Have you heard of an auto-adjusting stop-Loss limit?

I’ve realized I’d like to setup a stop limit order that’s rolling so I can say,

“sell if the stock gets below 20% of the next high.”

This would allow the limit order to adjust up while the stock is on a run, and then minimize the downside. An example is $ZM. If I could have implemented this approach when I bought it at $89 back in spring 2020, then I would have captured most of the gains when I ran up to it’s all time high.

Being a long term investor, I don’t want to watch stocks closely and manually set a stop limit order. I’d prefer to let them run and hold them for as long as I can, but also minimize the long down run like what $ZM is encountering.

Is there a platform or tool that allows this functionality?

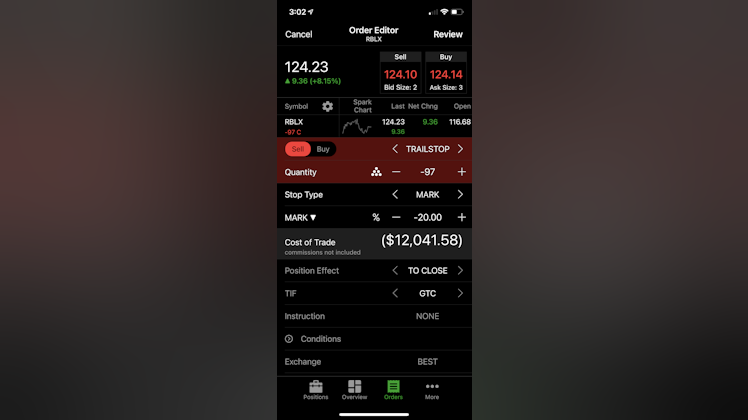

*edited: Thanks to @trendspundit I learned about a “trailing stop limit order”. Here’s what it looks like when I set it up in Thinkorswim app for $RBLX . I set a larger window of -20% market price because $RBLX is more volatile.

+ 2 comments