Following Up On My Pair Trade Idea - Long Monday, Short Asana

For my original Monday Thesis, see here

For my pair trade concept reasoning, see here

The Gist Behind The Trade Concept

I presented a theory a few months ago remarking on going long the #1 player in a niche category, and going short the #2 player in the same type to produce super pure alpha.

If you have two companies in a competitive landscape, of which the outcome will be winnings accumulating to only one winner... then this concept should work. For instance, technology companies and especially innovative companies are ripe with such opportunities.

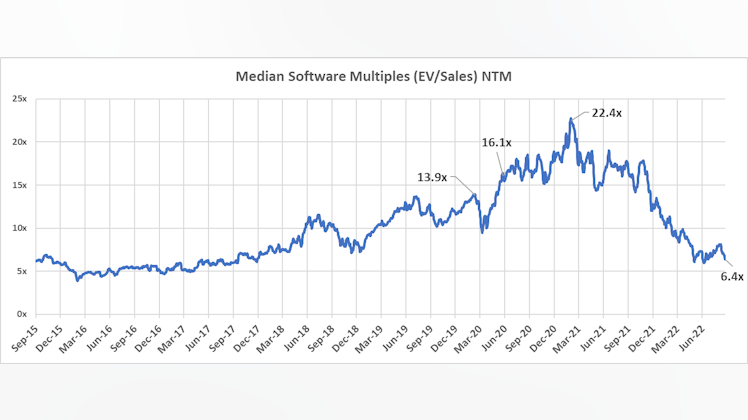

The idea is: if two companies are trading at similar valuations, and one is better, bet on the spread of valuations between the better company and worse company widening.

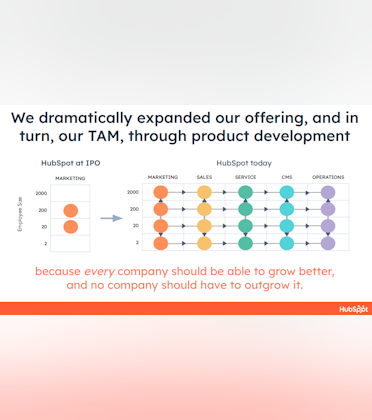

Monday has a soft product edge, perhaps a major one, but I couldn't tell. Most customer review sites place the workflow software category leaders as Monday and Asana among public companies. That said, Monday had been growing faster on YoY against Asana and was seemingly on a trend to capture market share faster.

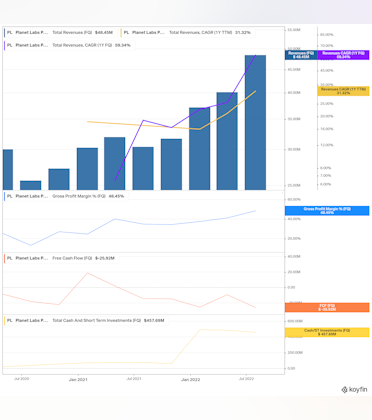

The more critical element of the thesis, however, was cash. Monday's cash flow management has been smarter, and more efficient. Considering the company is HQed out of Israel, they simply had lower engineering salaries to deal with leaving more cash flow for capturing growth. Asana is a fast-growing but cash-burning behemoth operating out of Silicon Valley. Now that cash is important, companies need to make compromises on reducing profitability or capturing market share. The outcome? Monday can outspend Asana on Sales and Marketing execution, for a roughly equivalent product.

That original theory seems to have played out across 2-3 quarters. Monday has kept the gas on the pedal, while Asana has seen a moderation in its sales growth with far weaker guidance. The market generally acknowledged these fundamental changes as I write this. Earnings results produced the results which I was hoping for.

