Trending Assets

Top investors this month

Trending Assets

Top investors this month

@carterkilmann

Carter Kilmann

$10.4M follower assets

15 following281 followers

That is something 😮

I was taking a look at the $CVNA asset page and the average return for holders on Commonstock of Carvana, is... ouch.

In 2023, I'm narrowing my scope to follow a simple investment theme: follow the money.

And who controls the most money? The government.

If Uncle Sam wants something to succeed, he has the power to throw ludicrous sums at the problem until it’s resolved. With that in mind, we’ll dive into industries that stand to benefit from public policies over the next decade. For instance, under the Bipartisan Infrastructure Law, the US Department of Energy recently awarded $2.8 billion to a portfolio of 21 projects for the development of domestic battery facilities.

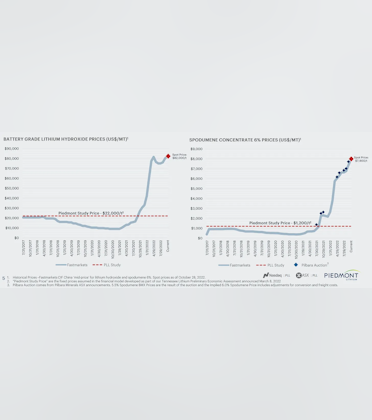

One of those recipients was Piedmont Lithium ($PLL), a lithium-mining startup that just upped its annual delivery to Tesla on Tuesday.

Piedmont Lithium and Tesla Amend Offtake Agreement

Electric vehicles run on rechargeable batteries. Those batteries are composed of a variety of metals, such as nickel, cobalt, possibly manganese — and lithium.

While it’s a small component in the typical EV battery (roughly 10% by weight), it’s critical nonetheless. So, it’s no surprise that lithium demand is expected to greatly outpace supply in the coming years, supporting all-time-high prices for this metal.

In September 2020, Tesla reached an agreement with Piedmont Lithium for roughly 53,000 metric tons of spodumene concentrate (high-purity lithium ore) each year through the end of 2025 (with an option to renew for another three years). Now, that annual delivery is up to 125,000 metric tons.

Here’s commentary from Piedmont Lithium President and CEO Keith Phillips via a press release:

"The electric vehicle and critical battery materials landscape has changed significantly since 2020 and this agreement reflects the importance of — and growing demand for — a North American lithium supply chain. This agreement helps to ensure that these critical resources from Quebec remain in North America and support the mission of the Inflation Reduction Act to bolster the U.S. supply chain, the clean energy economy, and global decarbonization.”

Piedmont Lithium has economic interests in lithium mines in Canada and Ghana, which are its current sources of spodumene concentrate. That said, not all lithium is created equal; this ore still needs to be refined further and converted into lithium hydroxide. The company is in the process of developing facilities in Tennessee (estimated completion in 2025) and North Carolina (2026) that will do just that.

The US isn’t exactly a world leader when it comes to lithium production — it’s eighth behind a host of other countries, notably Australia, Chile, and China.

Perhaps Piedmont Lithium will help close the gap. Add PLL to the watchlist.

Originally published via the Due Diligence newsletter.

www.stockduediligence.com

A mining startup worth watching: Piedmont Lithium

Can PLL rejuvenate the US lithium industry?

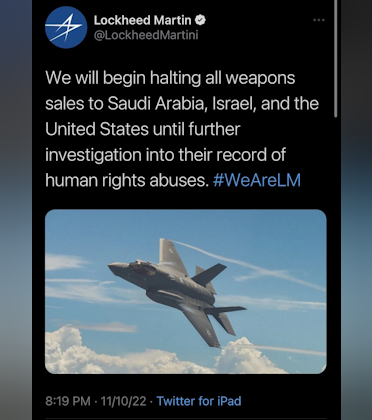

What happens when fake accounts pose as corporate brands?

A defense contractor cuts ties with the very country it resides in.

A drug manufacturer announces that it will start giving away a notoriously expensive product for free.

A banana distributor declares it…overthrew a government?

Thanks to Musk's changes to Twitter's verification badge system, fake accounts can now exploit a blatant loophole and pose as major companies. The deception cost the likes of $LMT and $LLY billions of dollars in market cap.

