Trending Assets

Top investors this month

Trending Assets

Top investors this month

Part 1 of 4: Why ETH is More Scarce than BTC

I recently wrote an essay on why $ETH.X will win store of value. It consists of deep-dives into the four primary drivers of my thesis:

- More Scarce

- More Secure

- Organic Demand

- Real Yield

This memo will be part 1 of a 4-part series and explains why I believe ETH will be more scarce than BTC in the long-run. Please feel free to leave feedback in the comments if something is unclear or doesn't make sense, and I'll do my best to clarify!

Stores of Value

In my previous essay, "Why Bitcoin Makes Sense," I wrote extensively on what makes for a good store of value so I won't spend too much time on definitions here (see the section "What is money and why are some forms of money better than others?" for a quick primer).

The basic premise is that money is simply technology that makes our wealth today available for consumption tomorrow. Thus the "best" money is the one that will give its holder the most purchasing power over time. There are several factors that influence a monetary good's suitability as a store of value, but the most important is supply growth or scarcity.

Have you ever wondered why gold emerged as the predominant store of value throughout human history? Why not silver or copper or one of the other 118 elements? The primary reason is scarcity. The growth rate of gold's supply has historically hovered around 2%. Only silver comes close with an annual growth rate of 5-10%, rising to around 20% today. An extremely low supply growth rate allowed gold to maintain its purchasing power over time better than anything else, and the world eventually converged on it is a store of value.

For thousands of years, gold was the best we could do in terms of a limited-supply monetary good that could maintain its value over time. However the invention of Bitcoin created the first truly scarce form of money to ever exist. With Bitcoin, we have a precise measurement of supply, 21 million bitcoins, that anyone can audit with their home computer. Bitcoin took what gold did better than anything else, and improved on it by an order of magnitude. Yet, Ethereum might just do the same to Bitcoin with the migration to proof-of-stake and an upcoming change to its gas management.

**Ethereum's Monetary Policy and EIP-1559

**

Ethereum's current yearly network issuance (i.e. inflation rate) is around 4.5% with 2 Ether per block and an additional 1.75 Ether per uncle block (plus fees) rewarded to miners. Ethereum does not have a fixed supply because a fixed supply would also require a fixed security budget for the network. Rather than arbitrarily fix Ethereum's security, Ethereum's monetary policy is best described as "minimum issuance to secure the network."

Bitcoiners hate this ambiguity because they believe that the base layer of the financial system should be stable. Bitcoin’s development is intentionally careful and slow, and no more than 21 million bitcoins will ever exist.

The Ethereum community believes that they are sacrificing this near-term stability for long-term network security, and the fact of the matter is that Ethereum does have a history of reducing issuance to these estimated minimums. Furthermore, the move to proof-of-stake (PoS) will allow for a drastic reduction of Ether issuance while maintaining the same level of network security. I'll expand more on this later, but Vitalik has a great essay on his blog explaining how proof-of-stake is able to offer more security for the same cost.

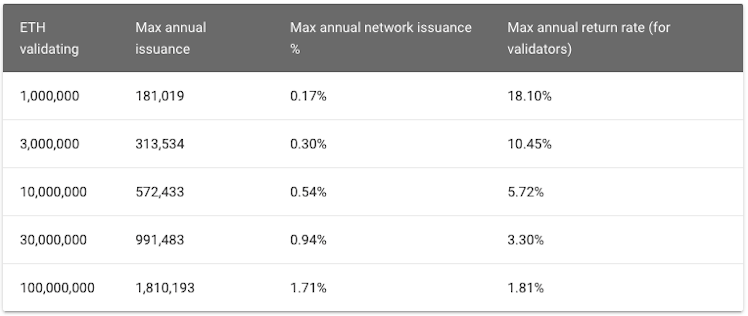

According to the current Eth 2.0 spec, Ethereum's issuance rate will be greatly reduced as part of PoS. And instead of new issuance going to miners, it will go to validators who stake their ETH to process transactions and agree on the state of the network (more details here). There will be a sliding scale between total amount of Ether at stake and annual interest earned by stakers. The current spec would produce the following annual interest and inflation numbers

based on total network stake:

