Trending Assets

Top investors this month

Trending Assets

Top investors this month

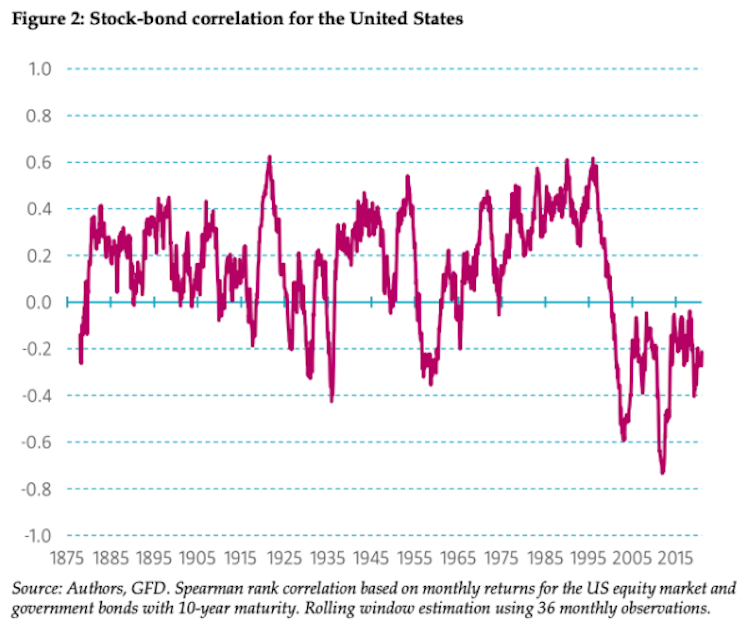

Stocks & Bonds correlation ... a very long time series!

Diversification potential of bonds & equities mix via Robeco's historical data starting in 1875:

Key finding: "for the post-1952 period with independent central banks, a positive stock-bond correlation is observed during periods with high inflation and high real returns on Treasury bills."

A positive stock-bond correlation has been more common than a negative one, even though the latter has been observed mostly in the past two decades (a positive correlation means stocks and bonds move together; negative correlation means stocks and bonds move in opposite directions).

Thoughts?

Mav

defeats the diversified strategy of stocks and bond. can you share the source?

Already have an account?