Check out the latest issue of Due Diligence to read more about the problems at Twitter.

www.stockduediligence.com

Amazon to cut workforce + Fake Twitter accounts cost brands billions

A quick fix of the latest financial happenings.

Great to see you back my man!

Two Price-Beaten But Promising EV Stocks: FSR + LCID

Shares of $FSR are down about 45% this year. Yet, operationally, two factors continue to work in the EV-maker’s favor.

First, despite supply chain issues and chip shortages around the world, Fisker remains on track to commence production of the Ocean, its inaugural all-EV model, on November 18. (It rolled out the first model from Magna’s high-volume line on Wednesday.)

Second, even though vehicle sales have slowed globally, preorders for the Ocean have not — there are now 56,000+ preorders for the Ocean, including 5,000+ reservations of the Ocean One launch edition. Preorders of the former cost $250, while the latter costs $5,000 (and it hasn’t even been unveiled yet).

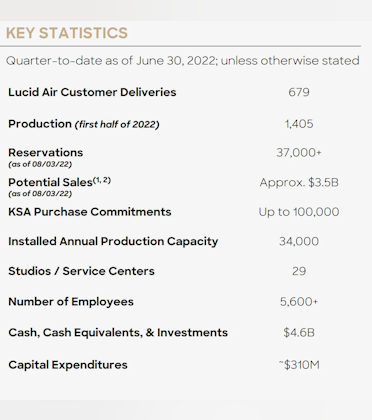

Shares of $LCID are down nearly 60% in 2022.

Like the Fisker Ocean, the Lucid Air is in high demand with 37,000+ reservations through the beginning of August, which equates to about $3.5 billion of potential sales.

Unlike the Ocean, production of the Air has already commenced — but logistical struggles and broader supply chain issues forced the company to slash its 2022 production guidance range from 12,000–14,000 to 6,000–7,000.

Assuming the company can fix its logistical pains and navigate macroeconomic conditions in the near term (two big assumptions), it’ll have no problem meeting demand.

Currently, Lucid’s Arizona-based production facility has the ability to push out 34,000 models of the Air per year. Once phase two of the facility’s expansion project is completed (est. early 2023), the company’s production capacity will jump to 90,000 models of the Air and Gravity (its upcoming electric SUV). Moreover, Lucid recently broke ground on a Saudi Arabian factory that’s expected to be capable of producing 155,000 models.

Originally published via the Due Diligence newsletter.

www.stockduediligence.com

Pessimistically Optimistic + Two EV stocks show promise

A quick fix of the latest financial happenings.

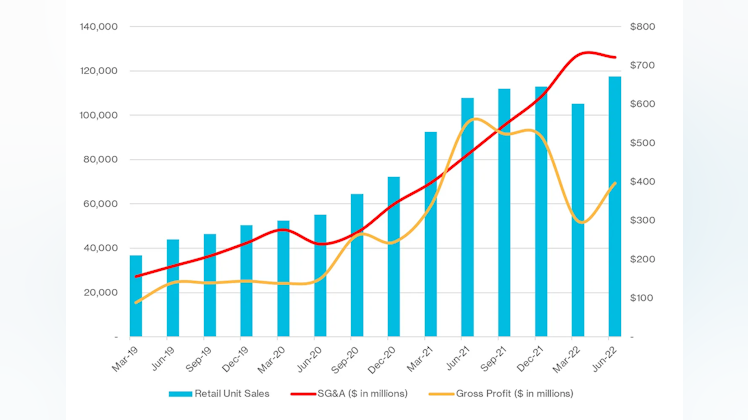

What Moves This Stock? Carvana

A lot of factors influence $CVNA. That’s hardly rocket science — car sales in general are an indicator for the broader US economy, let alone a catalyst for Carvana’s share performance.

However, if we look under the hood, Carvana’s ability to execute its long-term business plan will determine if shares can return to their former glory.

In April, Carvana announced a priority shift from scaling its platform to achieving profitability, by way of streamlining the company’s cost structure. In other words, it wants to take an ax to its SG&A.

That same day, Carvana fired 2,500 employees. Brutal.