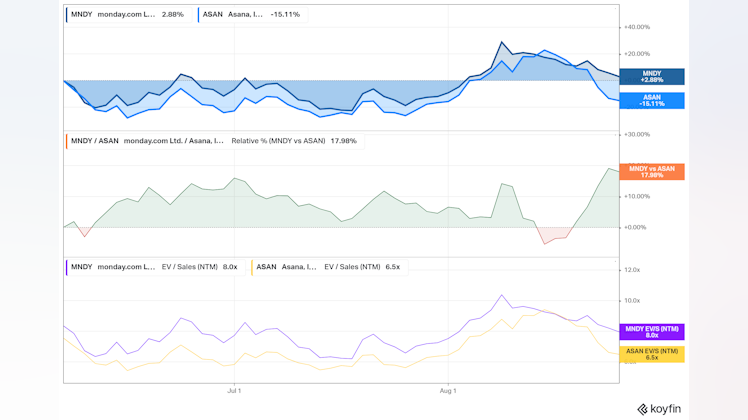

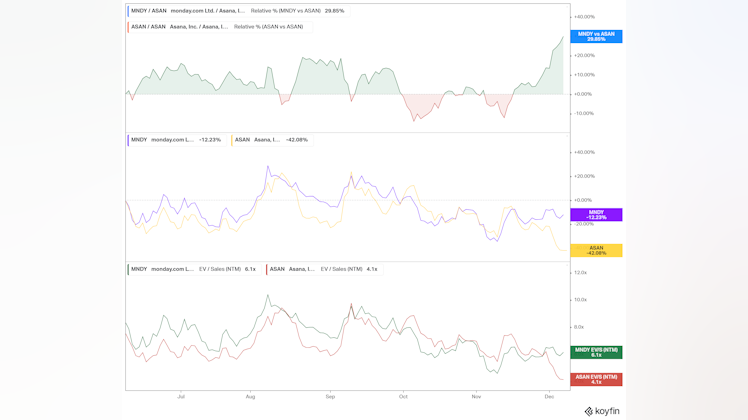

So, price action has followed post-Q3 earnings results for both companies.

The Performance Spread & Results So Far

This was never a smooth ride, but as mentioned in my last article, one can pick levels and position size appropriately into such a concept. As it stands, since the original idea was posted here on June 8 2022, The spread is now at an all-time high of ~+30%. With valuations now sufficiently different and reflective of risk/reward (6x vs 4x on sales), I'd personally close the trade here to record a profit. That's if I did trade in the first place.

It's All Theoretical - I didn't trade this

Unfortunately in India, where I'm based, I have restrictions on foreign market trading. I basically can't go short, use leverage, or meddle with derivatives. That makes this whole exercise just a fun thought experiment. But it's worth thinking about it anyway since you keep learning.

Takeaways

- Trading skills come in handy. If you play poker, you'd really know what I mean as it requires a dynamic risk-management and decision-making process. I could've executed this super poorly even if the idea was right.

- This is a combination of fundamentals, and risk management, in equal parts. Fundamentals, in a volatile industry, can drive price differentiation even across 2-3 quarters.

- There might be few opportunities like this. This is the only one I know of with a rational basis in my universe. I would be very, very, sceptical of applying this concept in a space where you don't know the two companies well enough that also fit the right criteria.

- The bright side, of all this work - is pure, and I mean really pure, alpha. This isn't long Amazon, short Sears... which are two different styles of companies. It is the same high-growth space, so you're effectively neutralizing growth vs value turnarounds that can kill you in paradigm shifts such as 21-22.

I'm far from a trader - just a fundamentals-long guy with the occasional "Tactical" long. But I've heard of hedge funds that work on such stuff with super tight correlation/risk/alpha constraints. Citadel and prop firms that aim to compound capital every single year in every environment, deserve serious credit. There's a reason they have the kind of insane AUM and insane fees they do. Their investors would be thanking their stars this year. Apparently, their flagship fund was +32% YTD in 2022 a few weeks ago.

Great follow up, and thanks for teaching me a new use for Koyfin. How did you make the chart to compare the relative return of X vs Y?