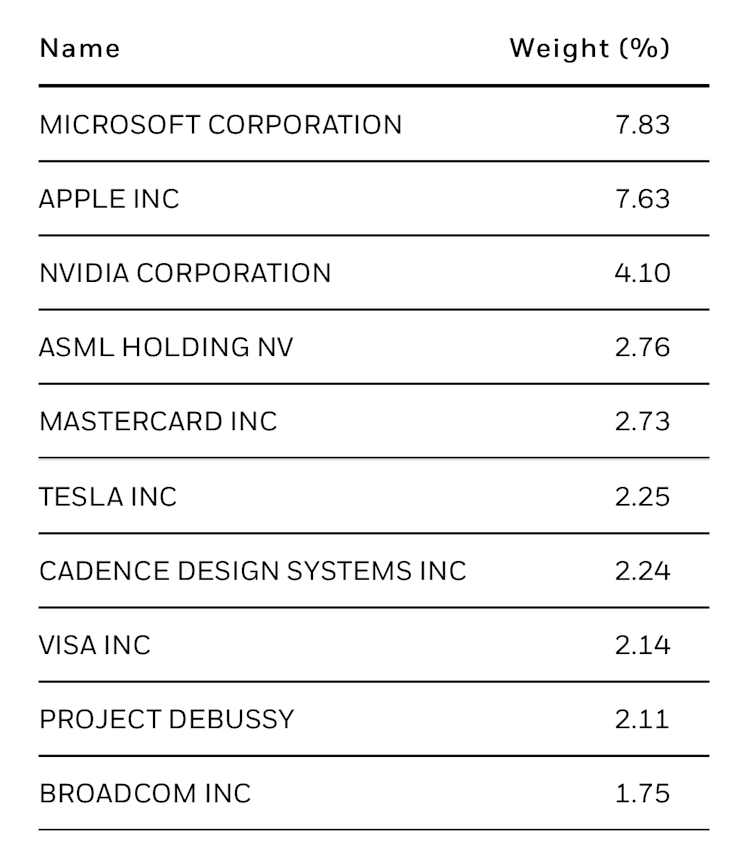

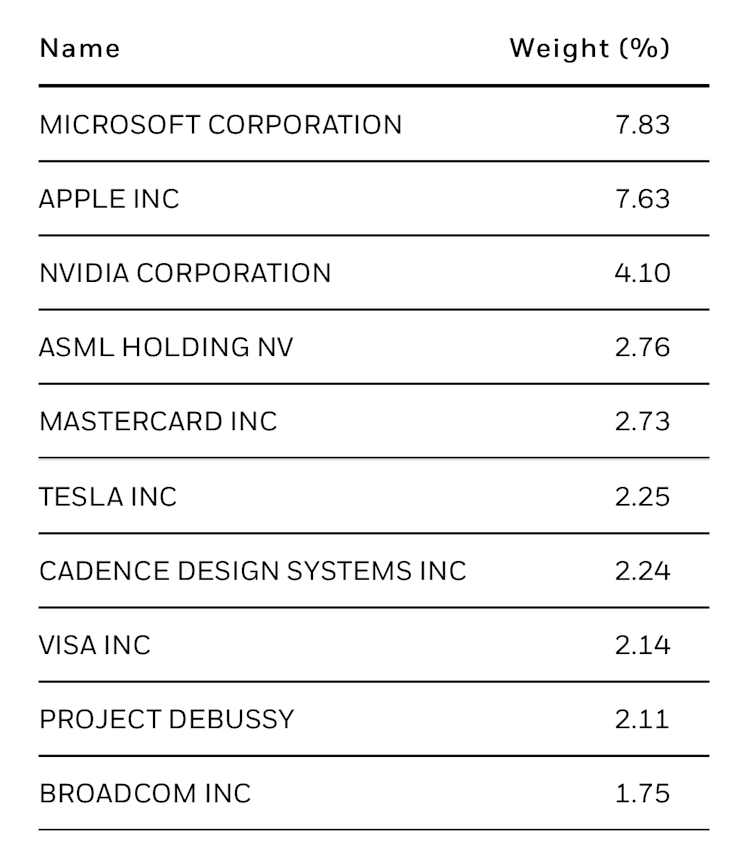

Came across $BST today. 9% yield with a 1% expense ratio trading at a slight premium. Provides access to some big names while consistently paying a monthly dividend the last 8 years. Largest positions are:

Already have an account?