Trending Assets

Top investors this month

Trending Assets

Top investors this month

Ultra-Bullish Omen for Software & Semiconductor Stocks

Welcome to new all-time highs.

If you’re surprised, don’t be. This is what markets do over time.

That said, staunch bears remain unconvinced that this rally is real.

Watching Technology stocks rip day after day gets old sitting on the sidelines…but I’ve got news for the doubters.

There’s more upside coming.

Today we’re going to unpack an ultra-bullish omen for Software and Semiconductor stocks.

Let’s start with the big news. Last week finally marked a milestone. After a 2-year hiatus, the long-awaited S&P 500 pierced a fresh new high.

If your curiosity is peaked on what comes next, we’ve got you covered.

We’re going to take a journey through history, uncovering similar periods to now and zero in on why 2024 will likely be favorable for one growth sector of the market – technology.

Bearish fantasies don’t hold water when you study the evidence.

New highs for markets aren’t uncommon. Pull up any long-term chart of the S&P 500 and you’ll see prices steadily climbing from left to right.

While investors have come to learn that stocks go up about 10% a year, sometimes expected gains take longer.

A case in point is the recent environment where it took just over 2 years for a new high to unfold.

This got me wondering 2 questions:

- First, how often does the market go through long stretches before making a new all-time high?

- Second, when a new high eventually comes, what does it mean going forward?

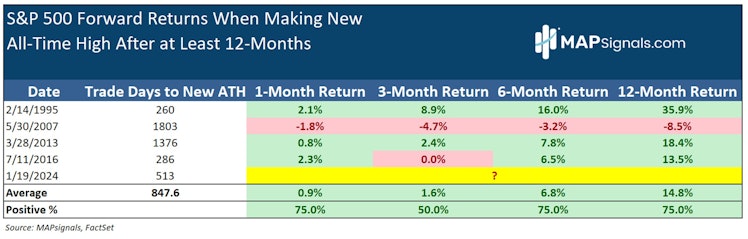

To help answer these burning questions, I went back to 1990 and singled out all instances where the S&P 500 made a new all-time high, yet not in the year prior.

Basically, I wanted to review cases similar to now.

Since 1990, I was able to find 4 discrete instances. If you guess that a long-awaited new high is somehow a bad thing, think again.

6-months later the market gains +6.8%.

12-months later, stocks show double digit gains of +14.8%.

Notably, 2007 was the only period where markets sputtered across the board. If you recall, that was just ahead of the Global Financial Crisis.

Given there’s no recession in sight, I’ll make the bold claim that we’re not going to face anything similar.

I’ll make a better observation. Technology stocks are poised to soar even higher than where they are now.

Anyone that knows me, quickly learns that I’m a growth investor.

After studying stocks for years, I’ve found that isolating high-quality compounders can grow your wealth in epic fashion.

The last decade in particular has shed a favorable light on growth-heavy areas of the market, namely Technology stocks.

Don’t be surprised if that trend keeps going…and here’s why.

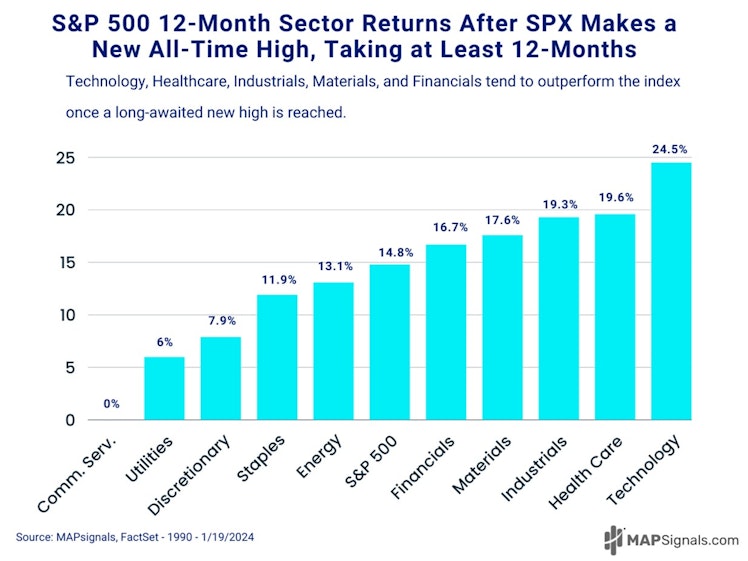

Using the same framework as above, I studied the forward sector performance once the S&P 500 makes a long-awaited new all-time high.

