Trending Assets

Top investors this month

Trending Assets

Top investors this month

Vysarn $VYS.AX - An opportunity under the Australian water

Hi there,

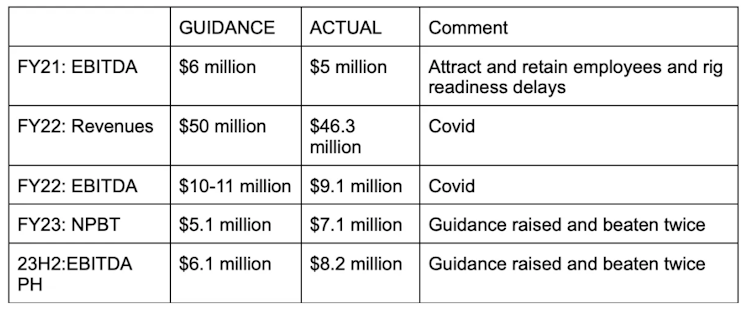

We are updating the investment thesis of one of our best performing ideas in 2023 - as there are several important points to address - . We are talking about an Australian small cap company called Vysarn Ltd $VYS.AX which share price has rallied >110% since we published the thesis 6 months ago.

We cover:

- Vysarn updated investment thesis

- Our interview with James Clement - Vysarn CEO (August 2023)

- FY23 Results analysis (Released on 25th August 2023)

Vysarn Investment Thesis in a nutshell

Vysarn is a vertically integrated company with 4 business divisions providing water services in Western Australia. With a market capitalization of A$ $79M, this micro-cap is trading around 2024’s (FY ends on 30th June) 4.5x EV/EBITDA and less than 7x NPBT. Vysarn is experiencing high growth and entering more profitable and less capital-intensive segments. The Chairman of the company already led a company that multiplied the value of their share x37 in five years. Vysarn´s management is highly experienced in the sector and in M&A.

Core business (hydro dewatering) revenues are backed by multi-year contracts with tier-one iron ore producers. This segment is expected to contribute around 14-16M EBITDA per year.

Since the start of the operations in Sep 2019, they had a clear route of integrating the business vertically, acquiring compatible businesses with their core division. The diversification into more capital-light segments is starting to translate into higher valuation multiples.

After an H1 negatively affected by rig maintenance, on Friday 25th August they just reported the FY2023 results which were proof of the level of revenues and baseline earnings the company can achieve.

Possible catalysts for the share price:

- Higher percentage of revenue by capital-light divisions.

- Inorganic opportunities (CEO interview)

- Dividend in the fiscal year 2024

Vysarn History

--------------------

Peter Hutchinson (current Chairman) bought MHM Metals, an ASX unlisted company, and renamed it as Vysarn in late 2017.

In April 2019 they agreed to buy drilling assets to Ausdrill for $16 million. In September, they relisted Vysarn on the ASX. With this funding ($7M from relisting + $8.8M from debt), Pentium Hydro, one of the subsidiaries of Vysarn, acquired the pre-agreed 10 drilling rigs plus some ancillary equipment (casing rotators, air compressors, rig carriers, etc.). The fair value of these assets was seven million higher than the purchase price.

A few weeks after the relisting, they signed the first contract to provide drilling services. Since then, they have moved from short-term contracts to longer-term ones with tier-one clients. Driven by strong demand, they bought other two drilling rigs. During these years they have accomplished almost full utilization rate during these years.

In November 2021, they completed the acquisition of Yield Test Pumping (Pentium Test Pumping) at less than 4 times EV/EBITDA, starting the company's vertical integration. Before the acquisition, Yield had already signed a two-year contract with Fortescue Metals Group (FMG) to provide test pumping services.

Only three months later, in February 2022, Vysarn launched their consulting division (Pentium Water) organically. And in the summer of 2022, they acquired ProEng for $2.6 million (3x EV/NPBT) entering the Managed Aquifer Recharge (MAR) segment. ProEng is one of the more clear proves of management's ability in M&A, with less than one year consolidated, once consolidated, ProEng has achieved more than $1.5 million in NPBT.

The latest movement by the company was to establish a 50/50 Joint Venture to enter the fluid containment solutions with Concept (a leader in this business in Eastern Australia).

Full thesis + CEO interview + FY23 results analysis --> https://moram.substack.com/p/vysarn-special-investment-thesis

moram.substack.com

Vysarn Special: Investment thesis + CEO interview + FY23 results analysis

MORAM - Sunday 27th August 2023

Already have an account?