Trending Assets

Top investors this month

Trending Assets

Top investors this month

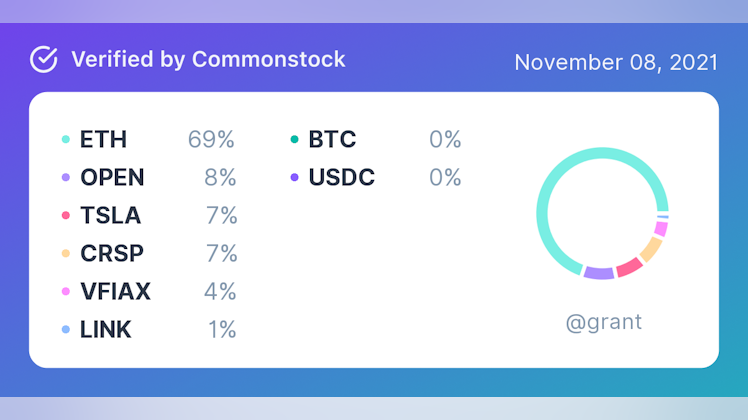

@grant

grantmagdanz.eth 🦇🔊

$31.4M follower assets

260 following290 followers

How is Opendoor valued at 4.8B but $IPOB is 600M?

CNBC

Palihapitiya finds next '10x idea' with $4.8 billion SPAC deal for real estate start-up Opendoor

"These guys are my next 10x" idea," Chamath Palihapitiya told CNBC.

+ 2 comments

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?