Back to 1990 whenever the S&P 500 marks a new all-time high, without reaching a new high in the prior year, a few areas of the market surge.

Notably, the Technology sector sports a face-ripper performance of +24.5% twelve months later:

That’s a lot of juice right there. And if you recall, back in early November when pundits predicted more pain for markets, we made the bold case for Technology names to explode in 2024.

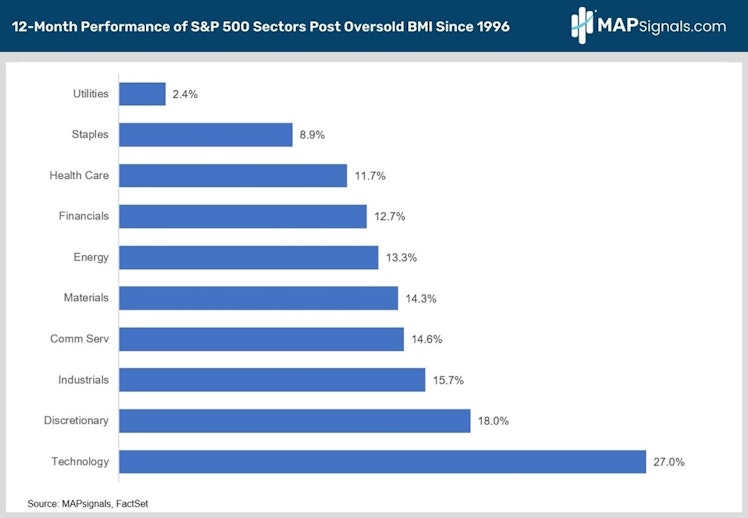

The reason for such an attitude was simply due to data. Markets were deeply oversold and since 1996, the Technology sector rips 27% on average in the 12-months after:

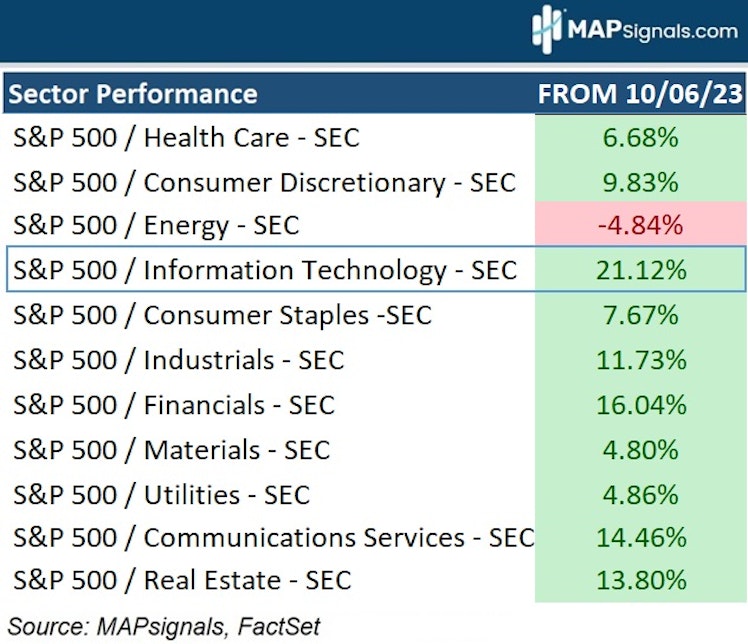

Fast forward to today and we can see that Technology has surged a mind-numbing 21% since the Big Money Index (BMI) went oversold:

BOOM! Hallelujah!

Money flow > News flow

But we can’t take the victory lap just yet. Let’s take our initial study one level deeper.

There’s an ultra-bullish omen for software and semiconductor stocks.

