Trending Assets

Top investors this month

Trending Assets

Top investors this month

@hogan_gpm

Mark Hogan

20 following17 followers

Teledyne Technologies Q4 earnings $TDY

$TDY Teledyne Technologies reports Q4 EPS $4.94 ex-items vs FactSet $4.53 [7 est, $4.45-4.59]

https://www.teledyne.com/en-us/investors/Documents/2022%20Q4%20-%20Teledyne%20Earnings%20Release.pdf

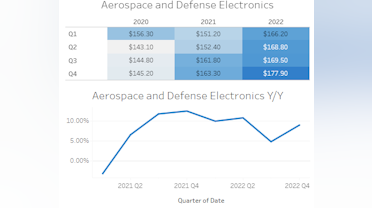

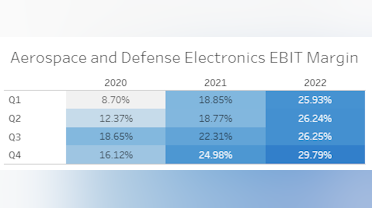

The Aero & Defense Electronics segment was a standout. See the solid y/y growth on a tough comp, plus improved EBIT margin for this segment:

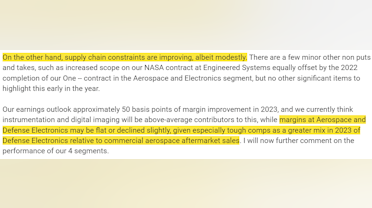

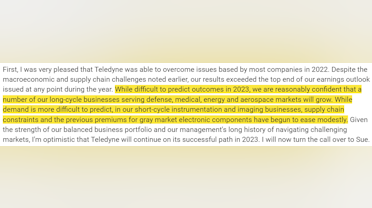

(From TDY's Q4 FY22 earnings transcript)

Guided Q1 EPS $0.02 below at the midpoint vs. FactSet consensus ($4.42 vs. FS $4.44) and FY23 EPS $0.07 above at midpoint vs. consensus ($19.10 vs. $19.03).

Expecting sales in-line with consensus ~5% growth. About 3.5% organic growth and 1.5% from acquisitions.

We have a $TDY insight post on our blog if interested in a background on the company: https://www.gpmgrowth.com/blog/core-portfolio-insight-teledyne-technologies-tdy

GPM Growth Investors, Inc.

Core Portfolio Insight: Teledyne Technologies (TDY)

HEICO reported FY22 results which included 18% sales growth to $2.2B and ~15% EPS growth to $2.55. Management is aiming for 15-20% earnings growth again in FY23. Here are a few comments I highlighted from the call with discussion about the long-term culture of HEICO:

I saw on the Quartr App's twitter a great extended look at the transcript: https://twitter.com/Quartr_App/status/1605565254087462918

GPM Growth Investors, Inc.

Core Portfolio Insight: HEICO

HEICO (Ticker: HEI/A) is a leading aftermarket supplier of parts for the aviation industry.

So timely, was just talking to a friend about $HEI and voila some great content to learn more! Thanks 🙏

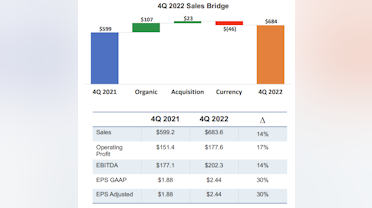

Nordson $NDSN reports Q4 EPS $2.44 vs FactSet $2.33 [10 est, $2.26-2.38]

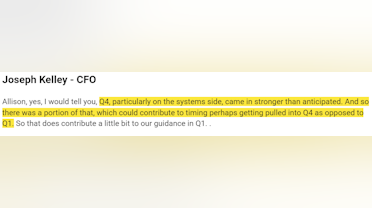

Q4 saw strong sales growth. However, on the systems side, some sales were pulled forward out of Q1 and into Q4.

