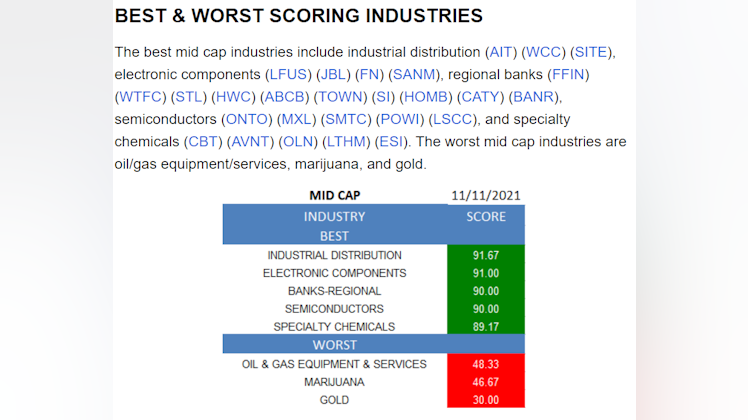

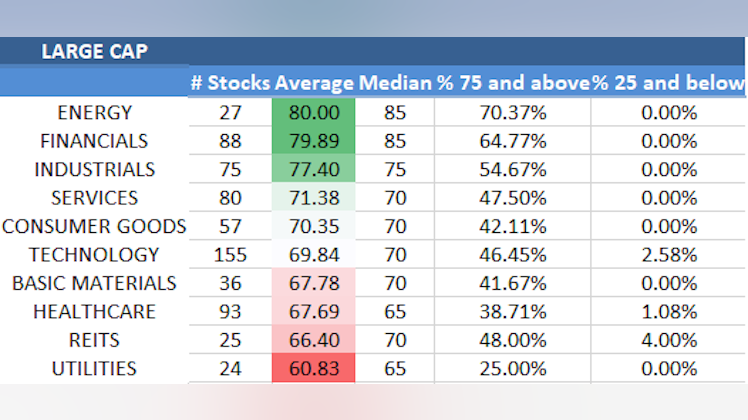

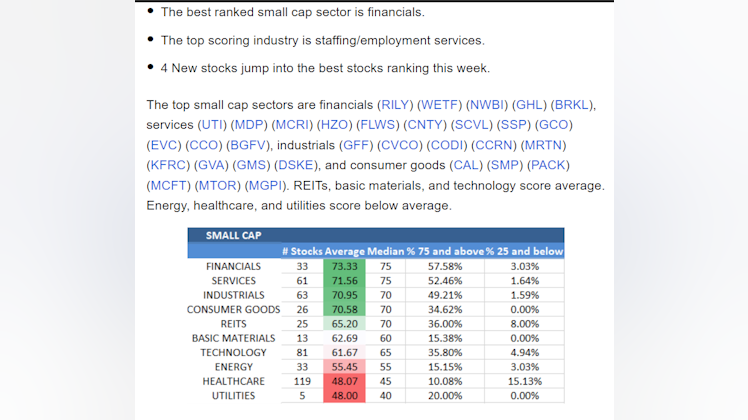

There are thousands of stocks. And there are always intriguing ideas! If you're hunting small cap ahead of the upcoming "January Effect", here's a snip from Friday's Small Cap Best & Worst stocks report.

Most were up today/beat the market.

I really enjoy trying to fish out a small / mid cap bargain. Unfortunately the brokerage here only offers US stocks with +$1 Billion Market Cap but I’ve got access to all of the ASX

I picked up Ioneer on the ASX on 5 October for 0.575c a share after it announced a deal to go 50/50 on its proposed Nevada Lithium mine.

Current price is 0.685c but it did reach as high as 0.80c.

Will do some more research but hopefully it can chart a similar path to $LAC