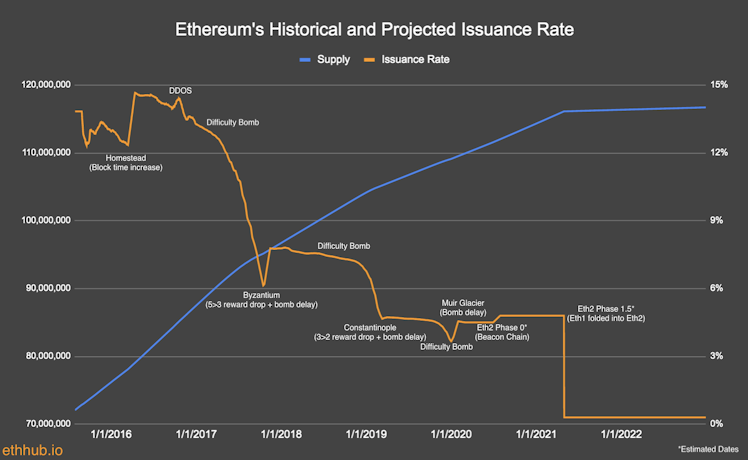

Basically, we can probably expect annual network issuance (i.e. inflation rate) to fall from ~4.5% today to less than 1% after the transition to PoS. The chart below highlights this massive drop well:

But that's still more than Bitcoin, which has a capped supply of 21 million BTC and a long-run inflation rate of 0%. So how exactly is Ethereum more scarce? Well, there's more. Ethereum has begun to address many of the concerns around its monetary policy with the upcoming release of Ethereum Improvement Proposal (EIP) 1559, which has been called "Ethereum's scarcity engine" or "ETH's burn mechanism".

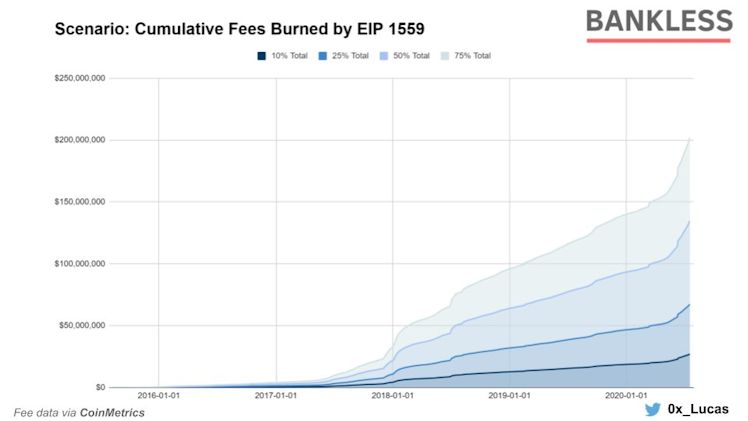

EIP-1559 is set for release in July as part of Ethereum’s upcoming London hard fork. Diving into the details of the proposal is beyond the scope of this essay, but the key aspect to pay attention to is that in addition to improving ETH gas UX, EIP-1559 will burn a portion of ETH transaction fees. This will permanently remove a portion of supply from circulation and decrease the daily net issuance of ETH.

Last year, an analysis of network transactions showed that EIP-1559 would have burned nearly 1 million Ether in 365 days, which is equivalent to almost 1% of the entire network. And as demand for Ethereum transactions grows, many expect this number to increase over time. Thus, when combined with the lower issuance required for PoS (less than 1%), Ethereum will actually have a deflationary monetary policy.

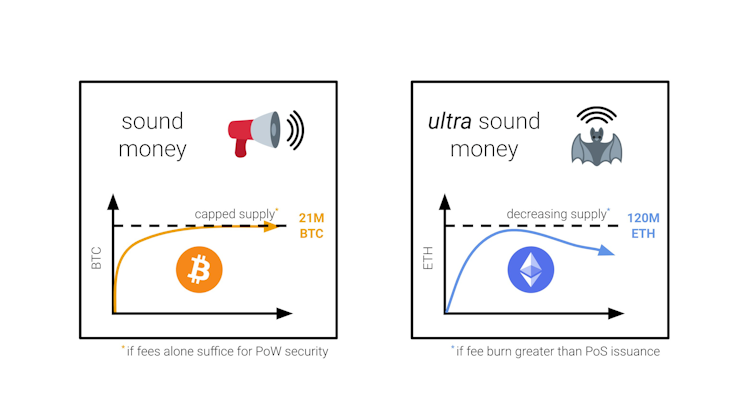

This has recently led to the new meme in the Ethereum community of "ultrasound money", coined by Ethereum researcher Justin Drake. The term is a little silly, but the point that Drake makes is that if Bitcoin is "sound money" because its supply is capped at 21 million, then a cryptocurrency with decreasing aggregate supply should be superior, hence the term "ultrasound money."

