Trending Assets

Top investors this month

Trending Assets

Top investors this month

The divide between those that live with parents vs those that live away from home

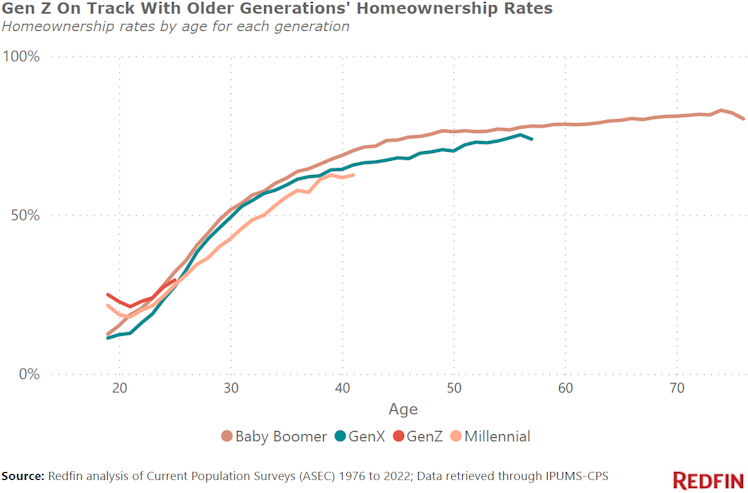

By 2030, it's expected that the majority of Gen Z is in the workforce. With Gen Z graduating college at a time when asset prices are overvalued and home prices are at their least affordable, it will be interesting to see who ends up in the "haves" and who ends up in the "have nots" and how they got there. A big reason why many members of Gen Z will be consider the "haves" is because they simply chose to live with their parents after college and not in their own apartment.

Let's be real, even with the rise in remote work, most college grads will be flocking to the expensive, coastal cities. Those cities are the most expensive cities in the country. A minority of the people graduating college will go to the Midwest, where housing is cheap but there are fewer job opportunities there. That minority of people moving to the Midwest will achieve home ownership way sooner and will be living in way bigger homes than those living in the cities.

Most college grads will be busy paying down their student debt. Those that choose to live with their parents will have a much easier and quicker time paying down those student loans on their own. Even if you have roommates, living on your own is still more expensive than living with your parents. Besides student loans, those living on their own will be accruing more credit card debt.

When Redfin writes about Gen Z being ahead of Baby Boomers, Millennials, and Gen X in terms of home ownership, they mean that those in Gen Z that were able to buy a home were able to do that in very affordable areas when interest rates were low and economic stimulus was plentiful. They weren't buying homes in the expensive cities like SF, Miami, NYC, etc.

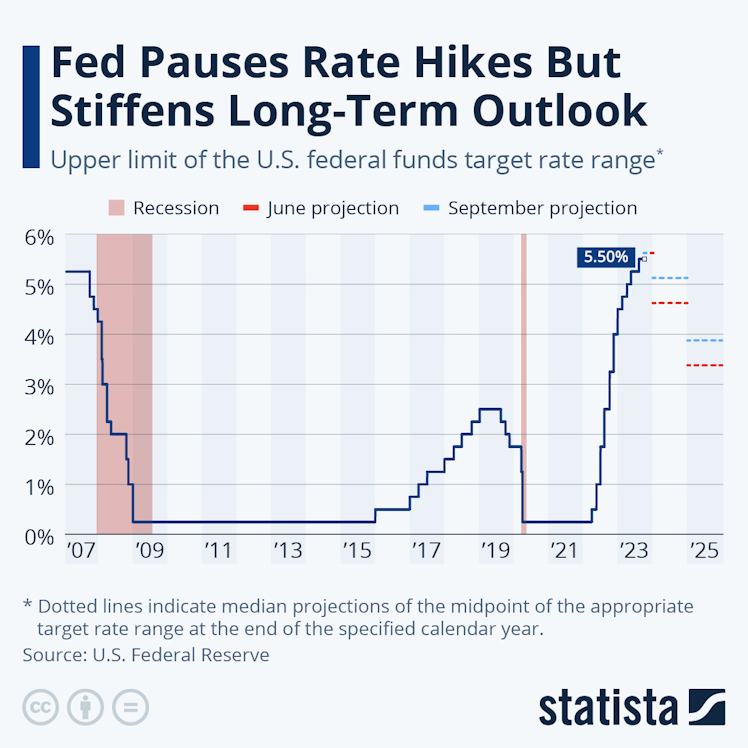

Even with interest rates surging, housing prices haven't fallen lower. But returns on bonds and other fixed income assets have risen. Members of Gen Z, who are taking advantage of the surge in interest rates by buying bonds and higher yielding REITs, will do better than those that don't. Most likely, it's the folks in Gen Z that are living with their parents that will be taking advantage of these times because those living on their own have to now deal with the end of the student loan payment moratorium.

In terms of competition for housing, the environment has only gotten more competitive. According to real estate influencer Julie Chang, homebuyers today are competing against:

- People with intergenerational wealth

- DINKs - dual income no kids who both make 6 figures and have been saving for 10+ years. Or have kids but just very high earners

- Home owners that have a lot of equity in their existing home that they plan to use in their new home purchase

- Extreme savers. Single people - people who have just diligently saved for many years

- People that are willing to house hack

- Baby Boomers looking to downsize in a one-story home in a walkable neighborhood near culture, restaurants, their kids/grandkids

- Investors looking to buy their next rental property

Conclusion

While it's still too early to tell whether those that choose to live with their parents right out of college will do far better than those who choose to live on their own, I expect the wealth gap within Gen Z to get bigger. With a competitive home buying environment, Gen Z's head start during the pandemic may cool down longer than we expect.

CNBC

Gen Z, millennials are ‘house hacking’ to become homeowners in a tough market. How the strategy can help

Gen Zers and millennials are using "house hacking" as a way to secure homeownership in a tough market. Here's how the strategy works.

Already have an account?