Trending Assets

Top investors this month

Trending Assets

Top investors this month

"BJ's Wholesale Club: Transformation?"

In June 2011, after 14 years as a public company, BJ’s Wholesale Club agreed to sell itself to two PE firms (Leonard Green & Partners and CVC Capital Partners), in a deal that valued the chain at ~$2.8 billion. At the time, some analysts argued the move would give the wholesale club the room to “accept earnings dilution, while preparing a national rollout beyond its core markets”. If the goal was significant unit expansion, the subsequent record has underwhelmed: BJ’s will end 2023 with 244 warehouses in 20 states, roughly 20% higher than its tally a decade earlier; as you can see below, that reflects a meaningful slowdown from the pace of unit growth reported at BJ’s over the prior 10-15 years, particularly during the late 1990’s / early 2000’s.

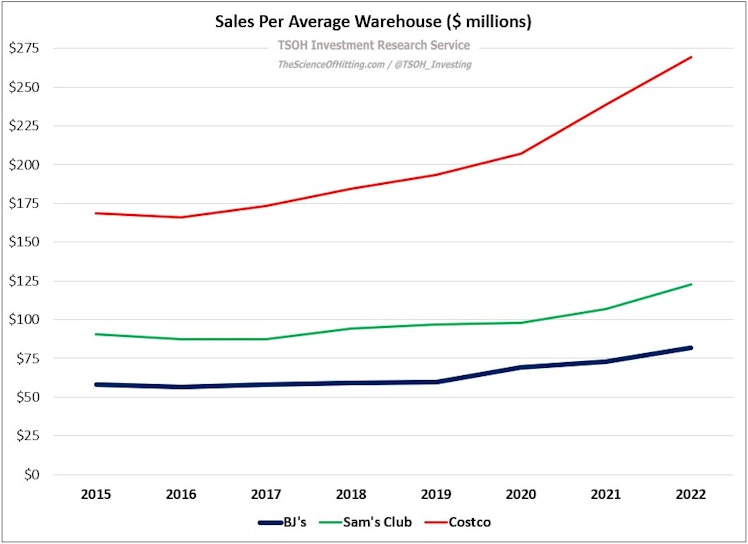

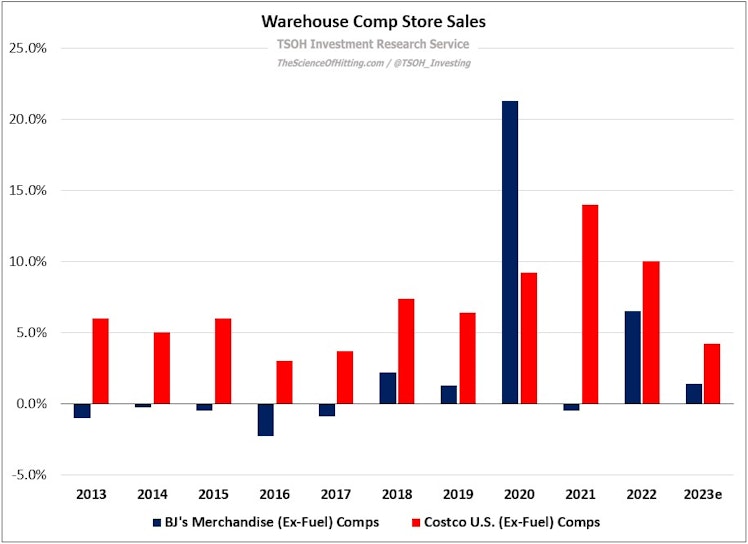

While it’s difficult to pinpoint a definitive explanation given some data gaps (limited historic financials in the S-1), I think one plausible answer is that stabilizing the core became a higher priority throughout the 2010’s. Here’s one data point to explain why: from 2008 – 2018, the sales volume per average BJ’s warehouse increased by ~8% (cumulative). Over the same period, average unit volumes at Sam’s Club and Costco increased by ~24% and ~35%, respectively. My sense is BJ’s largely muddled along throughout the 2010’s, with its PE owners taking the chain public once again in June 2018 (it jumped >25% on the first day, to a market cap of ~$2.7 billion; as of the most recent proxy, neither of the PE firms own >5% of the company).

Then the pandemic happened: in 2020, BJ’s merchandise comps were +21%. Following a decent run in 2021 and 2022, with two-year stacked comps at +6%, the average BJ’s warehouse generated total 2022 sales (including gas) of roughly $82 million – up nearly 40% versus 2019, and higher than the cumulative percentage gain over the prior 15 years (2004 - 2019). In combination with EBIT margin expansion, this led to FY22 adjusted operating income of $765 million, up ~110% versus FY19. The stock price, from ~$22 at the end of 2019, has roughly tripled over the past four years. (Relative to FY23e adjusted EPS of ~$3.9 per share, BJ’s trades at ~17x.)

As we look back on what has transpired at BJ’s over the past 5-10 years, here’s the key question that I think a potential investor must answer: has something fundamentally changed at BJ’s as result of its transformation efforts, or does pandemic-related strength mask a tough long-term hand?

End of preview - read the complete deep dive at the TSOH Investment Research service

thescienceofhitting.com

BJ's Wholesale Club: Transformation?

In June 2011, after 14 years as a public company, BJ’s Wholesale Club agreed to sell itself to two PE firms (Leonard Green & Partners and CVC Capital Partners), in a deal that valued the chain at ~$2.8 billion. At the time, some analysts argued the move would give the wholesale club the room to “

Already have an account?