Its goals are quite ambitious — the company set a FY23 goal of $3,000 SG&A per retail unit sold, excluding D&A as well as share-based compensation. (SG&A per unit = how much overhead it costs to produce a single sale.)

For context, Carvana’s SG&A per unit sold was $4,440 for FY21. For the first half of FY22, this metric is up to $6,029.

If we reverse engineer their $3,000 goal into a total dollars basis, assuming 425,000 unit sales (close to FY21’s output), that’s $1.28 billion of SG&A. Through six months of 2022, Carvana’s SG&A totaled $1.34 billion, excluding D&A and SBC.

So, the road ahead isn’t exactly clear of obstacles.

But Carvana has made progress.

For instance, it expects about a $125 million reduction in annual run-rate payroll after its April layoffs. Moreover, the company believes it can reduce SG&A per unit sold by $200 to $300 just by optimizing operations and raising internal benchmarks — although that’s obviously easier said than done.

Long story short, CVNA shares will reflect the company’s ability to reduce SG&A in the near- and mid-term.

Good points! $CVNA is an interesting one, no doubt. I passed on owning it as too many unknowns and due to heavy cash burn

What Moves This Stock? MP Materials

Everyone loves revenue growth and a plump bottom line. MP Materials checks both of these boxes. Of course, you won’t hear any shareholders complain about MP’s sales of rare-earth concentrate — but that’s not what moves this stock.

What does? Progress toward becoming the only fully-integrated supplier of rare-earth elements (REEs) in the US.

A little background:

MP Materials Corp. ($MP) is a rare-earth mining company — the only one operating at scale in North America. Since purchasing Mountain Pass out of bankruptcy in 2017, MP has revamped the mine’s process flow and established a profitable, environmentally-friendlier operation. Currently, the company is still reliant on China for processing, but a three-stage plan to build out its infrastructure and become a fully-integrated supplier of rare-earth elements (REEs) is underway.

The most sought-after and valuable REEs are neodymium (Nd) and praseodymium (Pr; together, NdPr or PrNd) — two key components of permanent magnets. Really important things like refrigerators, smartphones, EVs, wind turbines, and even jets and missiles need permanent magnets. But China controls most of the world’s supply.

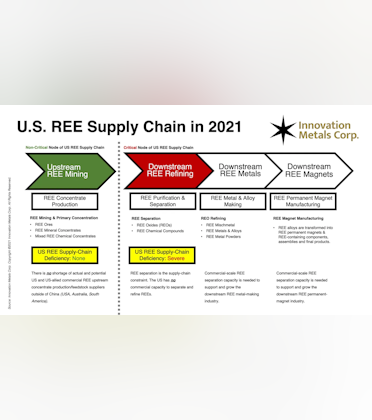

MP Materials (and the US government) want to change that. At the moment, thanks to Mountain Pass, the US has a bountiful source of REEs — but that’s the extent of its supply chain.

Here’s a perfect overview from a 2021 Innovation Metals Corp. investor deck.

So long as the above remains true, the US must rely on China. However, MP is currently progressing through a three-stage process that will conclude with a vertically integrated operation, all the way from mining REEs to producing permanent magnets and selling them to manufacturers.

Stage I

Naturally, the initial stage commenced with the purchase of Mountain Pass in 2017. MP leveraged the existing facility — which Molycorp had already put a sizable amount of funds into — and implemented changes to improve efficiency, plant up-time, and mineral recovery. All said and done, MP’s adjustments helped achieve 3.5x more REO production volume than the mine’s previous operator, Molycorp.

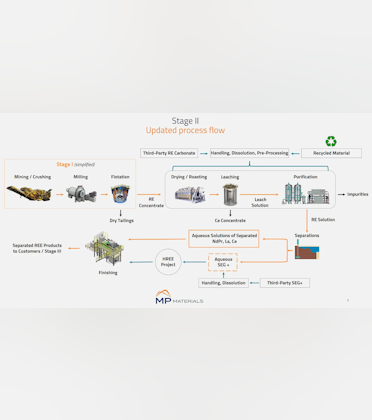

Stage II

“Upon completion of Stage II, we expect to be a global low-cost, high-volume producer of NdPr oxide, which represents a majority of the value contained in our ore.” — MP’s 10-K

Stage II is currently underway. In short, MP is expanding its operations to enable the separation of rare-earth concentrate — the “Downstream REE Refining” phase of the above supply chain graphic. As the following table outlines, this is no small feat.

