Trending Assets

Top investors this month

Trending Assets

Top investors this month

Talking About Losses

Perhaps the only universal truth in investing is that you will make mistakes. Sometimes you will lose money.

I linked a trade above where I bought NGL Energy partners at $3.34 on April 4th. The position is down -13%.

Discussing losses is important because it opens you up to understanding what went wrong. And for those reading, it reveals trustworthiness.

So far NGL Energy partners has been a losing position for me, but here is why I'm still holding:

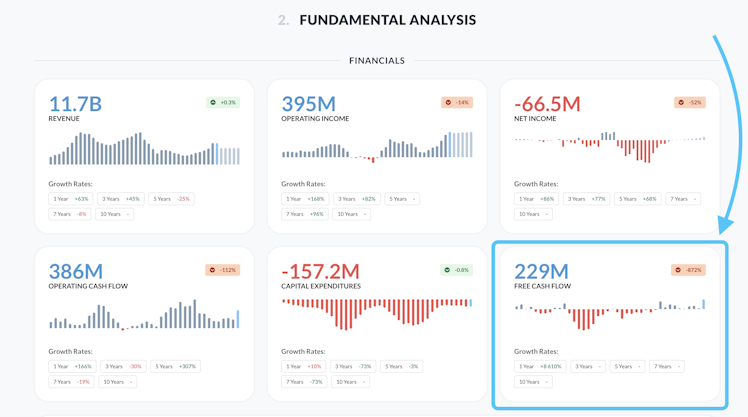

Since 2018, $NGL's free cash flow has gone from negative to positive:

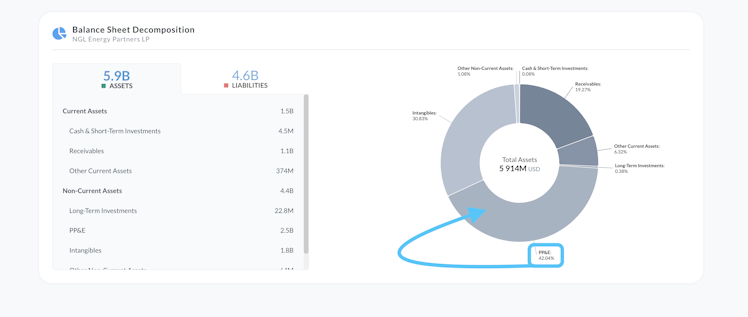

Most of NGL's assets are in property, plant, and equipment...

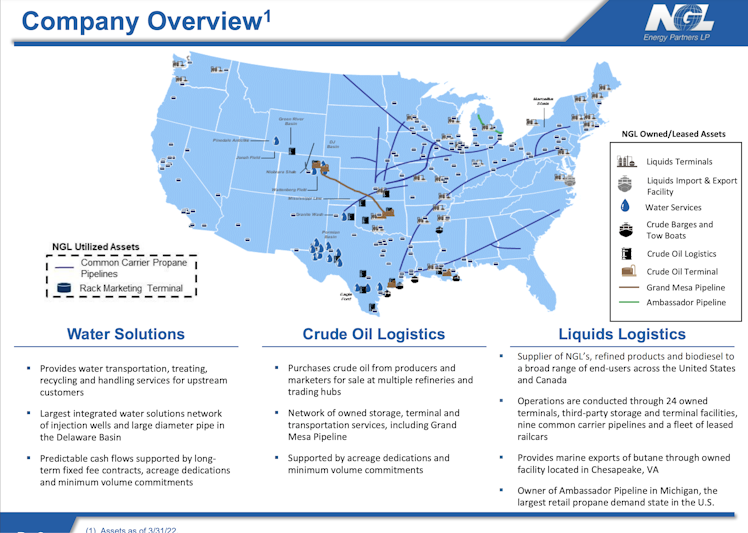

...which makes sense because they own a large network of oil pipelines and crude oil terminals:

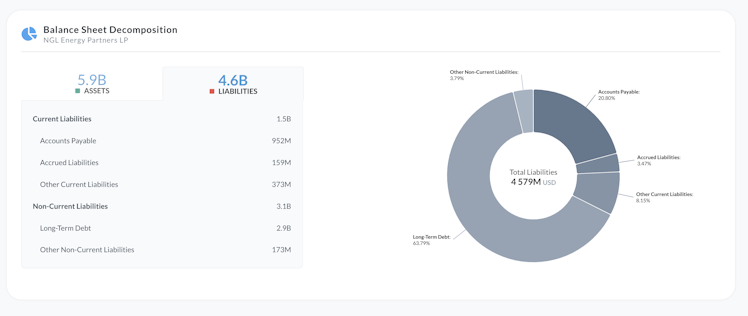

The vast majority of their debt is long term.

