Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Data 8/16

Stocks are lower today as investors await the release of the latest FOMC minutes (releasing right about now). Both the DJIA and S&P 500 are higher, while the Nasdaq is lower. All 3 major averages fell at least 1% on Tuesday, with $SPY falling below its 50-day moving average.

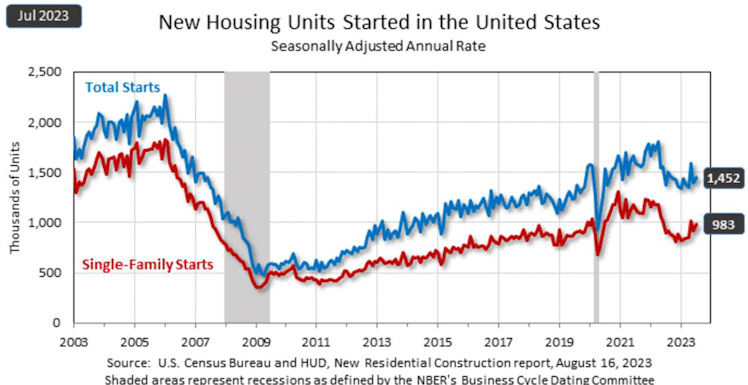

For economic data, US housing starts rose 3.9% in July to an annual rate of 1.45M, matching expectations. Single-family starts rose 6.7% to an annual rate of 983,000. Building permits rose 0.1% to 1.44M, missing expectations of 1.47M.

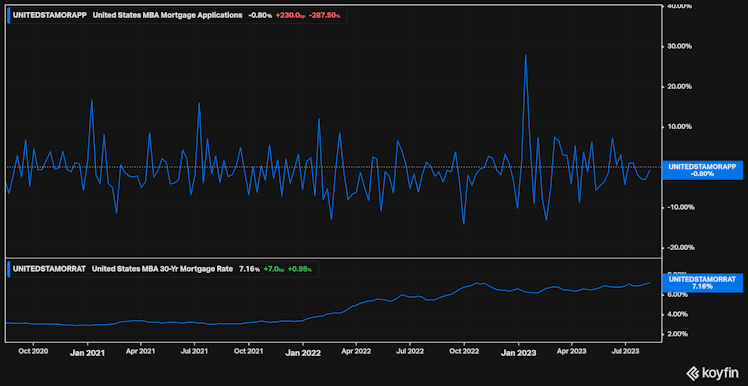

MBA mortgage applications fell 0.8% from last week. Purchase applications were flat, while Refinance applications fell. The report showed that the average rate of a 30-year mortgage rose 7 basis points to 7.16%, matching the rate from October 2022, the 3rd straight increase and is also the highest level since 2001.

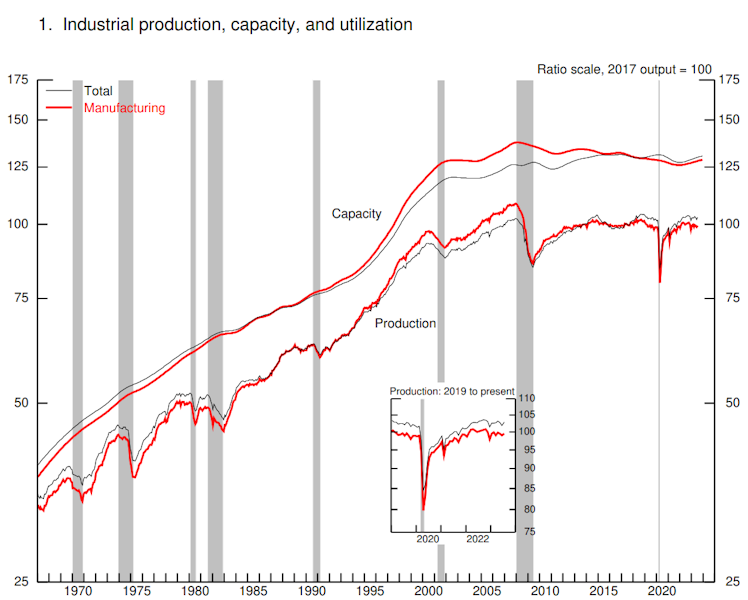

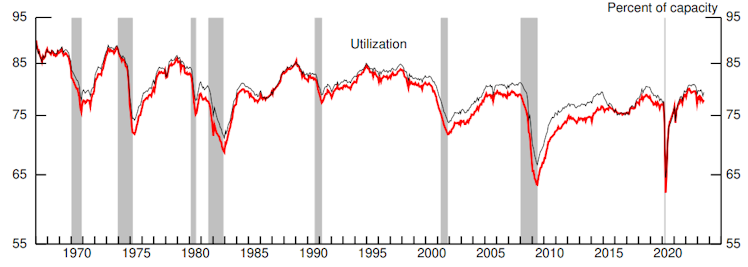

Industrial production increased 1.0% in July, beating expectations of 0.3% & bouncing from the June decline. Manufacturing rose 0.5% for the month, vs flat expectations. Capacity utilization rose more than expected to 79.3%.

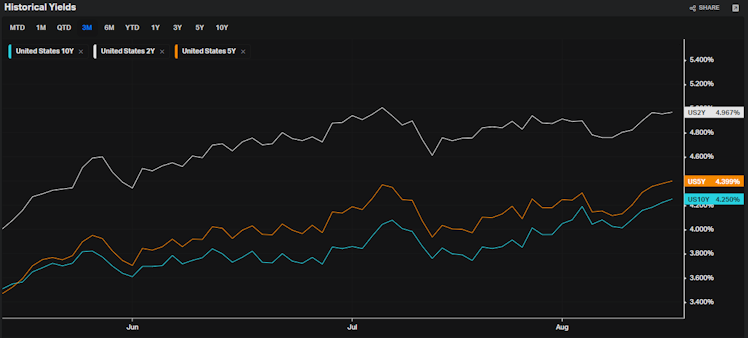

Treasury yields are higher today, with the 2-year T yield up 1.1 basis points to 4.96%, the 5-year T yield up 2.1 basis points to 4.40%, and the 10-year T yield up 2.9 basis points to 4.25%. Advance rates are higher throughout most of the curve today.

Already have an account?