Trending Assets

Top investors this month

Trending Assets

Top investors this month

In light of the US credit rating downgrade, consider the credit ratings of the EU

Here are the credit ratings of the EU, US, and the UK based on what S&P, Moody's, Fitch, and DBRS have:

US

- S&P: AA+

- Moody's: Aaa

- Fitch: AA+

- DBRS: AAA

EU

- S&P: AA

- Moody's: Aaa

- Fitch: AAA

- DBRS: AAA

UK

- S&P: AA

- Moody's: Aa3

- Fitch: AA-

- DBRS: AA

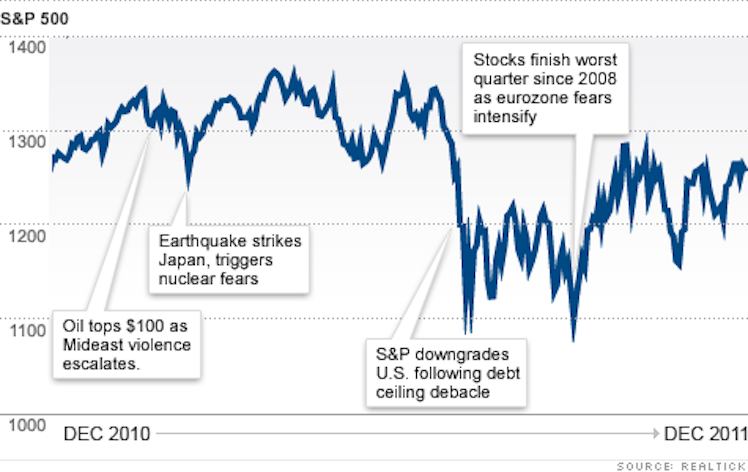

The recent Fitch downgrade on the US credit rating has many people bearish on the markets. Looking back at 2011 when S&P downgraded the US credit rating from AAA to AA+ because of the government’s budget deficit and rising debt burden in the wake of the 2008 recession recovery, stocks plunged significantly.

Interestingly, in May 2023, a former S&P official told Reuters that he believes the US would see its credit rating be downgraded in the future, and based on what we saw recently, it happened.

Looking back at the comparison in credit ratings between the US, EU, and UK, I am surprised that Fitch hasn't considered downgrading the credit rating of the EU despite many things, like the energy crisis created by the Russian invasion of Ukraine and the huge budget deficits due to European nations being a welfare state and the stagnate economy as a result of overregulation and other factors. The analysts didn't even factor the geopolitical risks that comes with the EU choosing to be reliant on the US for military protection. Without the US, Europeans would be reliving 1939 but with modern weapons as Russia would launch a wider scale invasion of the European continent. At least with the US, they're friendly with their neighbors and the location of the US makes it very far from powder keg regions like Eastern Europe, the Pacific, the Middle East, and Africa. In these ways, the EU deserves a lower credit rating.

As for the UK, it's understandable why their credit ratings are much lower than what the US and EU have. Brexit has messed up economic ties with many other nations. The country is trying to get out of the welfare state status it built during its time in the EU through austerity measures, which have ended up hindering its economic growth and the standard of living for the majority of British residents significantly. The monarchy is draining the British tax funds with their lavish spending. The risk of Scottish independence and related political uncertainty could create additional uncertainty around the UK's institutional framework.

I'm not going to say I disagree with Fitch's downgrade of the US credit rating. I will say that I think that Fitch should also downgrade the credit rating of the EU to AA-, the same rating as the UK. In ways, it looks like Fitch is blind and irrationally optimistic of the EU and rational about the US. As more EU nations look to unveil their own version of "unprecedented austerity", the economic outlook for the Eu continues to get bleaker and bleaker. From what we've seen with the austerity, there's more harm than good that comes with it.

tradingeconomics.com

Credit Rating - Countries - List

This page includes the sovereign debt credit rating for a list of countries as reported by major credit rating agencies.

Already have an account?