MP’s upgrades to facilities and broader process flow should translate to lower cost separation and a smaller environmental footprint. The company expects to achieve full run-rate production volume for Stage II in 2023. Once the separation facility is operating, MP will be able to separate its concentrate into four products:

- Neodymium-praseodymium (NdPr) oxide

- Samarium, europium, and gadolinium (SEG+)

- Oxalate, Lanthanum (La) carbonate

- Cerium (Ce) chloride

More recently, the Department of Defense awarded MP Materials a $35 million contract to develop an HREE processing facility at Mountain Pass, which will be the first of its kind in the US.

Stage III

The final stage of this operational revamp will establish MP as the only vertically-integrated rare-earth magnets producer in the Western Hemisphere. These facilities would enable MP to convert NdPr into permanent magnets, which are integral components of EV motors. Again, referring back to the Innovation Metals Corp. graphic, MP will have built out the “Downstream REE Metals” and “Downstream REE Magnets” segments of the rare-earth supply chain.

In December 2021, MP announced the development of its initial magnet manufacturing facility in Fort Worth, Texas — as well as a long-term supplier agreement with General Motors to source and manufacture the finished magnets necessary for more than a dozen GM electric vehicle models. The company expects to begin delivering alloys in late 2023 and magnets in 2025.

The facility is expected to produce 1,000 metric tons of finished NdFeB magnets (NdPr, iron, and boron) each year, which is enough material to power roughly 500,000 EV motors. And this would only account for roughly 10% of the company’s NdPr output, giving it much more runway to sell these magnets to other manufacturers.

Where do things stand now?

Last week, we got an update via MP Materials’ Q2 earnings call. The company’s production sales and bottom line continued to benefit from high market prices for rare earth concentrate — net income increased 170% to $73.3 million compared to Q2 of 2021.

More importantly, Stage II is making great strides.

Here’s some color from Jim Litinsky, CEO and Founder of MP Materials (emboldened for emphasis):

“We remain on target for a mechanical completion by year end and we've begun pre-commissioning, which includes checkouts and initial performance testing on both legacy and new circuits in preparation for commissioning. In addition, our Stage 3 facility is going vertical and forward, and we remain heavily focused on key hires, procurement of long lead equipment and other items tracking for a late 2023 start of product for magnetic alloy.”

And there’s no shortage of demand for what MP will eventually produce. On the call, an analyst asked for more insight into potential supplier deals on the horizon given the growing electrification efforts around the country, particularly in the auto industry. Here’s Jim’s response:

“We're not demand constrained, we're supply constrained. There's a lot of interest from a lot of parties. It's not just the OEMs — it's OEMs, wind and a number of other use cases.”

As the company continues to progress through Stage II and III, expect $MP to make significant movement.

"Progress toward becoming the only fully-integrated supplier of rare-earth elements (REEs) in the US."

It's nice that this is kind of a brad vision statement, and a lot of smaller indicators can point towards progress or not.

Sounds like late 2023 is a timeframe for when we can expect the Fort Worth magnet manufacturing facility to be complete? Was I reading that right?

What's up with the newest meme stock $HKD?

And are we really in a recession?

Plus, three eye-opening tweets.

All in the latest edition of DD:

www.stockduediligence.com

New meme stock just dropped (literally) + Are we really in a recession?

A quick fix of the latest financial happenings.

What is the Howey Test and will it derail crypto?

And the latest eye-opening tweets from

All in the latest edition of DD:

www.stockduediligence.com

The Howey Test + More tech layoffs

A quick fix of the latest financial happenings.

A Sign of a Looming Recession (And Maybe a Soft Landing?)

Last week, JPMorgan held its Q2 earnings call. The biggest takeaways you’ll see in the headlines are that the bank (1) set aside another $428 million for potential loan losses, (2) saw profits slip by 28% compared to last year, and (3) paused its share buyback program.

When the country’s largest bank sets aside more money for potential losses, it’s typically not a good sign. But it’s not as grim as it seems.

