I'm working on a premium service and need people to participate in a "closed beta."

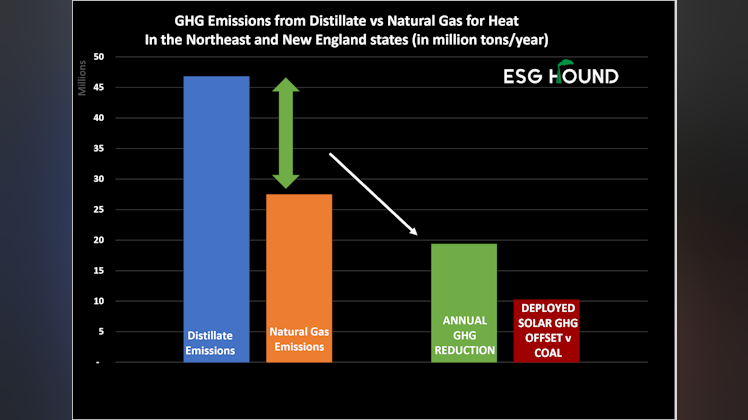

The jist is a little "teaching you how to do research using under exploited public sources" a little bit of "operational auditing" and a little bit "how to spot accurate sustainability claims."

Despite my handle, I think the service would be best suited for industrial analysts and researchers generally. It's what I'm good at. Anyways, I'm offering free, no obligation access to the training/seminar format for a few months as I work out the kinks. I'm minimally screening folks* to keep the group appropriately sized via email so if it's something you'd find helpful shoot me a message here or at ESGHound@gmail.com

Some of the reasoning is in this post

*please don't be shy though

esghound.substack.com

ESG Hound Sells Out

$$$$$$