Trending Assets

Top investors this month

Trending Assets

Top investors this month

Match Group: Temperature's Rising

From “Tinder’s Melting Ice Cube?” (November 2023): “What’s clear is that the investment community continues to harbor serious questions / doubts about management’s strategic vision. Above all, Mr. Market is very concerned about the trade-off between Payers and RPP, particularly at Tinder; do RPP lifts justify the Payer declines? Is the second variable even an active choice?”

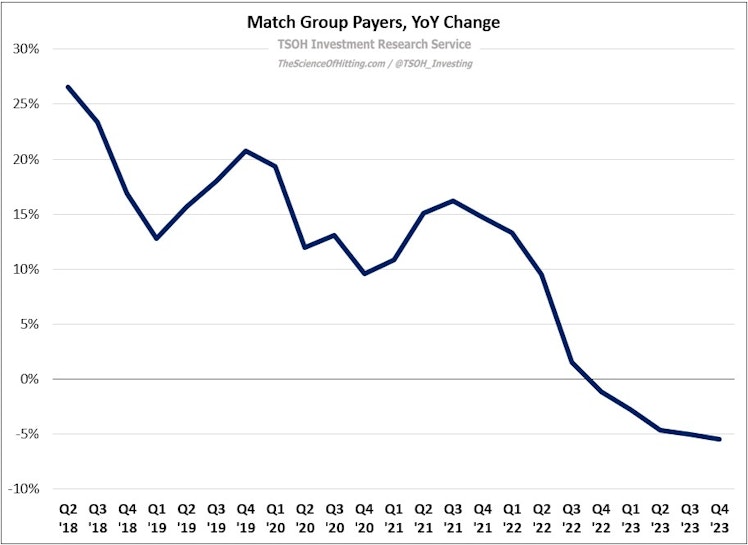

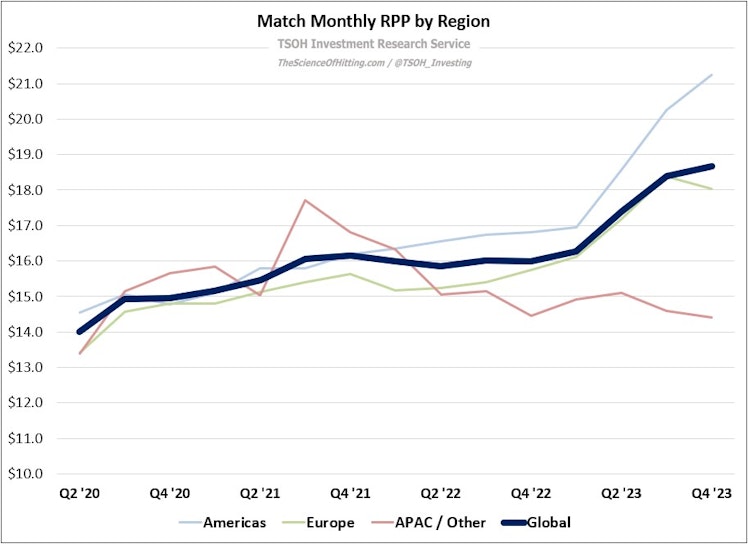

Match’s Q4 FY23 results did not provide an answer to that question. Total payers declined by 5% YoY (comparable to the Q3 FY23 decline), with an outsized impact from Tinder (-8%) and the Americas region (-12%). Those volume pressures continue to be outweighed by pricing, with revenue per payer, or RPP, up 17% YoY in Q4 FY23 (led by Americas, with RPP +26%).

For the year, Match’s revenues increased 6% to $3.4 billion. The business generated more than $800 million of free cash flow (~$2.8 per share), with $550 million allocated to buybacks. In addition, the board authorized another $1.0 billion repurchase program, with management committing to return at least 50% of ~$1.1 billion in FY24e FCF to shareholders (by comparison, the market cap is ~$10 billion). If management holds to that capital allocation framework, and if the business is able to maintain its current trajectory on profitability, more than $3 billion is likely to be returned to owners through repurchases over the next five years (or >30% of today’s market cap).

That valuation suggests Mr. Market continues to be cautious on the trade-off between volumes and rates that we saw in 2023, and which will continue into 2024. This is the key question to answer on the investment. For that reason, it is the topic that I’ll focus my attention on in today’s write-up.

thescienceofhitting.com

Match: Temperature's Rising

From “Tinder’s Melting Ice Cube?” (November 2023): “What’s clear is that the investment community continues to harbor serious questions / doubts about management’s strategic vision.

Already have an account?