For weeks hundreds of Airbnb hosts have been complaining about a sudden drop in bookings. This started with a viral tweet by

"Texas Runner DFW" in October, in which a superhost from Palm Springs said their "occupancy literally hit 0% the last two months". After that, many others have come forward and said the same thing, ending up with this

viral video by Shelby Church. I took this personally, and asked 17 Airbnb hosts in places like Miami, Greece, Spain, Paris, Rome, etc (some haters will say I was vacationing, but I was actually doing research). Anyway, I discovered some pretty interesting things.

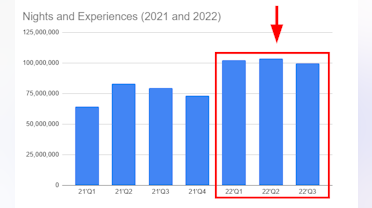

The first thing was that hosts in Europe didn't seem to be having the same issues as the ones complaining in the US. The ones in Miami did have an occupancy hit, but in line with summer, which is off-season due to hurricanes. Overall, the Airbnbust cases came from second tier cities in the US, many of which enjoyed record bookings in 2021 and first half of 2022. We know Airbnb's has done around 100M nights and experiences for 3 quarters in a row, so where did all those bookings go?

I believe 2 things happened around summer that sucked all the excess demand from the vacation rental market in the US. Leaving novice hosts in the dust.

Event 1: The Reopening of Europe

In 2021, everyone in the US did local vacations, as COVID was still rampant. So many cabins in the mountains, and trips to New York. It wasn't until the beginning of 2022 that US consumers started traveling abroad. And even then it sucked! I missed some flights to Colombia and Spain in Feb. The COVID requirements would change every week. But look at what happened in Spring:

March 14: France removes vaccine pass

April 9th: Czech Republic removes all COVID travel restrictions

April 13th: Greece follows suit, then

April 15th Estonia

April 18th: Cyprus

April 29th: Bulgaria

May 1st: Lithuania and Croatia

May 16th: Austria

May 23rd: Belgium

June 1st: Italy and Germany

June 6th: Spain

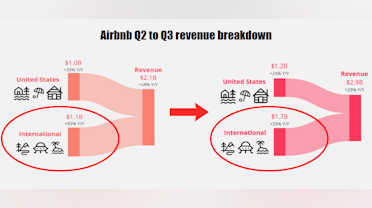

You get the point. All of Europe reopened in the span of 3-4 months. All that pent-up demand for EuroTrips from the US market came all at once. Which dried most of the excess demand for local vacations. Specially for cities not named New York, Miami, Vegas, etc. To illustrate this better I want you to visualize the change between Q2 and Q3 for

$ABNB revenue:

Notice how the share of bookings in the US dropped from 48% to 41%, as travel moved international for the first time in 2 years. Now you might be thinking "yeah, it dropped percentage wise, but there's still $1.2B in booking fees, surely there was still plenty of demand in the US", which leads me to the second event that solidified the Airbnbust.

Event 2: Amateur Hour is Over, Increase in Competition

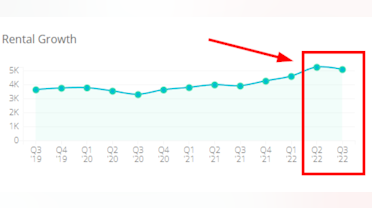

According to Jamie Lane, VP of Research at AirDNA, short-term rentals are in demand, with a YoY rise of 15.8% in the number of future nights booked as of October 2022. But data shows that while the number of bookings has risen, there has also been a sharp rise in supply of available short-term rental listings, up 23.3% in Oct 2022 vs Oct 2021.

All of this to say, that professional property managers entered the market in Q1 and Q2, outcompeting novice hosts for the excess demand left in the US. You can visualize this better in this graph, which illustrates the bump in Q2 in Palm Springs, California. Which is where all these Airbnbust reports started coming from:

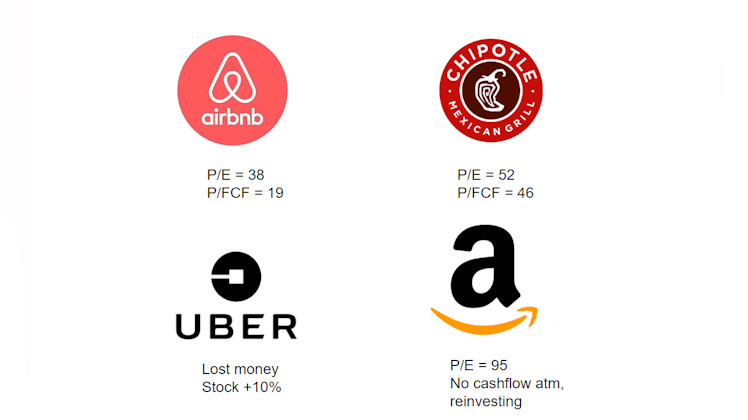

Okay so this sucks for US hosts, but what does this all mean for

$ABNB shareholders? Which is what we are all here for. An Airbnb shareholder will not be affected negatively by this. Airbnb will benefit from demand for travel regardless of where that demand is geographically moving to. And this is one of the advantages of

$ABNB over hotel chains. The pockets of demand for travel change very rapidly, and a hotel chain would need to build physical infrastructure first, whereas Airbnb can just direct traffic to hosts in those areas and get their fees regardless. And this is exactly what happened in Bali, Indonesia, before it became the hot spot it is right now. I believe the same event is happening once again, but on a bigger macroscale.