Company Deep Dive: Unity Technologies

I put together a Deep Dive on $U this morning following last week's earnings.

Highlights include:

A) The Business

Unity describes themselves as the “world’s leading platform for creating and operating interactive, real-time 3D content.”

And that they “provide a comprehensive set of software solutions to create, run and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices.”

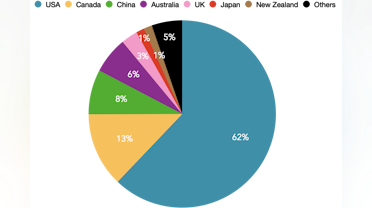

- Games made with Unity accounted for 71% (!) of the top 1,000 mobile games

- Monthly Active Users who consumed Unity-made content reached 2.7 billion (!)

- Applications built with Unity were downloaded on average 5 billion times per month

- Monthly active creators were 1.5 million (as of 6/30/20)

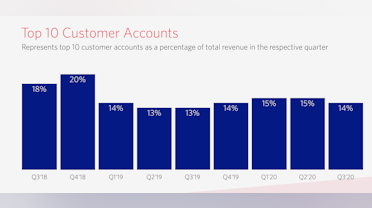

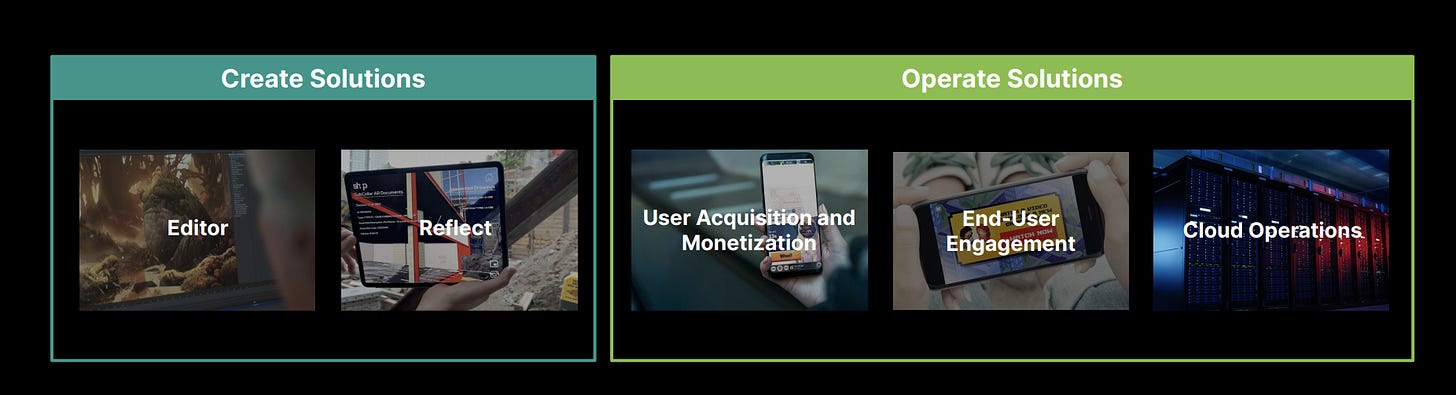

They break out their business into three separate categories: Create Solutions, Operate Solutions and Strategic Partnerships/Other.

Pretty simply, Create Solutions are used to create the games and content.

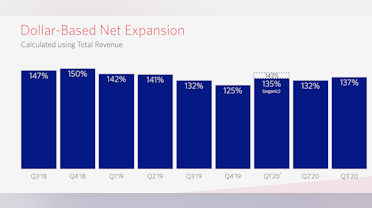

Operate Solutions allows customers grow, engage and monetize their user base.

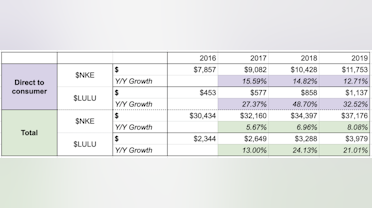

Create Solutions utilizes an annual subscription model, while Operate Solutions utilizes a mix of revenue-sharing and usage-based pricing.

B) Beyond Gaming

"We continue to gain significant traction with customers and leading brands in industries beyond gaming, including architecture, engineering and construction; automotive, transportation and manufacturing; and film, animation and cinematics."

Measured by 2019 revenue, Unity works with:

- Eight of the top 10 architecture/design firms

- Nine of the top 10 auto companies

Case Studies in the post include Skanska (leading construction company), Volvo, and Moving Picture Company (production company that created Disney's 2019 Live Action The Lion King.

C) Conclusion

Powering creators, dominating mobile-game development, an impressive partnership list out of the gate—and this is all before we get to how Unity can transform the architecture/design, automotive and film industries. I like being a part of the future. So I’m starting small, watching and being patient.

Despite the excitement, it takes time to build the future.

Please check out the full post at:

And make sure to sign-up!!

Thanks so much,

~MazwoodCap

@mazwoodcap this is fantastic! thanks for sharing. the "beyond gaming" part especially. you have a platform and ... ;)