Trending Assets

Top investors this month

Trending Assets

Top investors this month

First I want to tag some people as they will want to see what I have to say. @capisce_capital @couch_investor @nathanworden @interrobangbros @seasnar I probably forgot some people but this is everyone I talked to about the CVS news last week I think. So before I get started I want to say this is all gonna come out as you all know me, real and to the point lol. So let's get started. You all heard what I had to say last week about the CVS news which was pretty typical coming from a shareholder on a day with bad news lol.

However, I have taken some time now to truly think and have kept everything you all said to me in my mind as well. First, now that my emotions have had some time to come down and I reflect on the news, the CVS thesis for me remains in tact. I know I've told some of you that this could be a thesis buster it's not. Second, I want to say I did not realize that CVS put out a 8k in an SEC filing last thursday. This is what I expected and I just did not see this piece. I usually get an email about SEC filings from CVS and I did not get one this time (have to figure out why, my emotions could've been saved lol). I'm happy to see that the company did come out on that day and address it. When you stock drops over 10 percent in a day, I do not expect you to go hide (speaking to management specifically Karen and Shawn). And so the filing was exactly what I wanted to see. Now let's get into what it said. The filing said "CVS Health Corporation (“CVS Health,” the “Company,” “we” or “our”) understands that Blue Shield of California has announced today, as part of a new pharmacy care model, that it will use a number of pharmacy service providers beginning in 2024. CVS Caremark will continue to provide specialty pharmacy services." Typical first couple of sentences as we saw from the news when it came out.

However, now let's get into the material information. "The financial impact associated with the partial termination of the Blue Shield of California contract is not expected to have an impact to our previously issued 2023 guidance and is expected to have an immaterial impact on our longer-term outlook."

This is the same news I heard from analysts on the day so as expected I am happy there is no change to the 2023 guidance and longer term guidance.

"CVS Caremark remains the leading pharmacy benefit manager in the United States, serving more Americans and more health plans today than any of our competitors."

Now something the filing said which I have echoed all along owning CVS is this right here. "CVS Health believes customers choose CVS Caremark because of its ability to seamlessly administer complex pharmacy and specialty pharmacy benefits with high levels of customer service and satisfaction, as well as our leading cost position." I've said this all along people pick CVS and Caremark in particular because of the seamless transition it provides across all your healthcare needs.

CVS went on to say "We are pleased to continue to serve Blue Shield of California customers for their specialty pharmaceutical needs." They through this line in there which I thought was very good to see. "Specialty pharmacy spend now represents over 50% of pharmacy benefit spend in the marketplace." CVS retained the spec pharmacy portion of the contract which is a higher margin business than the generic pharmacy business anyway so if you want to see maybe a little positive that is it there. I however think the real positive news is that Blue Health still see's the value in Caremark because of this.

They ended it by saying "We remain confident in the value that CVS Caremark provides to our customers and that our integrated solutions will continue to resonate in the marketplace as we deliver our leading cost position and service excellence to our customers." That last sentence truly does summarize my thesis for CVS quite well. I am confident in CVS ability to provide to their customer through multiple integrated solutions in the marketplace. Integrated being the keyword. CVS is setting up something only a few companies have and the others do not have it set up as well as CVS. Again I have said this a while ago, CVS is trying to become a one stop shop for all your healthcare needs-seamless transition for customers, something Amazon or Mark Cuban does not have the ability to do.

Now I want to say this and not in a joking way. I think Amazon and Mark Cuban are swinging at CVS low hanging fruit. Not to say PBM business is not a huge driver for CVS but this news was immaterial to CVS financially as seen through their confirmation of 2023 and longer term guidance. I think customers will continue to see the value and benefit of CVS across not just Caremark but all the integrated levels of CVS. I don't think this is a crush to CVS moat at all. I think this is just an insurer that decided that Amazon and Mark Cuban could maybe give them better value. Now if this continues to be a trend I think it could cause for more concern but for now it is just something to monitor. The good news again however is that CVS Health reaffirmed its 2023 full year GAAP diluted earnings per share (“EPS”) guidance range of $6.53 to $6.75, adjusted EPS range of $8.50 to $8.70 and cash flow from operations range of $12.5 billion to $13.5 billion.

