Trending Assets

Top investors this month

Trending Assets

Top investors this month

Allegion: Turning Keys, Unlocking Future

The below is an extract of the latest write-up released in our newsletter. In this write-up, we cover $ALLE.

For the full write-up you can click here --> Allegion: Turning Keys, Unlocking Future

If you enjoy this memo, make sure that you subscribe to our newsletter. You can always join as a free subscriber, spend some time evaluating our work and decide later if you want to jump in.

-------------------------------------------------------------------------------------------------------------

Business Overview

Its history

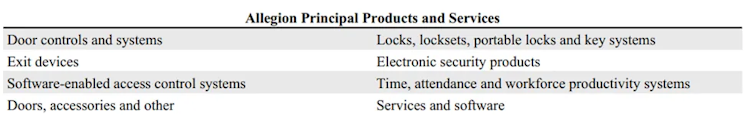

Allegion plc is a leading provider of security products/solutions for residential homes, commercial businesses (hospitality, retail, office) and institutions (education, healthcare, government, campuses) providing among others Door controls and access control systems, locks, locksets and electronic security products.

Source: Allegion 10K 2022

Allegion’s history as a public company is short as it was spun off from Ingersoll Rand Plc on 1 December 2013 (the “Spin-off”). David D. Petratis was appointed as the Chief Executive Officer and President of the Company in August 2013 and lead the Company until July 2022. Following his retirement he was succeeded by John H. Stone (more about him later) who currently leads Allegion.

Despite having a short history as a public company, its roots go back to over a century with Von Duprin (acquired by Ingersoll Rand in 1974), one of its key brands, being the inventor of the “panic release bar” exit device in 1908, Schlage (acquired in 1974) was founded in 1920 and was awarded the 1st patent for both cylindrical and push-button locks while CISA (acquired in 2004) was founded in 1926 and patented the first electrically controlled lock.

Among others, notable steps in its recent history is the adoption of Internet of Things (“IoT”) solutions in 2014 through Schlage sense launch, Overtur launch in 2017 (a cloud-based suite of tools that helps architects and door hardware consultants to collaborate on specifications and the security design of doors and openings), the launch of Allegion Ventures fund in 2018 to invest in upcoming technologies to make smarter solutions and its largest acquisition (~$900M) of Stanley Access Technologies in 2022 (“Access Technologies”), a leading provider of automatic doors which patented the first hands-free door operator in 1931.

Since the Spin-off, i.e. over the period 2014 to 2022, Allegion managed to grow sales by a CAGR of 5.6%, of which 4.7% was organic. During the same period adjusted earnings per share increased by a CAGR of 11.3%.

As of today, its portfolio comprises of ~30 brands with key brands such as CISA, Interflex, LCN, Schlage, Simons Voss and Von Duprin, holding key market positions in their primary product categories and over 1,000 global active patents.

Source: Investor Day presentation, May 2023

Segments

The Company operates under two reporting segments, namely, Allegion Americas and Allegion International (primarily Europe, Asia and Oceania) while it also provides revenues by nature, like Mechanical Products, Electronic Products and Services and Software.

Revenues by nature

Allegion shall not be perceived as a mechanical products only company since Electronics account for a respectable 26% of FY2022 revenues.

Source: Stratosphere.io (use coupon code STOCKOPINE for a 25% discount), StockOpine analysis | Notes: Electronic products include all electrified product categories, including, electronic and electrified locks, access control systems, time, attendance and workforce productivity solutions and electronic and electrified door controls and systems and exit devices. Services and software include inspection, maintenance and repair, design and installation, aftermarket and locksmith services, as well as SaaS offerings.

Electronics will play a vital role on the future success of Allegion as the world becomes more digitalized. Although there was a decline in the sales mix of electronics in 2022 due to a slower growth rate (8.8%) compared to Mechanicals (12.6%) and Services & Software (231%), it is worth noting that electronic parts shortages severely impacted growth. Over the most recent quarter, Allegion reported that the supply chain is again healthy and Electronics in Americas grew by ~40% (compared to high teens in 2022).

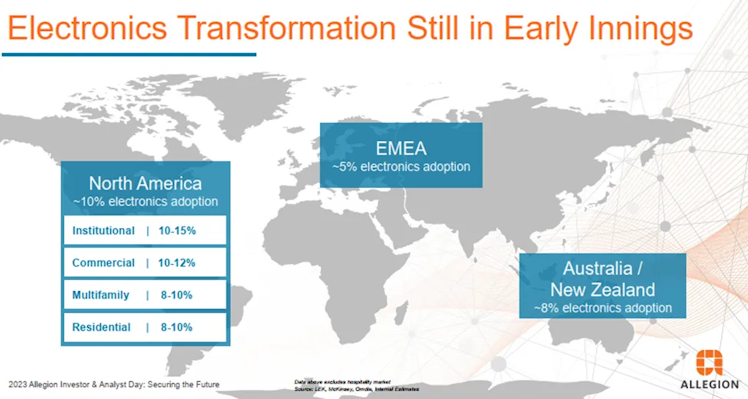

Adoption of electronics is still at the early innings, reportedly at ~10% for North America, ~5% for EMEA and ~8% for Australia/ New Zealand providing a massive opportunity for growth as consumers adopt new technologies.

“Electronics, when you think about the electronic smart lock component of that, certainly growing at the high single digit, near double-digit levels over the next foreseeable future as adoption of that business -- or adoption of electronics in the residential space continues to increase.” Dave Illardi Senior Vice President of Allegion Americas

Source: Investor Day presentation, May 2023

The greater adoption, albeit slow, of Electronics brings new non-traditional technology competitors for the Company, however, ALLE has shown that innovation is at the core of its culture with recent examples being the Schlage Encode Plus™ Smart WiFi Deadbolt (smart lock), CISA Domo Connexa (smart door), Schlage Mobile Student ID (access and payments virtual ID leveraging NFC technology and being eco-friendly) and Zentra (smart access solution for multifamily buildings) while acquisitions is another lever to maintain competitiveness.

In terms of profitability, Electronics and Mechanical exhibit relatively similar gross margins.

Regarding Service and Software, the increase in revenue mix for 2022 (from 1.2% to 3.4%) is a result of the acquisition of Access Technologies in mid-2022. In H1 2023 where revenue mix is more relevant, services account for 5.1% of total sales. Services is an interesting and recurring segment, though labor shortages and high skills required make the expansion a slow process.

--END OF EXTRACT-- That's just a glimpse of the full picture

Hope you enjoyed this extract! If you did, consider signing-up and/or share it with friends. Your support will be appreciated.

📢 The rest of the write-up covers Allegion Americas & International, Acquisition of Stanley Access Technologies, Management, Industry, Financials, Competitive Advantages, Opportunities, Risks and Valuation.

📢 Refer 3 friends to sign-up at the free tier to get a comp subscription 👇

-------------------------------------------------------------------------------------------------------------

Disclaimer: The content of our newsletter is not a trading or investment advice and we do not provide any personal investment advice tailored to the needs of any recipient. The information provided should not be considered as a specific advice on the merits of any investment decision.

www.stockopine.com

StockOpine’s Newsletter | Substack

We invest the time, so you can save hours!

Providing high-quality fundamental research and stock ideas. Click to read StockOpine’s Newsletter, a Substack publication with thousands of subscribers.

Already have an account?