Trending Assets

Top investors this month

Trending Assets

Top investors this month

@kermitcapital

Kermit Capitál 🇵🇦🇨🇺

$222.7M follower assets

81 following2,906 followers

Oh, Thank Heaven! For sEVen/elEVen.

Disclaimer: I don't own shares of 7&i Holdings and this is not a recommendation.

Here are 5 reasons why I've been paying attention to $SVNDF lately:

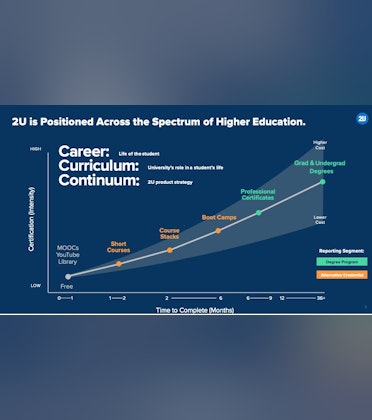

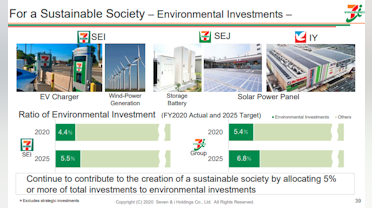

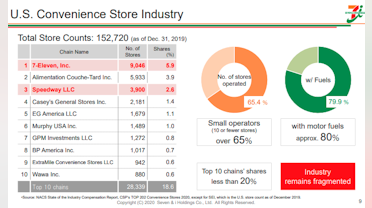

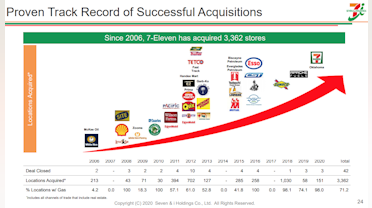

1) Electric Vehicles: With 9,046 stores, 7/11 has the most convenience stores in the US accounting for 5.9% of total convenience stores nation-wide. 7&i holdings, parent company of 7/11, recently acquired Speedway, which is the 3rd largest convenience store chain and the largest gas station chain in the US. This acquisition is the most recent step in a 15 year track record of rolling up the fragmented US convenience store & gas station market. They have been investing in remodeling gas stations to service EV's by equipping them with solar panels, batteries and chargers.

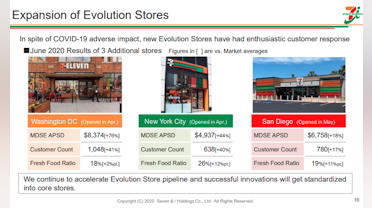

2) Fresh Food & Proprietary Beverages: The brand we know as 7/11 is owned by a Japanese company called 7&i Holdings. 7/11 is the #1 convenience store in Japan and are well-known for their remarkably high-quality selection of fresh food and fantastic in-store experience. They have recently begun the process of revamping their US stores with the goal of expanding their fresh-food and proprietary beverage selection.

3) Food Delivery: 7NOW, 7/11's delivery app, saw a 6x increase in monthly sales over the course of 2020 (granted this is off of a small base). Only 960 stores out of their 12,946 convenience stores in the US (including Speedway) have this delivery service enabled today.

4) Digital Payments: 7-Eleven Wallet embedded within the 7/11 App enables contactless payment at 7/11 stores and lets customers earn rewards points. This could be 7&i's foothold in the Financial Services sector in the US. If that sounds farfetched, consider the list of Financial Services that 7&i subsidiaries already have in operation.

5) Valuation: With a P/S at 0.6, $SVNDF has a pretty good margin of safety.

Risks:

- Revenue growth has been stagnant.

- Execution risk is high.

- Volatility in gas prices.

$NTDOY Console Sales

Source: Visual Capitalist @visualcap on Twitter.

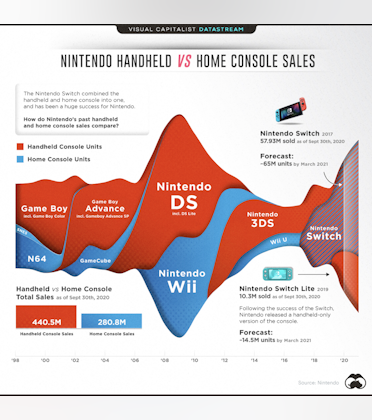

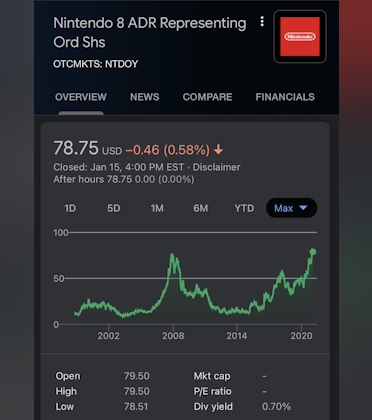

Historically, the stock price has followed console sales. Recently the stock price has reached ATH that haven’t been seen since 2008. While the number of console units sold today is approaching the Wii/DS era, the business today is much more attractive than it was 13 years ago, for the following reasons:

- The release of the Switch signaled a paradigm shift from a boom/bust console cycle to an iterative hardware model reminiscent of the iPhone. This allows Nintendo to retain and build their active customer base with new hardware launches and increases their audience for new game releases.

- The digitization of game sales means the process of selling new games is frictionless. Their vertical integration enables them to own distribution.

- Management has signaled that they will be aggressive with the growing the IP revenue line that currently stands at ~4% of total revenue. This can be seen with the launch of Theme Parks and eventually streaming content.

For me personally, the switch has been a fantastic console given its portability and price point for friends to also get it. $SNE and $MSFT have their consoles at similar price points to GPU options from $AMD and $NVDA. If Nintendo can keep this price point low and get more marquee first party titles beyond Breath of the Wild 2, the stock can go much higher.

Marketing Today: Fraud in Ad Tech

Marketing Today is a podcast that goes behind the scenes with the world’s best chief marketing officers and business leaders.

In its 194th episode, host Alan Hart interviews Kevin Frisch, who was recently the CMO of Wag and before that the Head of Performance Marketing, and CRM for $UBER. Before Uber, Frisch served as chief marketing officer of GSN Games and Snapfish. Frisch was named to Forbes’ CMO Next List 2019: 50 Game-Changing Marketing Leaders.

Frisch discusses the largest ever fraud case, a case between Uber and its suppliers of performance marketing and advertising. Frisch shares what happened, what was the trigger that launched the investigation, how they diagnosed what was going on, and several measurement challenges along the way.

Frisch shares the revelations on ad fraud and the difficulty of finding it only after you have the detailed data, “Until you do that, if you’re just relying on the higher-level reporting, you just don’t catch it.” He advises that “you should start by assuming that, half of what’s on the display channels, is fraud.” “You can’t sort of out-source, and say, here’s an anti-fraud tool, let me just run it through that.” There is still so much to learn about fraud. Frisch shares a much-needed perspective on how to approach and avoid issues.

Link:

Marketing Today with Alan B. Hart

194: Historic Ad Fraud at Uber with Kevin Frisch

During this 194th episode of “Marketing Today,” host Alan Hart interviews Kevin Frisch, who was recently the CMO of Wag and before that the head of performance marketing, and CRM for Uber. Be…

Will be interested to see if Kubient’s KAI solution starts getting traction /adoption in this area $KBNT

Mario Cibelli on $SFIX

Mario Cibelli is the managing partner of Marathon Partners Equity Management. He was recently on the "Invest like the Best" podcast and discussed visiting the fulfillment center of $NFLX in the early days and more recently $SFIX.

Below are some quotes I found insightful:

"The Stitch Fix DC visit that we did recently, I'll say this, I was like a kid in the candy shop down in Dallas. That was the most interesting DC that I've seen since my early days on Netflix."

"I walked out saying, 'This is not an e-commerce business that we just saw. This is a whole different kind of service.' And I don't think anyone, anyone in the world potentially, is trying to do what they do at scale. And it's going to be a very complicated thing to get right, but if they get it right, and I think they've gotten a lot right so far, it could really be something special."

"So the way Stitch Fix presents its units, generally speaking, all the collar stays are out, the plastic's gone, everything is taken apart. They're picked, they're folded, they're stacked, they're wrapped, they're put in a box, and they're sent out. The quality control, quality checks go on at this point. That was a tremendous part of the human labor that was present in the DC, was in that area."

"When the box is opened, you could try everything on inside of six or seven minutes because it's all ready to be tried on. That's an interesting way to present units versus another e-commerce operation that will send you some shirts. The collar stays are in, there's pins in them, they're folded nicely, there's plastic on top of them. If you had four or five things sent to you from a traditional e-commerce company and you want to try them all on, it might take you seven or eight minutes just to get everything set so you actually could try them on. They put great effort into ensuring that when the box is open, that it's very presentable. That's an expensive, labor-intensive thing to do for a very small win. So that labor bottleneck is, I think, very different than traditional e-commerce."

