Trending Assets

Top investors this month

Trending Assets

Top investors this month

September Idea Competition - GREGGS plc (LSE: GRG)

INTRODUCTION

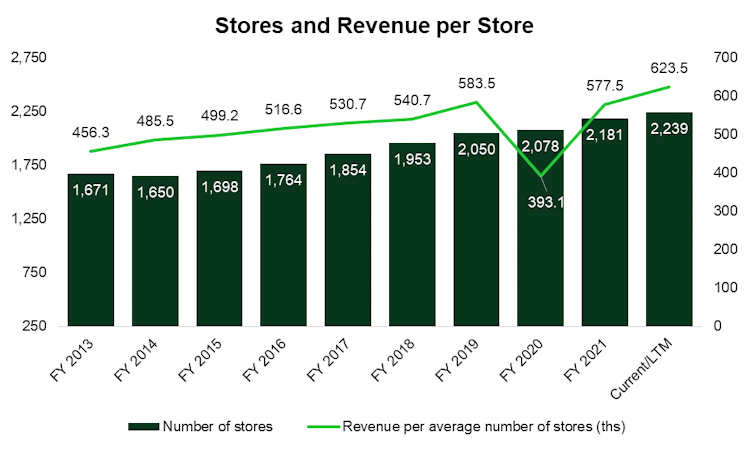

Our selection is Greggs (Market Cap of £2.01B), a bakery chain known for sausage rolls which transformed into a modern vertically integrated UK food-on-the-go retailer, providing a wide menu of food and drink choices. Greggs is being around for over 80 years in UK and serves consumers through 2,239 stores (401 are franchised). In the first half of 2022, Greggs generated £694.5M sales and £55.8M Pre-tax profit.

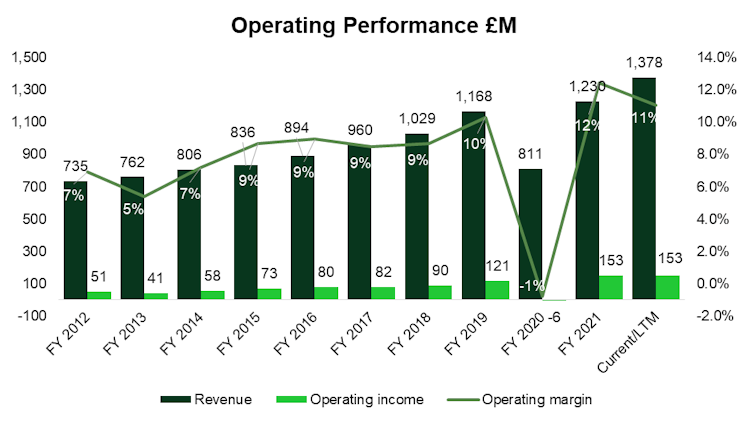

During the last 10 years it depicted a Revenue and Operating income CAGR of 6.9% and 12.3%, respectively, with an average operating margin of 8.0% and average Return on Equity of 19.5%, whereas its share price grew by 425%.

Greggs has a cash position of £147.5M, undrawn facilities of £70M and lease liabilities of £290.9M.

Koyfin, StockOpine

THESIS

- Growing number of stores boosting revenues

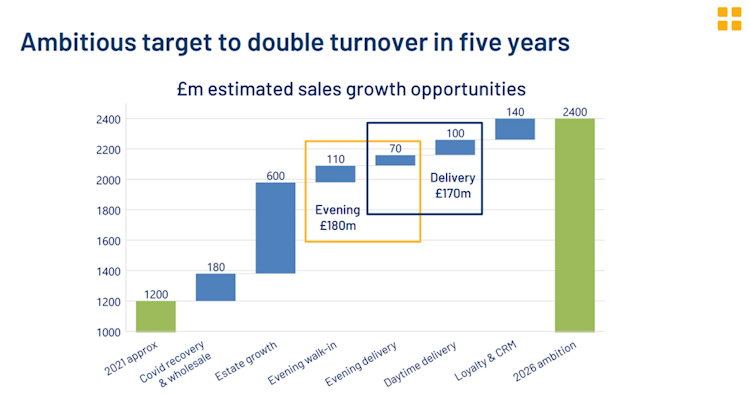

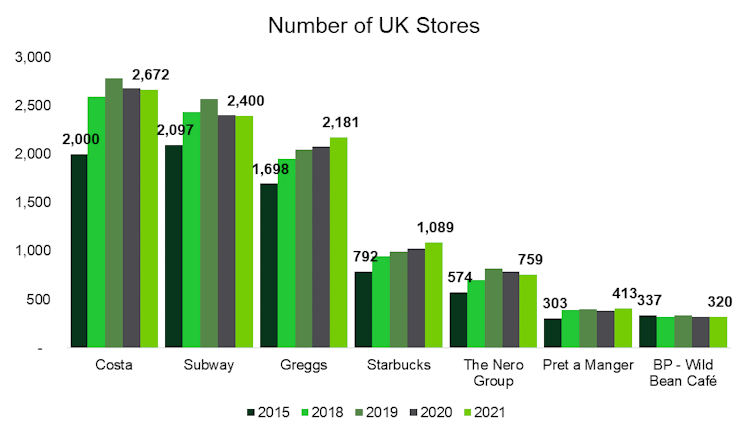

- Greggs plans to increase its number of stores from 2,239 to +3,000 by 2026, adding (net) 150 stores per annum, doubling its revenue from £1.23B in 2021 to £2.4B in 2026.

