Trending Assets

Top investors this month

Trending Assets

Top investors this month

@_equityideas

Markus Olsson

$394.2k follower assets

22 following89 followers

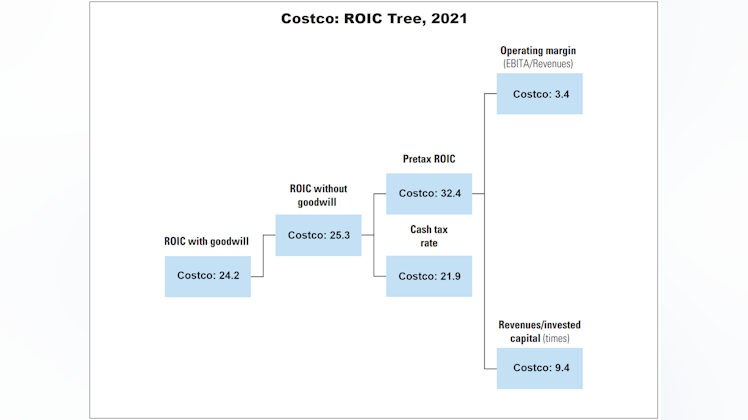

Costco $COST Deep Dive

theequityideas.substack.com

Costco: "We’re Not a Margin Company, We’re a Volume Company"

Costco Deep Dive

+ 5 comments

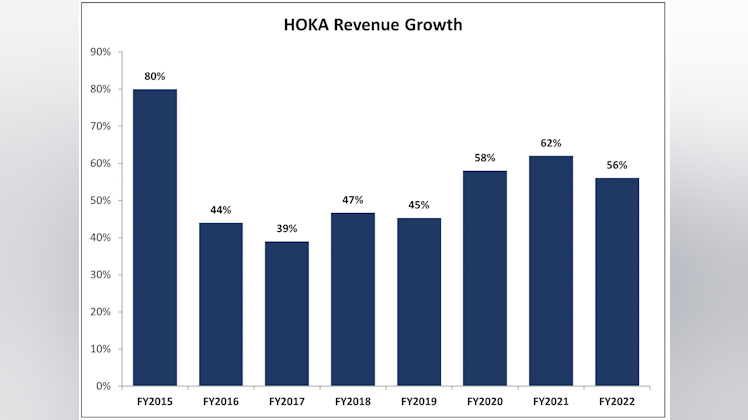

Deckers Brands: "The Ugliest Shoes of All Time"

theequityideas.substack.com

Deckers Brands: "The Ugliest Shoes of All Time"

A deeper look at Deckers Brands (DECK)

+ 6 comments

Lifco ($LIFCO) - Best In Class M&A Compounder

theequityideas.substack.com

Lifco: "A Safe Haven for Your Business"

Best in class M&A compounder

Add a comment…

Introducing Equity Ideas

theequityideas.substack.com

Equity Ideas | Substack

In-depth equity research on Nordic and U.S. companies from an MSc. Finance alumnus focused on uncovering quality businesses. Click to read Equity Ideas, a Substack publication with hundreds of subscribers.

+ 13 comments

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?