Trending Assets

Top investors this month

Trending Assets

Top investors this month

$BOX - priming itself for a bullish breakout.

Thanks go to @gkotak for bringing this one to my attention and @nathanworden for organising the initial conversation (and all of his other ongoing work, of course).

$BOX breaks one of my core trading rules in that is has less than 10% upside from current price to average analyst rating.

It's closer to 9.8%, but there's where the bad news seems to end.

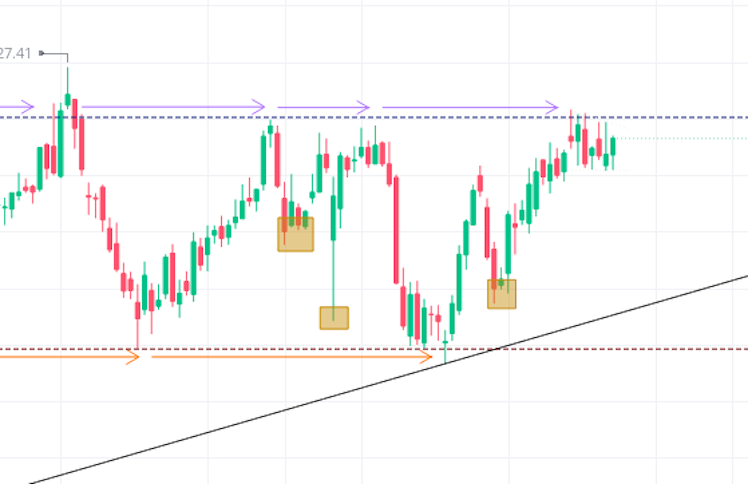

On the chart, we can see an uptrend since the March 2020 sell-off and a consolidation into a trading range.

And there is a lot of interesting activity inside the range. One of the things we can see is that the support touches are taking longer to happen while the resistance touches are happening more quickly; the price is starting to rise faster than it is falling.

We can also see that the price is often finding it a struggle to return to the support of the range as highlighted by the yellow boxes below.

From the above two phenomena, we can deduce that buyers are willing buy sooner and at higher prices while sellers appear to be holding out for longer. What I would expect from this is for the sell orders around the resistance level will eventually be exhausted. If you're familiar with the concept of order absorption, this is a good example.

Focusing in on the last few weeks of activity, we can see the price begin to consolidate into a descending triangle against the resistance following a rally.

Normally, I trade in the direction of a triangle's hypotenuse. But when you consider the triangle in the context of the wider chart picture then I would be comfortable to consider it a bullish continuation pattern.

Finally, if we focus on Friday's action using the 5 minute chart, we can see an impressive rally accompanied by even more impressive volume.

What makes me even more impressed with the above rally and volume is the timing; Friday afternoon up until close. Many day-traders and swing traders close out their positions before the end of Friday so that they're not subject to any news or negative events over the weekend or pre-market Monday, so to see this is a great sign.

I'm looking forward to opening up a position on $BOX Monday pre-market.

SL = $25.28 (slightly below triangle pattern and ~4% from current price)

TP = $29

Already have an account?