A lot of investors who are bullish NGL right now are excited about and are betting on management making progress on paying down long term debt: (which is 63% of their liabilities)

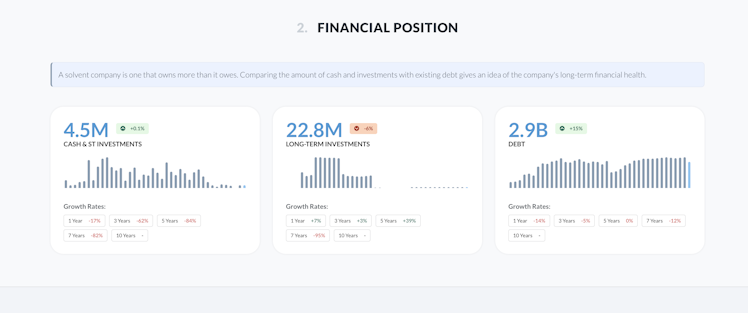

Their debt is their largest risk factor. Currently they have only $4.5 million in cash and investments but $2.9 billion in debt:

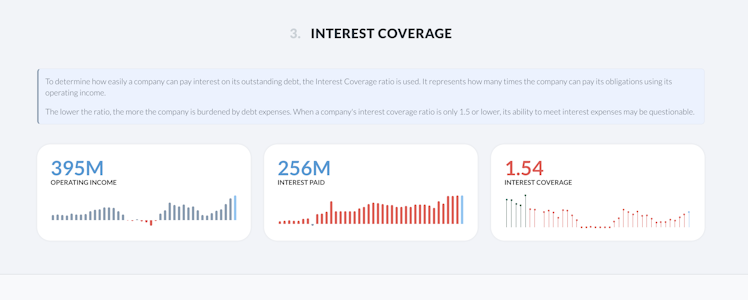

Paying interest on NGL's debt is a bit questionable. NGL's operating income is only 1.54 times the interest payments on it's outstanding debt:

Macro reasons to be bullish:

- Last month, OPEC+ announced it was slashing output by 1.16 million barrels per day.

- Continued investment in the Permian Basin

- Global oil demand is set to grow by 2 million barrels per day, keeping the market under-supplied throughout 2023.

- Natural gas production in the U.S. has increased for 23 consecutive months as electric power distribution and liquified natural gas (LNG) exports continue to rise.

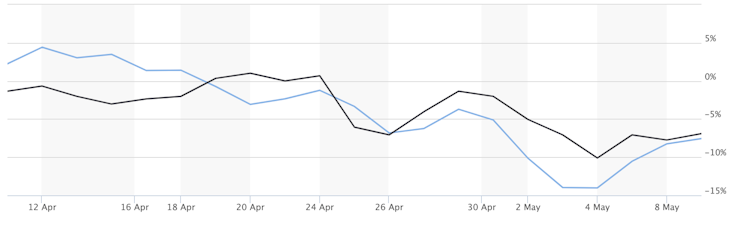

So why has NGL dropped over the past month?

It's sliding along with the rest of the oil market.

Oil prices saw their third consecutive weekly decline last week, marking the longest losing run this year. West Texas Intermediate has seen a 11% year-to-date fall.

NGL's stock has fallen along with the price of oil. The blue line on the chart below is the price of oil, the black line is NGL's stock price:

NGL is currently sitting at $2.77. Their earnings call is scheduled for May 31st. Hoping to hear about more debt being paid down.

Times Record News

Natural gas continues to set records

Natural gas production in the U.S. has increased for 23 consecutive months.

Already have an account?