$GME still gets a lot of attention. For example r/GME sub-reddit community has 361k members with 5–10 daily posts and quite active participation. Moreover GameStop as a company does not shy away from heating up the retail interest and actively engages into market frenzy.

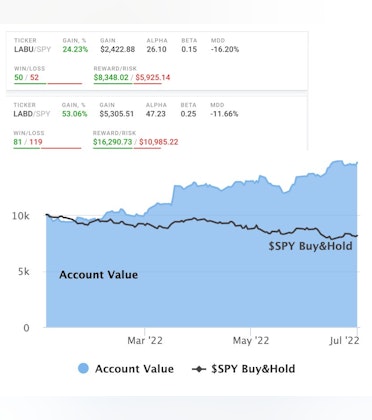

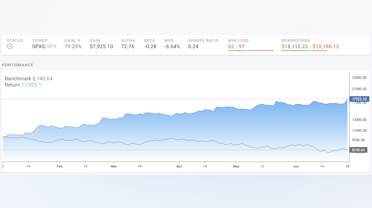

I always thought that in such environment I should be able to make money from rapid runs up and down. Below is a strategy which worked exceptionally well this year.

I would also like to share a disclaimer before the strategy details and results:

> The post is not a financial/investment advice and presented to the audience for educational purposes. Trading stocks is risky, trading meme stocks is crazy.

The Strategy

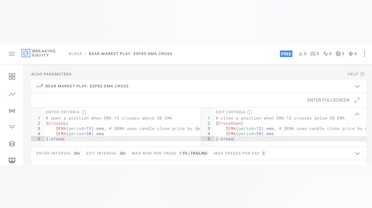

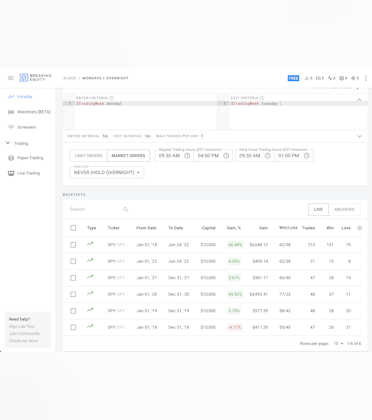

My whole idea was not to overcomplicate hence I went with just EMA cross. After playing with it a bi at the beginning of the year it appeared that 10min EMA 4×8 Cross worked the best. So I ended up with EMA 4×8 and a trailing stop loss.

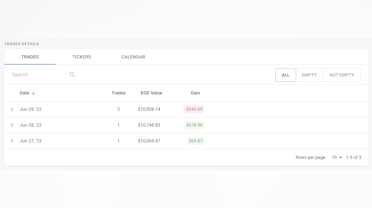

Below are a couple of images for lazy readers presenting the strategy and the results for the period from Jan 1, 2022 till Aug 10, 2022.

-----