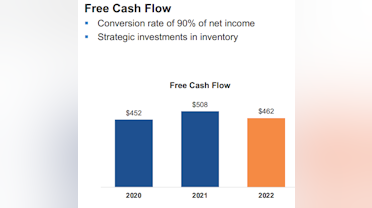

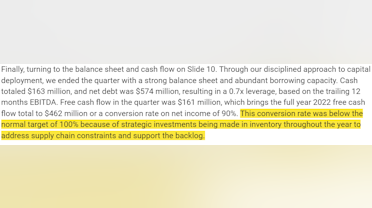

FCF conversion was down in 2022 due to inventory investments used to address supply chain constraints.

Management sees organic growth of 4-5% in first half of 2023 (on top of 2 straight yrs. of double-digit growth) but has limited visibility into back half, guiding for flat organic growth.

Discussion on $NDSN's business model: Its components are mission critical to the larger systems that contain them. Since these components are highly integrated and under constant use on production lines, the components eventually wear out, requiring replacement. Switching to a cheaper competitor would not make sense because the production line would have to be shut down, rendering any cost savings useless. This makes Nordson a predictable business, giving us confidence in forecasting in the long-term. Its aftermarket consumable parts account for 55% of total revenues, providing reliable & growing cash flows.

If you are unfamiliar with Nordson, I have a short background written here: https://www.gpmgrowth.com/blog/core-portfolio-insight-nordson-ndsn

I also have a public viz on Tableau to view Nordson's segment trends.

Tableau Public

NDSN segment analysis

NDSN segment analysis

Great note, thanks for sharing it! Don't see this name discussed much here.

Edwards Lifesciences ($EW) investor day

For a quick background on Edwards $EW I have a blog post here: https://www.gpmgrowth.com/blog/core-portfolio-insight-edwards-lifesciences-ew

Edwards held its investor day on Dec 8 (https://ir.edwards.com/events-presentations/

)

The key takeaways were:

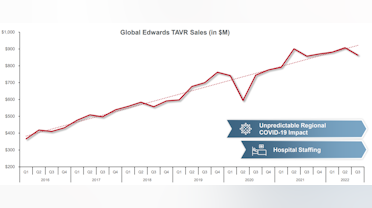

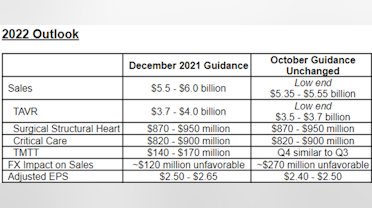

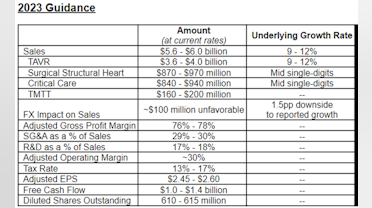

-After a decade of double-digit organic growth, growth paused in 2022 due to hospital staffing issues. Expecting a return to 9-12% growth in 2023.

-Edwards continues to invest the highest percent of sales into R&D (17-18%) of its peers. Its 2000+ engineers drive strong DD organic growth over time. Edwards does not rely on large acquisitions to grow.

-Edwards’ competitive advantage is that it has a singular focus on large unmet needs of structural heart. This allows it to have the best technology when it goes into hospitals to sell its mission-critical applications.

-Share buyback activity picked up greatly with the latest share pullback. Management says that temporary headwinds, which are out of Edwards’ control, are causing an anomaly in growth rates this year. This is not indicative of Edwards’ long-term potential, making this a strong share repurchase opportunity. Management has picked up buyback activity at opportune times in the past (Note the last couple large repo years were late ’16 into ’17 and ’20 when the stock pulled back 35%+ each time).

-Analysts have called an end to TAVR growth multiple times in the past (2016, 2018) but global TAVR still grows DD annually overall.