Yes, $428 million is a lot of money, but it’s not like JPM is sweating over it — this reserve allocation, which functions like an expense on their P&L, pales in comparison to the company’s net income of $8.6 billion.

Moreover, taking a step back, let’s quickly cover why JPM had to set more money aside.

In response to the financial crisis in 2008, legislation was passed to insulate the country’s financial system from another cataclysmic collapse. Nowadays, banks are required to hold a certain amount of capital to serve as a quasi rainy day fund — if the economy starts to spiral, the banks can keep servicing people, businesses, etc.

Every year, the Fed assesses the country’s largest banks’ ability to withstand a “severely adverse scenario” by running models with some pretty draconian assumptions. Here are the assumptions for 2022:

The supervisory severely adverse scenario is characterized by a severe global recession accompanied by a period of heightened stress in commercial real estate and corporate debt markets. The U.S. unemployment rate rises 5.75% from the starting point of the scenario in the fourth quarter of 2021 to its peak of 10% in the third quarter of 2023. The sharp decline in economic activity is also accompanied by increases in market volatility, widening of corporate bond spreads, and collapse in asset prices, including a nearly 40% decline in commercial real estate prices. The international component of the scenario features deep recessions in four countries or country blocs followed by declines in inflation and large swings in the value of the U.S. dollar against those countries' currencies.

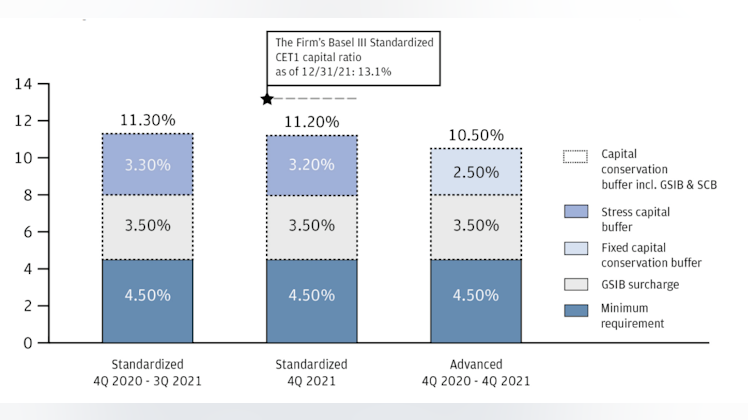

The results of this year’s test? Even in a worst-case scenario, the aggregate capital ratio of the 34 largest banks — essentially, their equity capital compared to their risk-weighted assets — would more than double the minimum capital requirement (9.7% vs. 4.5%).

However, the global systemically important banks (GSIBs or “too big to fail” banks), such as JPM, are held to a higher standard. On top of the minimum capital ratio of 4.5% and a stress capital buffer (SCB), the GSIBs have a capital surcharge.

For a good visual overview, here’s how JPM’s capital ratio at the end of 2021 stacked up against regulatory requirements (in short, it did well).

Except JPM’s SCB and GSIB surcharge are going up — on the company’s earnings call, they estimated a total capital ratio target of 12.5% for Q1 2023. As of last quarter, JPM’s standardized capital ratio was 12.2%. So, they have to set even more money aside for potential losses.

Long story short, the reserve increase shouldn’t be construed as a signal to panic. At least, not yet.

Here’s some insightful commentary from JPM CEO Jamie Dimon:

“Consumers are in good shape. They're spending money. They have more income. Jobs are plentiful. They're spending 10% more than last year, almost 30% plus more than pre-COVID.

Businesses, you talk to them, they're in good shape. They're doing fine. We've never seen business credit be better ever, like in our lifetimes. And that's the current environment.

The future environment, which is not that far off, involves rates going up, maybe more than people think because of inflation, maybe stagflation…there might be a soft landing.

I'm simply saying, there's a range of potential outcomes from a soft lending to a hard lending, driven by how much rates go up, the effective quantitative tightening, defective volatile markets.”

I usually think highly of Dimon's read on the markets/environment but he's painting a pretty broad picture with these comments:

I'm simply saying, there's a range of potential outcomes from a soft lending to a hard lending, driven by how much rates go up, the effective quantitative tightening, defective volatile markets.”

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?