"Let's just think about, from an operator's point of view, what it means to know that shipments, what they're going to be like in two weeks. It's very different than traditional e-commerce. There's no seasonality in the business, really. It has grown over time. But they have a very, very predictable production schedule. So if they're sending out 1,000 fixes today, they might send 1,010 tomorrow and 1,010 plus another five the next day. It's very kind of predictable."

"So when you introduced that level of predictability into a facility, it allows a tremendous amount of efficiency in planning and whatnot that would reverberate throughout the whole distribution center. That's just simply unavailable to a traditional e-commerce operation that might have a peak to trough delta of, I don't know, 3X to 8X. It just is a whole different way of planning your business."

"by the way, I would say it's not entirely clear that Stitch Fix is going to succeed. I think they will. The level of success, how far they take it, I don't know. But I'm not saying this is easy. I'm actually saying it's really, really hard. That's the whole point. That's going to allow them to potentially escape Earth's gravitational pull in a big way."

"I think a store operator like J.Crew or Urban Outfitters, I think, is attempting a service like this, that operates stores, good luck. It's going to be tough. It's going to be tough to do subscription apparel. It's not going to be easy."

"I think there's a chance that they could really be big and successful. 10 years from now, I'll be talking about that DC visit in Dallas that I did, just like I am about the Netflix visit we did in the early 2000s."

Colossus - Business Podcasts

Cornerstone Investing Insights

Mario is the managing partner of Marathon Partners Equity Management. We cover how his firm figured out Blockbuster's DVD volume, why investors should visit distribution center, and how a few

Thanks for writing this up!

Question- I get that having predictability is a Godsend for this kind of business, but what I don't yet understand is why they have this predictability.

Did he explain what causes this predictability? Is it the fact that Stitch Fix develops the trust with the customer such that Stitch Fix gets a hand in deciding what the customer wants and when?

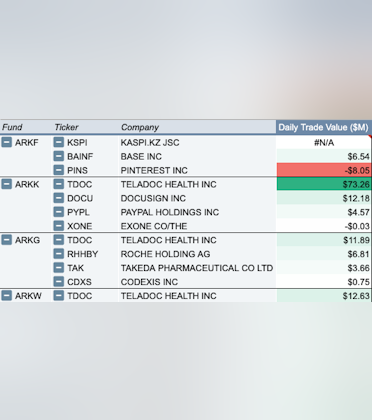

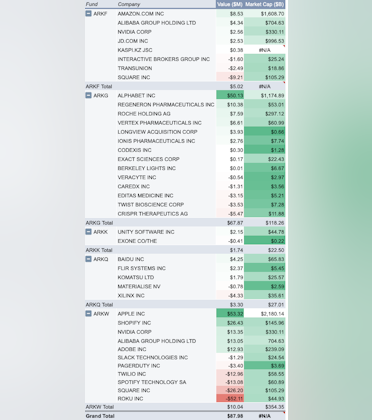

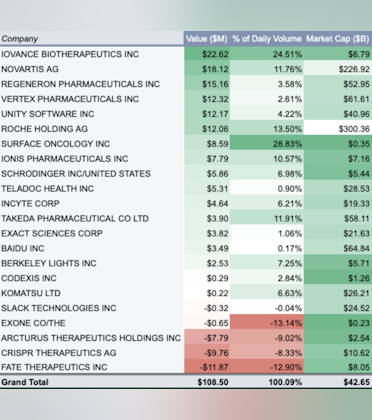

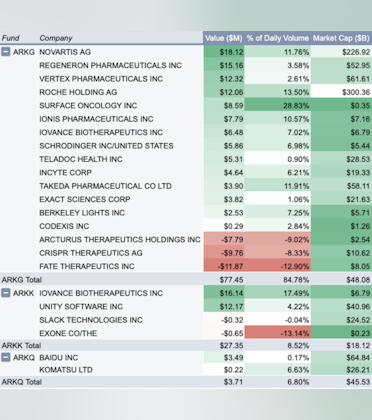

Ark Invest Daily Trades - 12/21

Broken out by Company:

Broken out by ETF:

Cathie Wood on 12/18 regarding when Ark invests in FAANG stocks:

"As a bull market extends, we do move into more 'cash-like' equities; they would be the less volatile stocks.

Certainly FAANG & $MSFT fit that.

We would do that increasingly."