(Source: investor day slides)

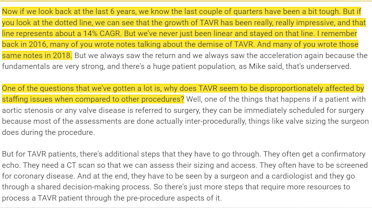

Guidance details:

FY Guidance (2022):

Reaffirms revenue low end of $5.35-5.55B vs FactSet $5.36B [25 est, $5.35-5.44B]

FY Guidance (2023):

EPS $2.45-2.60 vs FactSet $2.52 [24 est, $2.39-2.62]

Revenue $5.6-6.0B vs FactSet $5.72B [25 est, $5.46-6.12B]

(source: company press release)

(source: company press release)

-Global market opportunity across 4 product groups projected to double to nearly $20 billion by 2028

-TAVR market opportunity $10B by 2028

-TMTT market opportunity $5B by 2028

(No change compared to last year’s long-term targets)

-Prior long-term target was TAVR global opportunity of $7B by 2024 and TMTT $3B by 2025

Q: Why maintain 2028 targets when Edwards missed guidance this year?

A: Without FX, Edwards only missed by about $250M which is insignificant in terms of 2028 targets.

Q: Competition?

A:

Key charts:

-All operational EPS gain to be wiped out next year by FX

(Source: investor day slides)

-Share repurchase activity picked up meaningfully with the large decline in share price this year

(Source: investor day slides)

-No change to long-term 2028 guidance despite the slow down this year

(Source: investor day slides)

-EW's P/E multiple dropped significantly to 29.5X NTM EPS

(Source: FactSet)

Lastly,

Edwards Lifesciences announces retirement of CEO Michael Mussallem, 70 years old, effective 11-May-23

-At the 2023 annual meeting, Mussallem will stand for election as non-executive chairman of Edwards' board.

-He will be succeeded as CEO by Bernard Zovighian, currently corporate vice president and general manager for Edwards' Transcatheter Mitral and Tricuspid Therapies (TMTT) business. Bernard has been with Edwards for 8 years. Before that, he worked at various J&J from 1995-2014.

-Zovighian will serve as president of Edwards Lifesciences effective 1-Jan until he becomes CEO in May, working closely with Mussallem, the board and the Executive Leadership Team on a smooth transition.

-Larry Wood is taking on an expanded role, with responsibility for both TAVR and Surgical. Larry has been with Edwards since 1985.

ir.edwards.com

Edwards Lifesciences Corp - Events & Presentations

I like that their buybacks surged when their stock's PE ratio was lower than usual.

$ADI recent updates.

From 11/22 earnings call, management saw bookings stabilize during the quarter:

CFO Prashanth followed up at Credit Suisse on 11/29, saying that ADI has confidence into Q2 but not beyond that point:

Back on earnings call, said ADI has 3x higher ASPs compared to the analog sector. Prashanth followed up at CS discussing how ADI's engineering team creates new markets:

Looking at recent trends, B2B sales posted its highest growth rate in latest quarter:

Here is a link to our public viz if you want to check it out.

In addition, here is our summary on ADI's business for a quick background.

GPM Growth Investors, Inc.

Core Portfolio Insight: Analog Devices (ADI)

Analog Devices is a GPM Grade Company that generates substantial free cash flow to invest organically, make smart acquisitions, and increase dividends over time. Analog promotes a unique engineering culture and has a diverse product set that avoid risks of concentration.

$CRM Q3 FY23 earnings

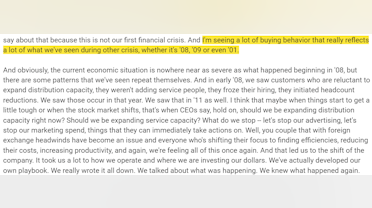

Benioff said he is currently seeing buying behavior comparable to '08-'09 and '01 crisis:

Going back to 2009, let's see what Salesforce noted on its earning call:

