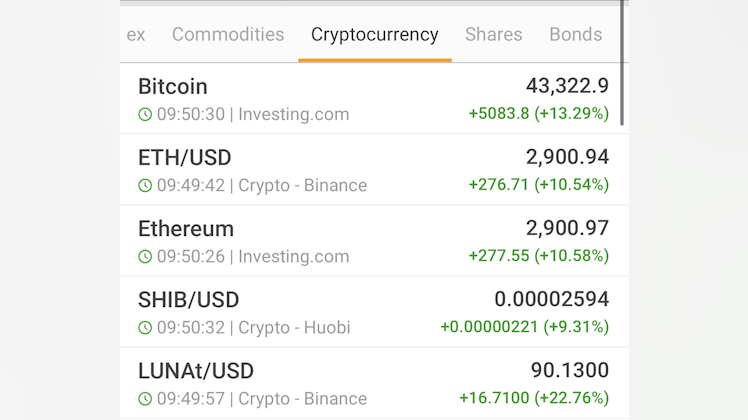

Bitcoin ($BTC.X )

#Bitcoin has seen a spike recently, gaining 12.89% with the price currently sitting at $43,000. The accumulation of Bitcoin addresses/wallets has also been on a frantic pace these last few days. This I feel is all related to the Russian invasion of Ukraine. I am very bullish on Bitcoin long term, however this situation poses a few risks that would be very interesting to look at. If Russia fully embraces Bitcoin, it could potentially limit the impact of various economic and financial sanctions put on them. This could also make the US 🇺🇸 and NATO countries regulate Bitcoin very strictly making it hard to use or spend.

How likely do you think it would be that the US and other NATO nations would increase regulation on BTC? That could really kick against the main proposition of BTC and it’s primary value IMO. Thoughts?