Trending Assets

Top investors this month

Trending Assets

Top investors this month

@investorscompass

Investor's Compass

40 following14 followers

Nvidia stock (NASDAQ:NVDA) isn't quite overvalued. Here's why

Investor's Compass

Nvidia Stock (NASDAQ:NVDA): Not Quite Overvalued. Here’s Why — Investor's Compass

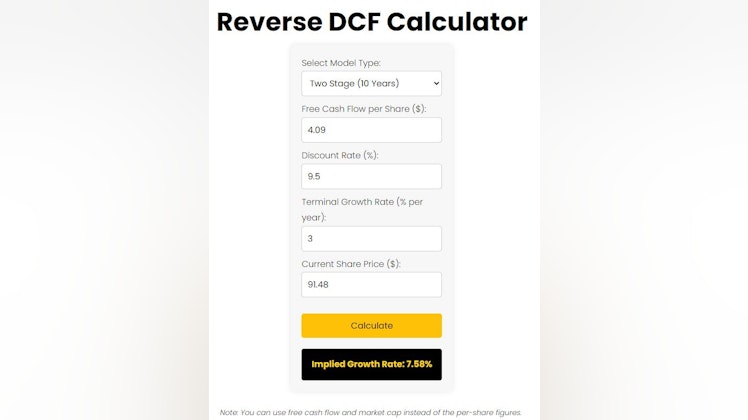

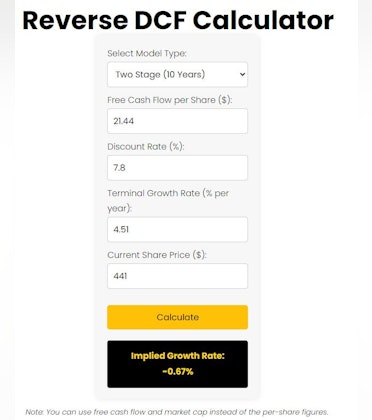

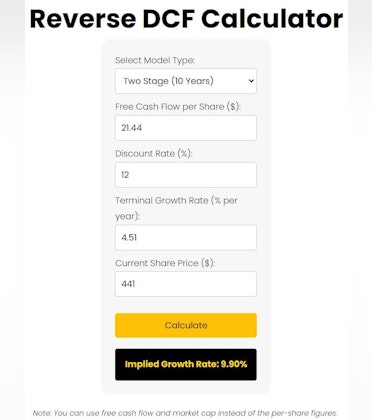

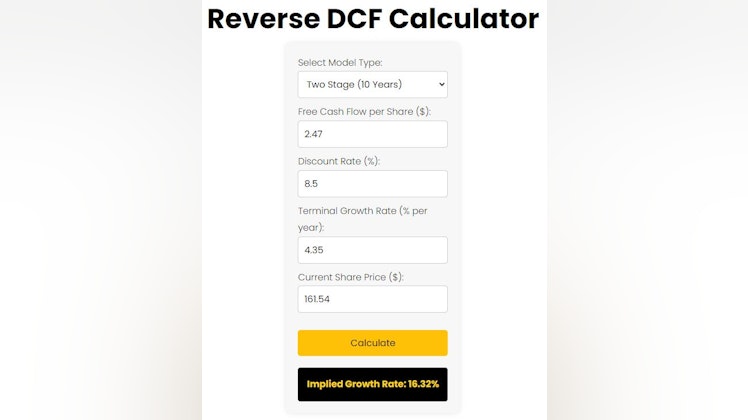

Nvidia (NASDAQ:NVDA) has gained nearly 2,000% in the past 5 years and has made significant strides in the tech industry. However, this rapid rise questions about its valuation. Using a reverse DCF calculator below, we see the market’s growth expectations embedded in Nvidia's current stock price, whi

The Most Common Mistake in Financial Reporting — Even NVDA Made It

Investor's Compass

The Most Common Mistake in Financial Reporting — Even NVDA Made It — Investor's Compass

Numbers can be confusing, and people can get the wrong financial data because of it. When looking at percentage gains, people (even large companies like Nvidia) often make this one simple mistake: people will see a, let’s say, 300% gain and think it’s a 3x gain. However, a 300% gain is a 4x gain, an

Dow Jones Hits Record High as Interest Rates Set to Fall in 2024

investorscompass.substack.com

Dow Jones Hits Record High as Interest Rates Set to Fall in 2024

The Federal Reserve recently announced that it will keep interest rates unchanged. This marks the third consecutive occasion where the rate has remained steady. The current federal funds rate lies between 5.25% and 5.5%, and the decision aligns with the easing inflation rate and a stable economy. Notably, the Federal Open Market Committee, which was unanimous in its decision,

Charlie Munger Dies at Age 99. These are His Best Quotes

Investor's Compass

Charlie Munger Dies at 99. Here are His Best Quotes — Investor's Compass

Charlie Munger, the vice chairman of Berkshire Hathaway and Warren Buffett's investing partner, left a legacy rich with insights encapsulated in his many thought-provoking quotes. Here is a curated collection of Munger's quotes, offering a glimpse into the mind of one of the greatest investors of ou

Reasons to Be Thankful: Stock Market 2023 Edition

investorscompass.substack.com

Reasons to Be Thankful: Stock Market 2023 Edition

Happy thanksgiving, everyone! As we approach the end of 2023, it's a fitting time to reflect on the various aspects of the stock market that have given investors and observers reasons to be thankful. This year has been a testament to the resilience and dynamic nature of the market.

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?