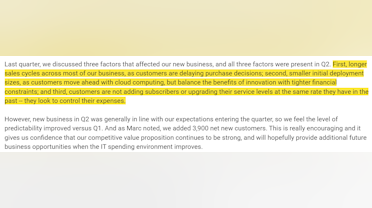

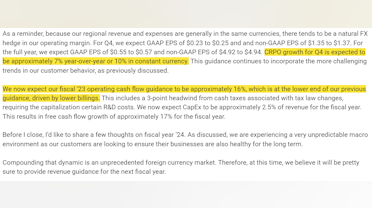

A similar buying behavior to today. However, they noted the level of predictability improved in that 2009 call vs. today they still do not have improving visibility. See the guidance from Q3 FY23:

$CRM guidance for cRPO was lower than expected at +10% CC. Cash flow guide is at low end of range due to lower billings. Did not provide FY24 guidance due to lack of visibility.

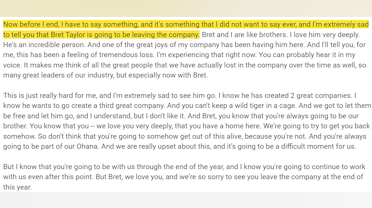

In addition, Bret Taylor is stepping down at the end of the year. He was promoted to co-CEO last November. Benioff is very upset. This follows Gavin Patterson and Keith Block both leaving.

$CRM growth remains strong across all segments. Non-GAAP profitability is improving.

$CRM bought back $1.677B worth of stock in Q3. Plan is to buy $10B over time.

Lastly, Starboard recently took a stake in Salesforce. See their presentation here.

Starboard says $CRM is trading at a discount to peers and needs to do more to improve profit margins.

I tried out @slt_research 's earnings call analysis (https://commonstock.com/post/5a4035ea-6b8e-4d59-9014-e75592655362

). The ratio of positive to negative words dropped to 3.1X vs. 4.8X last quarter.

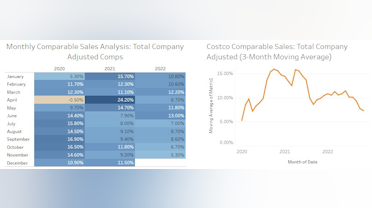

Costco $COST November sales results

From 11/30. Link: https://investor.costco.com/news/news-details/2022/Costco-Wholesale-Corporation-Reports-November-Sales-Results/default.aspx

"Better-performing departments included tires, sporting goods, toys and seasonal, and automotive. Underperforming departments were majors, primarily consumer electronics, jewelry and hardware." $COST

$COST total company adjusted comps are strong but starting to slow. See the 3-year stacks below. This is the first quarter of the year <30%.

Here is our public viz for Costco's comp trends

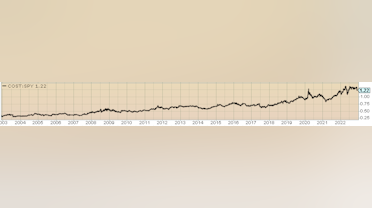

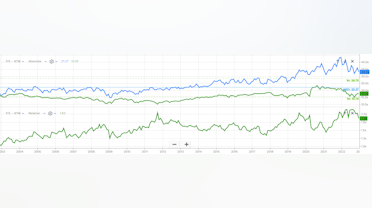

See COST's stock performance vs. SPY the last twenty years:

And here is COST P/E vs. S&P 500:

It seems like COST stock gets pushback for its premium P/E multiple. As seen above, it always trades at a premium. However, in the last twenty years, COST has only traded at 2X premium to the S&P 500 in 2011 and 2019. The stock took longer to deliver a return higher than market at this peak multiple both times. See 2011 case, for example:

Tableau Public

Costco Comp Sales Analysis

Costco Monthly Comparable Sales Analysis #COST #Costco #Retail #StockMarket

Nice to see you back posting sir!