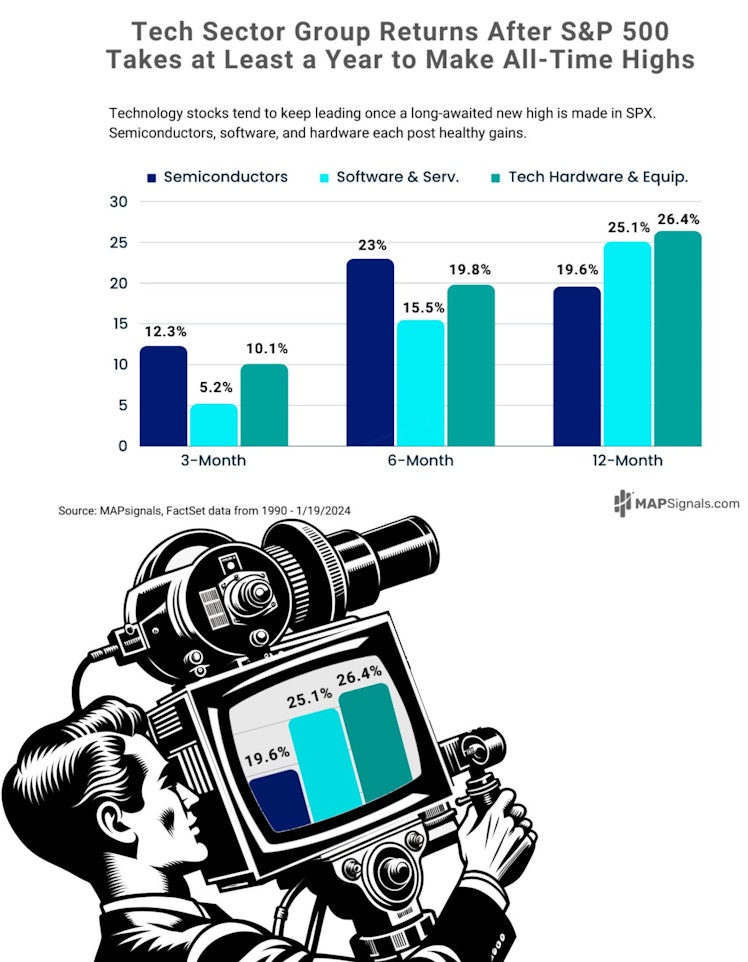

Now that we know Technology reigns supreme after a delayed new high, here’s the performance of the 3 major Tech industries: Semiconductors, Software & Services, and Technology Hardware & Equipment.

Folks, it’s time to unzip the bear suits.

Once the S&P 500 notches a new all-time high and the prior year saw no new highs, all 3 of these groups surged!

12-months later:

- Semiconductors rip +19.6%

- Software stocks explode +25.1%

- Hardware names vault +26.4%

Have a look:

Be like our friend, Marty McMap, and focus your attention on this ultra-bullish omen for software and semiconductor stocks.

These are the exact names attracting Big Money in our data now, and the kind of stocks we alerted our subscribers to own last time the BMI was oversold in October.

Through yesterday, those 5 names are up an average of +32% – handily beating the S&P’s rally of 12%.

Based on the evidence, there’s more room for them to run in 2024.

Let’s wrap up.

Here’s the bottom line: Markets are finally making new all-time highs. This isn’t a reason to fear stocks…instead, cheer stocks.

A year after a long-awaited new high in the S&P 500, equities gain +14.8% a year later.

Growth stocks, namely the Technology sector, trounce those returns posting a +24.5% performance.

This tees up the ultra-bullish omen for software and semiconductor stocks.

While markets remain overheated and due for a healthy pullback – use it for what it is, an opportunity to jump into the leading stocks of today…and tomorrow.

Don’t get lost.

Get MAP.

Lastly, if you’re a professional investor, Registered Investment Advisor (RIA), or are serious about markets, kick your research up a notch with a MAP PRO subscription.

MAPsignals

Solutions - MAPsignals

MAPsignals’ volume and price analysis tools enable investors to identify unusually large trading activities around individual stocks and ETFs. This allows traders and investors to move beyond sentiment with a more precise, predictive, and measured data analysis tool that MAPs the signals being delivered by the market’s biggest players.MAPsignals capabilities include: Read more »

Already have an account?