Link:

Ticker, Trade Amount ($M):

$AAPL, $53.3M

$GOOGL, $50.1M

$SHOP, $26.4M

$BABA, $17.4M

$NVDA, $15.9M

$ADBE, $12.9M

$REGN, $10.4M

$AMZN, $8.5M

$RHHBY, $7.6M

$VRTX, $6.6M

$BIDU, $4.2M

$LGVW, $3.9M

$IONS, $2.8M

$JD, $2.5M

$FLIR, $2.4M

$U, $2.2M

$KMTUY, $1.8M

$KAKZF, $0.4M

$CDXS, $0.3M

$EXAS, $0.2M

$BLI, $0M

$XONE, $-0.4M

$VCYT, $-0.5M

$MTLS, $-0.8M

$WORK, $-1.3M

$CDNA, $-1.3M

$IBKR, $-1.6M

$TRU, $-2.5M

$EDIT, $-3.2M

$PD, $-3.4M

$TWST, $-3.5M

$XLNX, $-4.3M

$CRSP, $-5.5M

$TWLO, $-13M

$SPOT, $-13.1M

$SQ, $-35.4M

$ROKU, $-52.1M

YouTube

Cathie Wood Sees 20% Returns After 'Unbelievable' 2020

Dec.18 -- Cathie Wood posted some of the best numbers in the history of money management in 2020. In this interview, the Ark Investment Management founder an...

+ 2 comments

Today Ark Invest

Woah..why do you think they sold $CRSP ? That’s concerning. Has been a good run but I am surprised nonetheless...

$SFIX up 91% since last earnings 10 days ago

Nicely done @kermit capital

Ark Daily Trade Summary - 12/16

Markets Insider

Teladoc drops on report that Amazon is building a business to offer primary care for other companies

Amazon's push into healthcare services has been years in the making, most recently marked by the e-commerce giant's launch of an online pharmacy.

No surprise to see Cathy load the boat on $TDOC today

Bought $NTDOY

Nintendo is a 131 year old Japanese company with the express mission ”to put smiles on the faces of everyone we touch”.

One of the reasons that Nintendo is an exceptional company is it’s long, successful track record of innovation in both technology (hardware & software) and creativity (storytelling & intellectual property).

Since 1980, Nintendo has had 14 major console releases. At the same time they released numerous influential franchises, including Mario, Donkey Kong, The Legend of Zelda, Kirby, Metroid, Fire Emblem, Animal Crossing, Splatoon, Star Fox, Super Smash Bros., and Pokémon.

A common criticism of gaming companies that manufacture consoles is the cyclical boom-bust nature of the business. Every new console is viewed as a high risk event where the customer count resets to zero. But there is reason to believe that the Switch is breaking Nintendo free from that narrative and toward an iterative product line similar to the iPhone.

See below for the origins of the Switch from Wikipedia:

“The Nintendo Switch was unveiled on October 20th, 2016. The concept of the Switch came about as Nintendo's reaction to poor sales of its previous console, the Wii U, and market competition from mobile games. Nintendo's then-president Satoru Iwata pushed the company towards mobile gaming & novel hardware. The Nintendo Switch's design is aimed at a wide demographic of video game players through multiple modes of use. Nintendo opted to use more standard electronic components, such as a chipset based on Nvidia's Tegra line, to make development for the console easier for programmers and more compatible with existing game engines. As the Wii U had struggled to gain external support, leaving it with a weak software library, Nintendo preemptively sought the support of many third-party developers and publishers to help build out the Switch's game library alongside Nintendo's first-party titles, including many independent video game studios. While Nintendo initially anticipated around 100 titles for its first year, over 320 titles from first-party, third-party, and independent developers were released by the end of 2017.By the start of 2018, the Switch became the fastest-selling home console in both Japan and the United States. As of September 2020, the Nintendo Switch and Nintendo Switch Lite have sold more than 68 million units worldwide.”

Below is an excerpt from Ryan O’Connor’s 2018 white paper on Nintendo:

“...let’s look at why we think Nintendo may be the single best risk-adjusted setup we’ve encountered in the history of the Fund. Perhaps the biggest reason, outside of valuation, is that Nintendo is changing from a cyclical, “hits-driven” business to a secular growth juggernaut with stable recurring revenues, expanding margins, and declining capital intensity. It’s doing this by getting away from having earnings depend on the success or failure of each new console. Instead, it’s transitioning to an iterative hardware model, where its installed base continuously grows and never resets. That should ensure the Switch benefits not just from the ongoing structural shift to higher-margin digital distribution of software, but also from the ability to sell high-margin software and related services to an ever-larger installed base. Moreover, the Switch’s explosive success has already ignited Nintendo’s long-lost network effects, fueling a sustained ascent of sales and earnings that we think will result in nothing less than a tripling of Nintendo’s share price in the years ahead. But Nintendo’s business model transformation doesn’t end there. Nintendo isn’t just surrounding its own indefinitely-lived hardware platform with a proprietary software-driven digital marketplace, like Apple surrounds its iPhone and iPad with its App Store. It’s also making games for smartphones themselves – vastly expanding its reach by targeting the world’s 2.5 billion smartphone users, and promising to layer on yet another high-multiple stream of stable, recurring, increasingly high-margin revenue.In short, entering the smartphone space dramatically expands Nintendo’s addressable market,

stepping up its recurring revenue base while permanently boosting its baseline profitability. (Its operating margins in mobile, at scale, should be over twice the corporate average.) And while some observers doubt Nintendo’s ability to succeed in smartphone games, we think that view is nonsense– an ironic collapse in confidence at the very moment our 800-ton Godzilla has finally mastered its mobile gaming powers. Later in this report, we’ll make the case that Nintendo is ready to tear into the mobile profit pool with a vengeance.”

A quick search for Nintendo in the App Store seems to support Ryan’s points on the smartphone gaming angle:

Another criticism of Nintendo over the years has been the undermonitization of it’s intellectual property. While this is true, Ryan O’Connor also provided some prescient insights back in 2018.

“Finally, Nintendo is aggressively ramping up monetization of its peerless library of game franchises and classic characters – the most valuable such collection in the videogame industry by far. Television shows, theme parks, movies, stand-alone retail locations, toys, and various licensed products are all in the works. Monetizing its IP is an area in which Nintendo has traditionally lagged, but over the last few years it’s been hard at work making up for lost time. These efforts promise to provide it with yet another pillar of defensive, high-margin, annuity-like revenue and cash flow.”

Since this letter was released, you can see evidence of this thesis coming to life with a theme park, hotel and innovative toys like Mario Kart Live: Home Circuit.

Mario Kart Live: Home Circuit Trailer: https://www.youtube.com/watch?v=01gaiThtflI

While the “Smart devices, IP related income, etc.” category has grown 794% from 2016 to 2020 it still only accounts for 3.9% of total revenue. With a renewed focus on this category and secular tailwind in demand for valuable IP driven by the Streaming Wars, there’s reason to believe this category will become an increasingly larger share of revenue over the coming years.

At a high level, Ryan laid out the four major tailwinds for Nintendo over the coming years:

“de-cyclifying the console business, moving to digital distribution, making smartphone games, and effectively monetizing its IP – should not only transform Nintendo’s business model, but permanently improve its ROE, rapidly expanding the sources and quality of its underlying revenue base and exponentially increasing its earnings power.”

Looking at the fundamentals of the business over the last decade, this is an exceptionally high quality business with a strong 6 year track record of increasing return on invested capital.

On a relative valuation basis, Nintendo appears to be undervalued by EV/Total Assets, EV/Sales and EV/EBITDA.

Most importantly, Nintendo is a company that has been relevant my entire life and I’d wager it will become even more relevant for the rest of my life. Very few companies, especially in the gaming industry, have matched the sustained cultural resonance that Nintendo has achieved globally for decades. This speaks to their deep-seeded culture that is at the heart of their competitive advantage.

A sustainable, resilient and innovative culture with a long track record of success is the single most important quality that I look for in an investment. It gives me the conviction to hold for the long haul. This is true for Amazon, The Trade Desk and Square. Nintendo feels like the missing piece in my portfolio. After doing my due diligence, I decided to initiate a 5% position. Over the next 12 - 18 months, I'll be looking for opportunities to add to this position if a better price point presents itself. Very few companies are worthy of the “never sell” category. I believe that Nintendo might be worthy of this title.

Ryan O'Connor Interview on the Investing City Podcast: https://youtu.be/NnWTzawMffU?t=1307

Ryan O'Connor investor letter on Nintendo from 2018: https://drive.google.com/viewerng/viewer?url=https://gallery.mailchimp.com/f5064af0f6e5340816e525710/files/ce57076f-3ee7-4dc1-82a6-ac476fc9d258/2018_Annual_Letter_Nintendo.pdf&wmode=opaque

drive.google.com

2018_Annual_Letter_Nintendo.pdf

I’ve been thinking a lot on autocatylsis. Nintendo seems to be a company I think has a lot of autocatylsis (franchises).

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?