HEICO reported Q3 EPS $0.60 vs FactSet $0.65 [12 est, $0.60-0.69]

HEICO's effective tax rate was 27% in Q3 vs. 15.7% in Q3 last year. Management believes the actual cash tax rate is 21% which would have resulted in EPS of $0.65-0.66 in Q3.

FSG segment sales were 5% better than expected. FSG sales topped pre-covid levels for the first time. FSG organic growth >20% the last five quarters.

ETG segment sales missed by 1%. Defense was weak within ETG due to delayed US Gov outlays. ETG saw about $25M of orders pushed into Q4 and Q1 FY23.

(see our public viz for HEICO segment trend analysis)

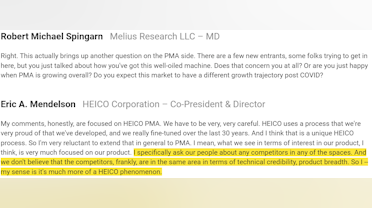

New entrants on PMA side are not competitive in terms of HEICO's technical credibility and product breadth. HEICO has fine-tuned its process over the last 30 years:

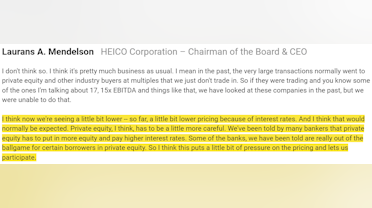

Interest rates are reducing prices, letting HEICO participate in more M&A:

Recent acquisitions include:

HEICO's largest acquisition ever-

HEICO announces its Electronic Technologies Group entered a put option agreement to acquire Exxelia International for €453M in cash

A French electronics (Hi-Rel = High-Reliability) company for aero & defense mainly. Expected to close Q1 of FY23. Revenue is E190M (about $193M USD) in CY2022. Revenue is 60% in Europe and 40% in US and other. EBIT margin is slightly less than ETG’s margin.

This acquisition would boost HEICO’s total revenue about 8% from $2.4 billion in FY23 to $2.6 billion. For ETG, revs should go from $1.02 billion in FY23 to $1.22 billion (+20%)

The company announced its Flight Support Group has acquired 96% of Accurate Metal Machining, Inc. for cash at closing, plus potential additional cash consideration to be paid if certain post-closing earnings levels are attained. Additional financial details were not disclosed.

-HEICO stated that it expects the acquisition to be accretive to its earnings within the year following closing

-Cleveland-based Accurate Metal Machining is a manufacturer of high-reliability components and assemblies

-Accurate employs ~250 people at its Cleveland production facility

HEICO Corporation announced that its Electronic Technologies Group acquired all of the stock of Sensor Systems, Inc. for a combination of cash and approximately 575,000 HEICO Class A common shares. Further financial details were not disclosed.

-HEICO stated that it expects the acquisition to be accretive to its earnings in the year following the acquisition.

-Sensor's products include, among others, Aircraft Direction Finding, Altimeter, Glideslope, Global Positioning System, L-Band, Marker Beacon, satellite communications, Total Collision Avoidance System, Very High Frequency and Very High Frequency Omni-directional Range antennas.

-HEICO Corporation announced that its dB Control subsidiary acquired 100% of the stock of Charter Engineering, Inc. for cash at closing.

-Further financial details were not disclosed.

-dB Control is part of HEICO's Electronic Technologies Group.

HEICO Corporation announced that its Electronic Technologies Group acquired approximately 80% of the capital stock of technology component company Ironwood Electronics, Inc. for cash paid at closing, plus additional cash consideration to be paid if Ironwood meets certain earnings targets.

The balance of Ironwood's shares will continue to be owned by Ironwood's CEO, David Struyk, and other key managers. Further financial information was not disclosed.

Eagan, MN-based Ironwood employs approximately 75 people in the design, manufacture, and sale of its products.

HEICO stated that it expects the acquisition to be accretive to its earnings within the year following acquisition.