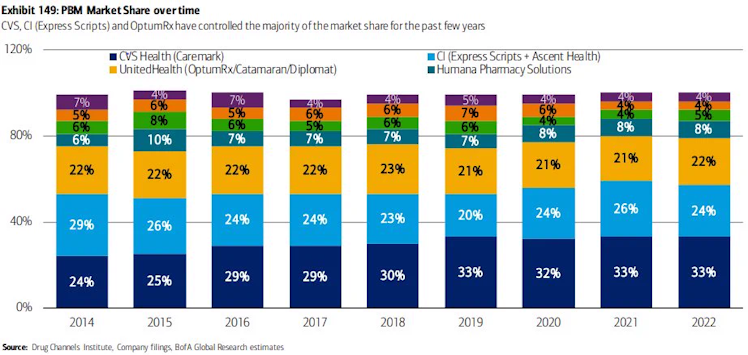

Now before I get into more of my analysis I want to share some graphs I found online that I thought would be appropriate to share to give you just some more overall background information.

Okay, now to my analysis and what has occurred over the past few days more in detail. Now all of you know I have been one of the biggest supporters of CVS for a very long time. Biggest bull out there I think and I will always tell you like it is just like I did on the day of the news. But after taking some time to think I truly have never been more confident in CVS. Now I know I talked to some of you about selling and never getting back in. Again this was my emotions talking not my head.

First about the news just simple, CVS should not have been down as much as it was with barely an affect on long term earnings. Simple as that. This hit is immaterial in the long run (this hit only now if there is another insurer that does the same thing that's different). Second, and the biggest thing I want to share with you all is I don't see this working for Amazon and Mark Cuban. Don't get me wrong it is possible but I think this becoming a regularly thing is highly unlikely. Many times in the past other companies have tried to do something similar to this Amazon and Mark Cuban thing and failed miserably. CVS and UNH the big two have already been quite competitive in the negotiating and reduction of medicine costs. I guess the thought is Amazon and Mark Cuban company would force the already competitive pricing lower which in turn would limit profit right but I am so skeptical of that working. Again CVS and UNH have such a great system and relationship already set up, decades built on building out there PBM's I just can't see that changing. This has been my thesis all along. Everyone who follows and knows me. I've said it all along CVS is becoming a one stop shop for all your healthcare needs not just PBM's. So you mean to tell me patching together a network of Amazon and Mark Cuban is better than going to a synced already established one stop shop that has everything-ain't no way you can convince me of that. I think after this massive selloff the company is so undervalued it hurts. People are expecting CVS to fold overnight. Someone go pull up my post of earnings a few weeks ago. Go look and read through the results. I'd be happy to share them here but I don't want to make this post longer than it already is lol.

In conclusion, I hope you all get my idea throughout this post. CVS is becoming a one stop shop for all your healthcare needs and that's their moat. This news didn't affect that as much as the market thinks it did. I am as confident as ever in the future of CVS. I think this reaction has truly been totally overblown both on a financial level and on a business level. Again most of you know because I talk to you on the side what I like about CVS as well as their recent acquisitions. It is all part of a long term plan that I don't see the thesis altered at all. Now again is it a minor concern sure but I think this price action was an emotional overreaction similar to my feelings at first glance on the day of the news.

I still trust in Karen and Shawn. I still trust in CVS and the plan. Most importantly I trust in my research-simple as that. As I said in my comment to @couch_investor, the healthcare industry is not easy to invest in. I truly believe it takes a special kind of investor but I know the value CVS brings to the table and I know the plan for the future. I believe CVS is well on their way to showing everyone who doubted them wrong. Any questions put them in the chat but I hope you all can get my thoughts now after some reflection. And PS I know I am still behind with posting my write up up of CVS. Law School is making that really hard to finish right now but I promise I will get it posted as quickly as I can especially after the news because I know people genuinely like to hear what I have to say about CVS as I have believed in them for many months I think years now.

Already have an account?