In the long run, Ethereum will be the more scarce asset. However, I'm probably even more bullish shorter term. With the removal of proof-of-work, ETH’s issuance will drop by around 90%. This is estimated to have the equivalent impact on miner selling pressure as three Bitcoin "halvings".

Stock-to-Flow and the Migration to Proof-of-Stake

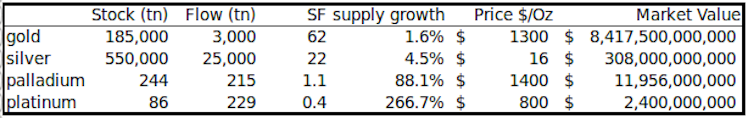

The best attempt at quantifying Bitcoin's scarcity and using it to model Bitcoin's value comes from PlanB's stock-to-flow model. He essentially argues that scarcity—defined as the rate of supply growth—directly drives value. The more scarce an asset is (lower supply growth rate), the more valuable it is. Below is a chart he created to help make his point ("SF" stands for "stock-to-flow" and is simply the inverse of the supply growth rate):

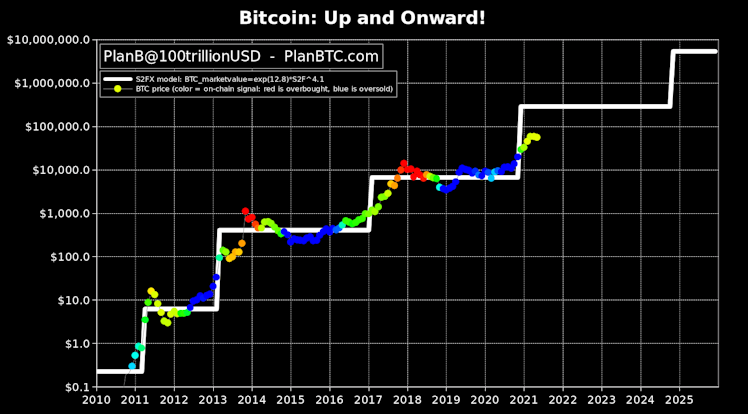

The shocking part is that this model has held up extremely well in the two years since he published it. In the chart below, the white line is the forecast, and the multi-colored dots represent the price of Bitcoin through May 2021.

As we can see, there are large jumps in Bitcoin's modeled value every four years. This is because the block reward paid out to Bitcoin miners is cut in half every 210,000 blocks (roughly every 4 years). And because block rewards are the only way new bitcoins can be minted, Bitcoin's supply growth is cut in half every four years.

As PlanB articulates (and quantifies) in his essay, this drop in supply growth is highly correlated with surges in Bitcoin's price. This is likely because it directly cuts selling pressure from miners in half. Because Bitcoin uses the resource-intensive proof-of-work (PoW) consensus mechanism, miners must sell bitcoins to cover their hardware and electricity costs. So when the block reward was halved from 12.5 bitcoins per block to 6.25 in May 2020, selling pressure from miners fell from 1,800 bitcoins per day to 900. This equated to a difference of roughly 1.6% of Bitcoin's market cap (almost $18 billion at today's prices) that isn't being sold every year by miners. With such a large supply shock, it's only natural we'd see the price of BTC skyrocket until it reached a new equilibrium level at the reduced inflation rate.

Ethereum, currently uses the PoW consensus mechanism today as well. But when it fully transitions to PoS, the ~4.5% annual Ether issuance will drop to less than 1%. This will equate to more than 3.5% of Ethereum's market cap (more than $15 billion at today's prices) that isn't being sold every year by miners. Further, I'd expect even less selling pressure because the block rewards will be distributed to stakers who are not forced to sell because hardware and electricity costs are minimal. To be fair though, most stakers will have to sell some ETH to pay income taxes on their reward, so new market supply won't go to zero.

Of course there are many other drivers of an asset's value than just scarcity. Acceptability by others is another. However, scarcity—at least for now—appears to be the most important factor in a good's monetary value because it leads to salability across time. On the other hand, security is also crucial factor. Just as gold is immune to rot, corrosion, and other types of deterioration, a cryptocurrency must be built to last through proper incentive engineering. After all, an asset that's not around in a few decades wouldn't be much of a value store.

I will discuss Ethereum's security advantages in my next memo.

Already have an account?