Tableau Public

HEICO data

HEICO data

Nordson $NDSN reports Q3 EPS $2.49 ex-items vs FactSet $2.44 [10 est, $2.38-2.47]

Q3 constant currency sales +7%, organic growth +4%

(for segment sales and ebit trends, see our public viz)

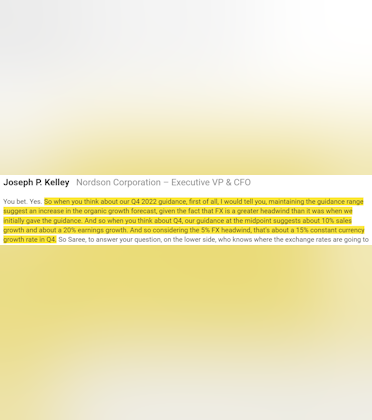

Maintaining guidance range suggests an increase in the organic growth forecast with FX a greater headwind. Expect Q4 sales +15% constant currency and EPS growth >20%.

Discussed CyberOptics $CYBE acquisition, expected to close Q1 FY23. Fits into Nordson's strategy of selling critical components into broader systems.

For more on $NDSN, see our May 2022 core portfolio insight (link to blog post here):

Founded in 1954 by Walter, Eric, and Evan Nord in Amherst, Ohio, Nordson is a $12 billion market cap company today that sells hoses, nozzles, valves, pumps, and more to industrial customers. These industrial customers have production lines with large systems that require the critical, but low unit cost, components that Nordson makes. Nordson has over $2.3 billion of revenue and more than 7,500 employees in 35 countries. It is on its 58th consecutive year of increasing the annual dividend, displaying the dependability of the company. CEO Sundaram Nagarajan joined Nordson in August 2019 after spending 23 years at Illinois Tool Works. [1] [2]

What makes Nordson a GPM Grade Company? First off is the focus on long-term sustainable growth. Over the last 10 years, the compound annual growth rate (CAGR) for sales is 7% and free cash flow (FCF) is 8%. Nordson's Industrial Solutions typically grows at a low-single-digits percentage rate, while its Technology Solutions grows faster in the high-single- to low-double-digits percentage rate. [1] [2]

Next, Nordson sells niche products with high barriers to entry. Its components are mission critical to the larger systems that contain them. Since these components are highly integrated and under constant use on production lines, the components eventually wear out, requiring replacement. Switching to a cheaper competitor would not make sense because the production line would have to be shut down, rendering any cost savings useless. This makes Nordson a predictable business, giving us confidence in forecasting in the long-term. Its aftermarket consumable parts account for 55% of total revenues, providing reliable & growing cash flows. [1] [2]

Nordson has solid growth opportunities beyond its dependable industrial business. The new CEO introduced the "Ascend" strategy which focuses on sustained organic growth while accelerating acquisitions in the Technology Solutions space. Management plans on shifting product mix so that Technology Solutions increases to 60% of total revenue, from 45% today. Nordson sees especially high growth within its Medical end market due to an aging population, more non-invasive surgeries (requires many single-use products), and medical OEM (original equipment manufacturer) outsourcing. Nordson has a stake in growing trends like Electric Vehicle (EV) battery manufacturing, factory automation, and more. Nordson's goal is for more than $3 billion of revenue by 2025, which includes 4% organic growth and 3% growth from acquisitions. [1] [2]

Sources:

Disclosure:

This blog post or document contains information about a company that is owned in portfolios managed by GPM and is intended exclusively for GPM clients. While this company is owned in a broad cross section of GPM managed portfolios, it should not be implied or assumed that every client portfolio or account currently holds this stock. Data presented is from sources we believe to be reliable. The opinions and commentary presented reflect our best judgement at this time, and may include “forward-looking statements”, all of which are subject to change at any time without obligation to update them. Shares of this stock are NOT held in accounts that invest exclusively in ETFs or mutual funds. Actual future results may be different than our expectations. There can be no assurance that your investment objectives will be realized. Investing involves risk and losses can occur.

Great commentary here, have you ever written something longer about this name?

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?