- Although the target set (Capital Market Day 10/2021) is ambitious, it is not necessarily unachievable given that Greggs added on average (net) 97 stores for 2017-2021 (excluding 2020). The target was recently reaffirmed by management.

Capital Markets Day, 2021

- Increase in Revenue per Store

- Over 2012 – 1H 2022 (“Current/LTM”), Greggs grew revenue per store by a CAGR of 3.4%. An acceleration is expected as Greggs extends opening hours, adds delivery to more stores and as it enhances its CRM platform.

Greggs filings, StockOpine

- Evening Trade: Management expects to extend opening hours of stores, where meaningful, to at least 6pm (normal closing hour used to be 4pm). Currently, 300 stores are open until 8pm and the plan is to reach 500 stores by year-end.

There is a significant upside from extending trade (35% of food-on-the-go market) since it would allow offering of wider range of products at higher prices (e.g. Sausage roll £1.2 Vs Southern Fried Goujons £2.75).

- Delivery: Beginning of 2021: 600 -> today: 1,180 and plan for 1,300 by the year-end. Delivery can be margin dilutive, but sales accretive (small switching level) as it reaches more customers and has higher basket size.

- Attractive Valuation

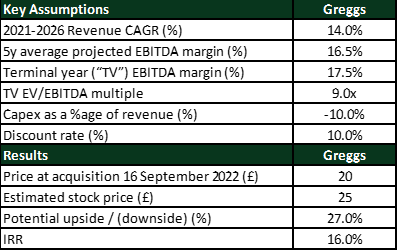

StockOpine

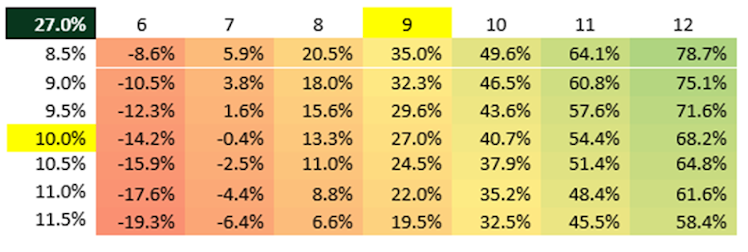

The estimated value per share is £25, 27.0% higher than our entry price of £19.7 on 16th of September (screenshot below), with a resulting IRR over a 5-year period of 16%.

- Revenue is based on management target, which per our recalculations translates into a) accelerating Revenue growth per Store (+7% CAGR) driven by Delivery, Evening Trade and Loyalty/CRM and b) the increasing number of stores.

- Terminal margin of 17.5%, lower than the average of 18.8% (2016-2021, excluding 2020) due to investment requirements as stores are added and due to a higher weight of delivery sales compared to the current 7% of total sales.

- Discount rate represents the minimum required return that we aim from our investments (i.e., 10%) and it is higher than the estimated WACC of 9.6%.

- EV/EBITDA multiple of 9x is similar to its 5Y average (9.1x), excluding 2020, and slightly higher than its current multiple of 8.4x. Despite this, it is lower than the median 13.9x of UK selected peers.

Potential upside / downside (%) by changing EBITDA multiple and Discount rate

StockOpine

RISKS

- Execution risk

- Roisin Currie, CEO recently succeeded Roger Whiteside and as there is no record to assess her abilities there is an execution risk. Nevertheless, Roisin is with the company since 2010, knows the culture and values and was selected across internal and external candidates.

- Fragmented market

- There is competition from Cafes like Costa Coffee and Starbucks, bakeries such as Wenzel’s the Bakers and companies like Krispy Kream UK and Subway. Despite the competition; the long track record, the competitive pricing position and the increasing number of stores demonstrate Greggs’ strong competitive positioning in a fragmented market.

Statista, Bakery Market Report (WilliamReed), StockOpine

- Inflation

- Even though Greggs is vertically integrated, it is not immune to inflationary pressures (ingredients, energy) and thus some costs will be absorbed, where others, would be passed to consumers (price hikes already took place in 2022).

- Unexpected increase in CAPEX may delay store openings. For instance, estimated CAPEX per shop increased from c. £275,000 (Oct 2021) to c. £325,000 per interim results.

REMARKS

We initiated a position in Greggs, as the 27% upside provides sufficient margin of safety considering the risks identified above.

Disclaimer: Not a financial advice.

Already have an account?